California health insurance -

Anthem Blue Cross versus Kaiser

California health insurance -

Anthem Blue Cross versus Kaiser

Anthem Blue Cross versus Kaiser - the Heavyweights of California

In the California health insurance market, this would really be the main event.

Kaiser versus Anthem Blue Cross of California IS the heavy weight bout!

Aside from pure market share, there's also a separate battle afoot between the two for the heart of how health care is paid for and delivered in the very near future.

That future is coming faster than ever with the rate increasing of late.

Enough of the big picture...what about how they differ at the ground level...to an individual member?

Great questions and we're using our 25+ years experience in the California health market as independent agents to compare the important aspects of the two carriers

First...some credentials Please!....

Okay....formalities out of the way. Let's get started.

Most importantly, we'll look at recent events which are really affecting how to compare these two dominant carriers.

Let's begin. Ring the bell...it's Kaiser versus Anthem Blue Cross.

The main event!

How Kaiser and Anthem Blue Cross are Structured

Before we get into different markets that they compete in, let's understand how they're set up.

This has a huge impact on how you as the member will interact with them.

We're talking about #1 and #2 in terms of California health carrier market share.

First, Kaiser.

Kaiser in California

Kaiser is unique among the California carriers and it literally created its own model!

First, Kaiser is non-profit. It really is designed by and for physicians.

Traditionally, Kaiser is an HMO.

This means that you must stay within the Kaiser network and that care is managed.

What does "managed" really mean?

For 99% of health care needs, you probably won't feel a difference. The day-to-day is handled very well by Kaiser.

If you get into more serious or obscure health care needs, you will have less choice in how you are treated.

Any negatives cast against HMO's usually arise due to this fact.

Here's the biggest difference...

Kaiser owns the hospitals/facilities and employs the doctors.

Read that last sentence one more time.

It's a big deal. The insurer and the health care provider are one company.

This really is the big difference between Kaiser and Anthem Blue Cross (or any traditional carrier).

Later in the comparison, we'll discuss the pro's and con's of this model against Anthem Blue Cross.

What about Anthem's structure?

Anthem Blue Cross of California structure

Anthem follows the more traditional route.

Anthem is a separate carrier that contracts with doctors, hospitals, and labs who provide the actual care.

Anthem essentially pays the bills when members use health care for eligible expenses.

The power of Anthem is in its ability to negotiated rates with the providers.

This is essentially a way to contain premiums and costs on PPO, EPO, and HMO plans.

In that respect, Anthem is really a middle-man who finances payment of health care expenses.

Since a hospital bill can run $100K these days, they spread this risk among all members.

This addresses the "I never get sick, why is my premium going up?" common refrain.

Really, Anthem's power is completely based on their ability to negotiate with the doctors and more importantly, the hospital chains (think Dignity, UC's, Sutter, etc).

This is why bigger can be better in California.

The more members you have, the better your position to negotiate from.

Anthem is a for-profit, publicly traded company. That being said, the margins for health insurance carriers is typically 2-4% and all carriers have to (by law) spend a certain percentage of premium received directly for healthcare.

In the end, it comes down to pricing, networks, and how the carriers interact with the members.

This is what is really important.

Let's get into it by market segment:

Individual and Family including Covered California

Small and Large Business

Medicare Supplements and Advantage plans

Kaiser versus Anthem Blue Cross - Individual and Family

This is the market that has seen the most change since 2014.

That's only going to continue.

Let's review the key components that go in to comparing the two carriers.

Pricing Comparison between Kaiser and Anthem Blue Cross - Individual/Family

This area probably shows the greatest strength of Kaiser versus any of the carriers.

Depending on area and age, Kaiser generally has some of the lowest priced plans on the market (aside from small regional HMO on individual/family).

The pricing can be significantly lower than Anthem Blue Cross EPO and even lower than Anthem Blue Cross HMO.

There are certain areas in California where Kaiser is actually more expensive for certain plan levels (Bronze, Silver, Gold, and Platinum).

That's not typical though.

We'll typically see individual/family rates 30% lower with Kaiser than for Anthem Blue Cross EPO. Anthem's HMO plans are generally 10-20% more than Kaiser.

There can be very big variances so it's best to run your quick quote to compare your area and age:

If the plans are standardized now and pricing is taken into account, what else is important in our comparison of Kaiser and Anthem Blue Cross in California?

Kaiser versus Anthem Networks

This is really a big difference between the two.

If you have non-Kaiser doctors that you want to keep, that may be the deciding factor.

With Kaiser, you have to use Kaiser doctors and facilities.

Anthem Blue Cross contracts with independent doctors and hospitals.

If you want access to the non-Kaiser hospitals, Kaiser's not going to work for you.

This is usually the reason a person decides to go one way or the other.

Out of area and out of State coverage

The other factor has to do with flexibility.

With Anthem Blue Cross, you will likely have more flexibility to see providers in other States and areas within California.

If a person travels for work or splits time in another area, this can be a big deal.

Kaiser is an HMO so you need to stay in the network. In a true emergency, you'll be fine but we have to be very conservative in our determination of "emergency".

Anthem generally has EPOs (like a PPO with no benefits out-of-network other than true emergency) and HMOs.

Anthem's EPO is the last individual/family plan to have access to Blue Card which allows you to see BCBS providers in other States. This can be very important if you live close to any border. Check with us on availability.

Access to care differences between Kaiser and Anthem

This partially depends on whether you're comparing Anthem's HMO, EPO, or PPO.

With an HMO, there will be more "management" of care through Anthem which is similar to Kaiser.

What does this mean?

With an HMO, the insurer (whether it's Kaiser or Anthem) will have more control over what your course of care will be.

This can be what type of medication is prescribed or what procedures are recommended (and eventually paid for).

With an EPO or PPO, the contracted doctor makes the decision on what is the best course of treatment. The carrier will then pay according to the benefits of the plan.

The carrier still has oversight on what is covered but there is generally much less "care management" with an EPO or PPO.

This is usually the 2nd biggest reason for a person to choose either Kaiser or a carrier like Anthem Blue Cross right after choice of doctors.

You can access the pricing, doctor networks, and benefits for both Kaiser and Anthem Blue Cross individual/family plans here:

We're happy to help with any questions including the Covered Ca tax credit (which applies equally to Anthem or Kaiser). There's no cost for our assistance at licensed CoveredCa agents for both Anthem and Kaiser.

Small Business Kaiser versus Anthem Blue Cross in California

Many of the same considerations occur with group health plans offered by companies.

Kaiser and Anthem Blue Cross are #1 and #2 in the group health market so clearly they're doing something well-received by companies.

It's also interesting that they're two of the largest carriers in the State so what's the connection and how do we compare them?

Size of Carrier Matters

Pricing in today's world is primarily driven by how good you are at containing health care costs.

- Health insurance is basically pass-through of medical expenses anyway.

- Contain those expenses and the premiums reflect it.

Kaiser and Anthem do this in different ways.

Kaiser is huge with multiple facilities across the State. Anthem Blue Cross has millions of subscribers so they can negotiated aggressively with providers.

And they do!

It can get downright ugly when Anthem contracts with one of the major hospital chains.

Kaiser on the other hand uses it's HMO model to manage care and contain costs.

If they see a good value for hypertension medication versus alternatives, they may move their members onto the equivalent drug.

One does it with size and negotiation. The other does it with care management.

Either way, the net effect is competitive pricing for California Small Businesses.

Who's Better for Pricing with Group health plans?

Each area will be a bit different but Kaiser is usually the low price leader. After all, HMO's will be cheaper in general anyway.

Anthem is usually #2 or 3 in terms of group health pricing.

In a world of escalating healthcare premiums for companies, this explains why they're popular.

You can quote both Kaiser group health and Anthem Blue Cross

plans here:

Kaiser and Anthem Group health Day to Day Interaction

From an employer's point of view, the next consideration is dealing with the carriers.

Both from their perspective as the employer and for their employees.

Both have made big strides towards bringing this interaction online for both parties.

Kaiser is probably a little further ahead on this front for California employers.

Aside from the management question mentioned above, both are comparable in claims processing, membership/billing issues, and online support.

Again, Kaiser is ahead with their online options and the fact that your care is coordinated under one patient ID.

This means every doctor has access to your records and that can be a big deal for more complicated health issues.

It's good that your cardiologist can pull your labs from your Primary Care doctor.

Online Tools for the two Carriers

Everyone wants everything online!

And why not!

We should be able to see our billing, claims, doctors, and more right on our cell phone.

They both offer this and Kaiser has a slight lead there.

Very slight.

A few years back, maybe much more but Anthem has made big strides forward.

For the employer, both carriers are about average for interactions.

Billing can occasionally cause headaches as does membership.

We may be able to combine Kaiser and Anthem under one offering to employees if you have mixed needs there. Check with us or run your Anthem and Kaiser group quote.

Keep in mind, we may be able to offer employees Kaiser AND another carrier side-by-side:

We're here to help you with both so you just email or call what you need and we'll take care of it. Check out our Google Reviews!

Medicare Plans between Kaiser and Anthem

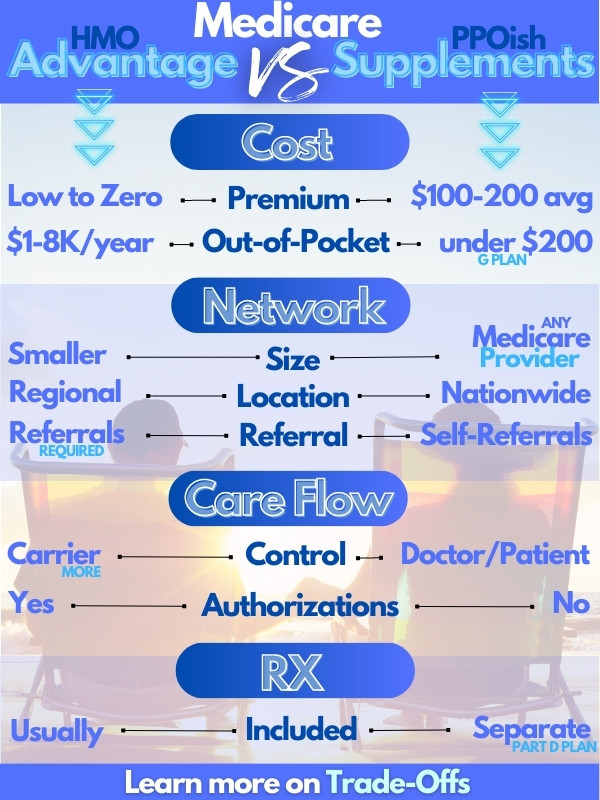

This is really a question of Medicare Supplements versus Advantage (HMO) plans.

What's the difference?

Great first question.

There's a pretty good intro Advantage plan versus Supplement comparison here but a quick summary.

Medicare Supplements allow you to see any doctor that accepts Medicare.

It's closest to the PPO type of plan.

Advantage plans are the newly branded version of the HMO for Medicare.

You generally have a chosen medical group or primary care doctor and care is more managed.

Think PPO versus HMO for Supplement versus Advantage plan.

We have great guides on the Trade-off between Advantage plans and Supplements or how To pick the best medicare plan.

So what about Kaiser and Anthem?

Kaiser is an HMO carrier so they focus on Advantage plans. You generally can't go outside of their facilities.

Anthem offers both Medicare supplements and Advantage plans.

Medicare pricing for Anthem and Kaiser

The real draw of Advantage plans (Anthem even has these options as well) is their monthly pricing.

They can even be no cost monthly!

You can quote both types of plans here (we'll send link for doctor/RX and "opt-in" required by law to quote Advantage plans):

You can get more info on how supplements are different from Advantage plans.

Keep in mind that you may make up for this on the back-end if you have medical costs!

The most popular Supplement plan runs around $150 for a 65 year old.

For HMO's, Kaiser is hard to beat but you have to use their doctors.

To see outside doctors but still have a low or no cost Advantage plan, that's Anthem.

For PPO or Medicare Supplements, that's Anthem Blue Cross.

It comes down to what doctors you want to see.

Summary of Anthem versus Kaiser in California

You'll see a constant theme whether we're talking individual/family, small business, or Medicare.

It's network (which doctors you can see) and pricing.

- Pricing is ruled by Kaiser

- Access to doctors/hospitals outside of Kaiser is ruled by Anthem.

For Small Business, we can actually offer both of them side by side.

You can quote the different markets and compare the two carriers side by side.

There's no cost for our service and we're contracted with both carriers.

We just want to find the best fit for your needs!

.jpg)

.jpg)