Critical Illness Insurance - Is it Worth it?

UPDATE: We have the new InPocket plan which can help fill in the deductibles of the ACA plans. Quote HERE

There's been a big uptick in the number of individual critical illness policies written in the last few years.

And for good reason.

With the ACA health care law, people quickly realized that their exposure for big bills was going to be high.

Roughly $7,000 thousand per person for most ACA plans

That's a big hit.

Most Americans don't have $7K lying around to address such big expenses.

A few key concerns:

- The plans are standardized so we can't get plans with lower exposure in most cases

- The Bronze, Silver, and Gold plans all have this high exposure for big bills

- The Platinum is generally ridiculously expensive

So...many people were asking if there's anything they can do to bring down the risk of this high backend.

The answer is yes!

Critical Illness and Accidental health coverage.

There's actually a product that will cover both under one policy but we'll cover the Critical illness part of it first.

You can always jump right to the InPocket quote here if you like:

Otherwise, feel free to jump to a particular section here:

- What is critical illness insurance

- How does critical illness coverage work

- Is critical illness worth it

- What conditions are covered by critical illness

- What are the 30 critical illnesses

- What are the 36 critical illnesses

- List of critical illness companies

- Which is the best critical illness company

- Critical illness rates

- Critical illness pros and cons

- Finally...Critical illness - yes or no? Good or bad?

- How to quote critical illness insurance

- How to enroll in critical illness insurance

Lots to cover.

Let's get started!

What is critical illness Insurance?

The official definition of critical illness insurance (per Wikipedia):

Critical illness insurance, otherwise known as critical illness cover or a dread disease policy, is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy

So, what does that mean?

Simple language please.

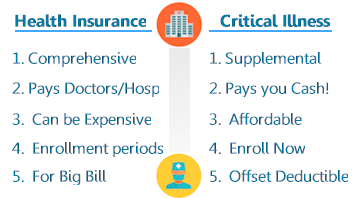

Critical illness is a unique type of insurance that pays you directly in cash if you are diagnosed with an illness that qualifies for coverage.

It's very different from health insurance which pays the provider (doctor or hospital) in case of triggering the benefits.

Critical illness pays you directly.

In cash!

How does it actually work?

How does critical illness work?

Let's walk through an example.

We'll assume we have the Blue Cross Blue Shield Balance plan with a $5000 benefit.

Now assume we have one of the listed critical illnesses befall us.

Let's say an eligible heart attack or stroke since those are more common than they should be.

The policy will then pay you up to $5000 directly!

In cash.

The theory is that you can use this money to smooth out this period of time.

There are actually many common uses:

- Pay deductible/max out of pocket on your health policy

- Mortgage

- Car payments

- Credit card payments

- Time off work

The list could go on and on.

The main point is that the benefit is cash to you.

They are not paying a doctor or hospital to reimburse expenses

You can use it in any way you see fit.

Critical illness plans are sometimes called supplemental health plans.

They're not designed to replace health insurance but to supplement them.

For more detail on how it works, check out our detail on the Balance plan or the brochure here.

It's one of our favorites due to its connection with Blue Cross Blue Shield and the addition of an Accidental health insurance benefit.

It's awesome to have both combined!

So...that's how it works.

Is it worth it?

Is critical illness worth it

This comes down to cost and probabilities.

We won't get all quantum mechanics on you but here's the deal.

The cost for mid level benefits (about $5K) is generally about $45/month for a person and $70/month for a family (2 or more people).

Essentially, we're paying $500/year to offset $5000 in potentially expenses.

This means that if we have a significant qualified expense in 10 years, we break even.

On average, a person has very large health bills every 7 years.

That's in our favor!

The pricing tells you a bit.

It's not $5/month!

That's because they're paying out for services more often than not.

My father in law would have triggered his benefit twice in the last few years.

Based on the 7 year average, we're paying $350year to probably get back $500.

Those are pretty good odds.

The payback increases quite a bit for a family plan since the additional cost is 40% of the full rate for the additional person.

This is one reason why they are so popular right now.

You can quote and enroll in the most popular critical illness plan right here:

What conditions are covered by critical illness

The popular Balance plan for Critical Illness and Accidental health lists the following critical illnesses:

- life-threatening cancer

- heart attack

- kidney failure

- Stroke

- coma

- coronary artery bypass

- loss of sight, speech or hearing

- major organ transplant

- paralysis

- severe burn

This list is pretty standard for what critical illness plans cover.

Some plans will list items for specifically which brings up the next section.

What are the 30 critical illnesses

Some carriers will list 30 designated critical illnesses for coverage:

- Major Cancers

- Heart Attack of Specified Severity

- Coronary Artery By-pass Surgery

- Stroke

- Kidney Failure

- Coma

- Paralysis (Loss of Use of Limbs)

- Heart Valve Surgery

- Blindness (Loss of Sight)

- Deafness (Loss of Hearing)

- Loss of Speech

- Multiple Sclerosis

- Fulminate Hepatitis

- Major Organ/Bone Marrow Transplantation

- Primary Pulmonary Hypertension

- Alzheimer's Disease/Severe Dementia

- Surgery to Aorta

- Major Burns

- Terminal Illness

- HIV Due to Blood Transfusion and Occupationally Acquired HIV

- End Stage Lung Disease

- End Stage Liver Failure

- Muscular Dystrophy

- Parkinson's Disease

- Aplastic Anemia

- Angioplasty & Other Invasive Treatment For Coronary Artery (with partial payment only)

- Bacterial Meningitis

- Benign Brain Tumor

- Viral Encephalitis

- Motor Neuron Disease

Some carriers will use a slightly expanded list.

What are the 36 critical illnesses

- Stroke

- Cancer

- Heart Attack

- Coronary Artery Disease Requiring Surgery

- Other Serious Coronary Artery Disease

- Angioplasty Or Other Invasive Treatments For Coronary Artery Disease

- Heart Valve Replacement

- Fulminant Viral Hepatitis

- Chronic Liver Disease

- Primary Pulmonary Arterial Hypertension

- Chronic Lung Disease

- Kidney Failure

- Surgery To Aorta

- Aplastic Anaemia

- Major Organ Transplant

- Blindness

- Loss Of Hearing / Deafness

- Loss Of Speech

- Coma

- Major Burns

- Multiple Sclerosis

- Paralysis / Paraplegia

- Muscular Dystrophy

- Alzheimer's Disease / Irreversible Organic Degenerative Brain Disorders

- Motor Neurone Disease

- Parkinson's Disease

- Terminal Illness

- Encephalitis

- Benign Brain Tumor

- Major Head Trauma

- Bacterial Meningitis

- Poliomyelitis

- Apallic Syndrome

- Loss Of Independent Existence

- Aids Due To Blood Transfusion

- Cardiomyopathy

For the most part, the covered illnesses are very comparable from carrier to carrier and plan to plan.

There's pretty wide consensus on what "critical means".

What about the companies?

List of critical illness companies

Critical illness has become very popular in the last few years.

This is primarily driven by the ACA law and it's large max out of pockets.

When you have $7K exposure even on a Gold plan there's a real need to supplement!

Some people have even used critical illness and accident plans because they can't afford the ACA plans (no tax credit).

This is risky but it may come down to rent/mortgage or insurance.

Rent/mortgage wins every time!

So...lots of carriers started offering critical illness plans.

Here are the main ones:

- IHC partnered with Blue Cross Blue Shield

- Metlife

- Aflac

- Allstate

- Unum

You notice something right off the bat.

One of them has health insurance experience!

Blue Cross Blue Shield (through IHC).

They have been one of the most popular in this segment with their Balance plan and we'll describe why next.

Which is the best critical illness company

Here's the better question...

Which is the best critical illness PLAN

Emphasis on plan.

All the major carriers are strong carriers.

Critical illness is a pretty standardized benefit across the market with the major carriers.

Our favorite is the Balance plan.

Here's why...

Traditionally, on the market, there are two types of plans:

- Critical Illness plans

- Accidental medical plans

Critical illness might pay for cancer and heart attacks.

Accidental medical might pay for broken bones and ACL repairs.

Very distinct needs.

Why guess on which one you might need help with.

Enter the Balance plan from IHC with Blue Cross Blue Shield.

It covers both!

That's a huge deal.

The pricing is about the same for a stand-alone critical illness plan with other carriers.

- We've had clients trigger the critical illness side.

- We've had clients trigger the accidental medical side.

Some triggered both!

Take out the guess work.

You can quote, compare, and enroll here:

The Balance plan brochure is available here.

Of course, we're happy to help with any questions at 800-320-6269 or by email.

There's no cost for our assistance.

Critical illness rates

The rates are very competitive for critical illness plans like the Balance plan.

Here they are (check updated quote here for new rates):

Critical Illness Insurance Rates

A few quick notes.

You'll notice that the family rate increase is much lower than a full person's rate.

This makes it an even better value to add family members.

Most people choose in the $5000-$7500 range (right in the middle).

The theory is to address the bulk of exposure from any of the short term health or ACA health plans.

Critical illness pros and cons

So...what are the pros and cons of critical illness?

Here's a quick look at both and then we'll touch base on whether it's a good decision in the next section.

PROs of Critical Illness:

- Cash paid directly to you

- Offsets the large exposure of ACA and short term health plans

- Relatively low cost versus expected medical expense

- Relatively large probability of triggering benefits over period of time

- Good supplemental coverage to other coverage

Con's of Critical Illness:

- Only triggers for listed illnesses

- Should not replace full health insurance since limit on triggering illnesses

- Additional monthly costs

Let's dig a little deeper in the need for Critical Illness coverage

Finally...Critical illness - yes or no? Good or bad?

To some extent, the recent volume of enrollment speaks for itself.

Critical illness is growing at double digits every year!

Just recently, an article came out that the number of employers offering high deductible plans exclusively jumped from 9% to 37% in a few years.

Many people are looking at ways to address big bills if they occur.

Critical illness plans have become supplemental plans to fill in the holes of every increasing deductibles.

We explained the cost to benefit ratio above (about 1 to 7) given an average big expense every 7 years.

It really comes down to this...

If you have a critical illness (or accident with the Balance plan), do you have $7K laying around.

Most of the US doesn't.

What would you do if you owe $7K?

Take out a loan?

Okay, now that $7K is $10-12K.

Credit cards?

Unless immediately paid back, most expenses put on credit cards cost about 2-3 times the original amount due to high interest.

That $7K becomes $14 or $21K.

We're going the wrong way!

If we can offset that potential expense for $40-50/month, that's not a bad trade off.

Insurance is all about trade-offs

A high potential expense versus a low guaranteed expense (monthly premium).

$40-50/month is a perfect example of this trade-off.

Based on the number of claims we've seen filed, it's appears the "potential" is higher than not!

How to quote critical illness insurance

It's easy to quote critical illness.

Just click here:

The Balance plan is our favorite for many reasons.

Pricing is great and they add in the accidental medical piece so you don't have to guess which one you'll need.

Nor do you need to buy a separate critical illness policy!

Everything including brochures, rates, and applications are all online!

Please let us know if we can help in any way at 800-320-6269 or by email.

How to enroll in critical illness insurance

Enrolling is easy as well.

You can access the online application here:

The full process is online for either desktop or mobile.

It's a simple application since critical illness does not cover pre-existing conditions.

Again, we're here to help with any questions at 800-320-6269 or by email.

Wrap on Critical Illness plans

We've covered a lot.

Critical illness continues to be one of the most popular health related products and that will only continue as more people are forced into higher deductible plans.

With exposure upwards of $6000 and $7000, there's a real need to address this gap.

Critical illness is becoming the go to supplemental plans for ACA health insurance.

We're happy to help with any questions.

There's no cost for our assistance!

Quote Critical Illness Plans and Rates

to view rates and plans side by side for both carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!