California

Small Business Options - How to cover out-of-state employees

California

Small Business Options - How to cover out-of-state employees

How to Cover Out-of-State Employees for Health Insurance in California

We get this question quite a bit...especially with remote working.

Usually, it's a company in another state that is setting up an office in California or that has employees in CA.

The home state plan may not work well for out-of-state employees due to network (HMO, etc.) or other rules.

This then begs the question...how can we offer these employees in California equivalent coverage?

We do it all the time! Let's walk through some of the basic rules and understand that some carriers are easier to work with on this front.

We'll cover these topics:

- Requirements for offering out-of-state California employees coverage

- Covering remote workers of California offices from out-of-state

- How to quote and compare coverage for California employees

- Get assistance finding coverage for your California employees

Let's get started!

Requirements for offering out-of-state California employees coverage

Let's walk through the mechanics of this.

You have your primary location or basis in another State or country but have employees in California.

It can also be the other way around where you're based in California but have employees in other states.

Either way, we have similar requirements.

Here are the big items we need to address:

We need California payroll for those employees

With California payroll (DE6 or 9), we can usually get this done. Even without a certification of qualification (says you're eligible to do business in California).

The payroll is the official document that establishes these employees to the State of California.

In the latter situation (California company with employees out of State), we just need to choose a carrier that handles multi-state well and there are a few ways to go there (more on that below).

As for the participation requirement (usually 75% of eligible employees), the DE6 will only show our California employees.

The employees in the home state on a local employer health plan (or Exchange/Medicaid) are official waivers so it won't mess up our qualification.

It then becomes 75% of the CALIFORNIA employees and Covered Ca, Medi-cal also work as waivers.

Again, we can help you with this whole calculation and there's no cost for our assistance.

Let's look at how this will actually work from a logistics point of view.

Covering remote workers of California offices from out-of-state

Let's say your home office is in Hawaii and you're setting up a California office (very common for some reason).

You have 4 employees in Los Angeles whom you want to offer coverage but Hawaii's health system is really geared for Hawaii (almost single payer).

We would quote the market with a focus on the carriers that work better in this situation.

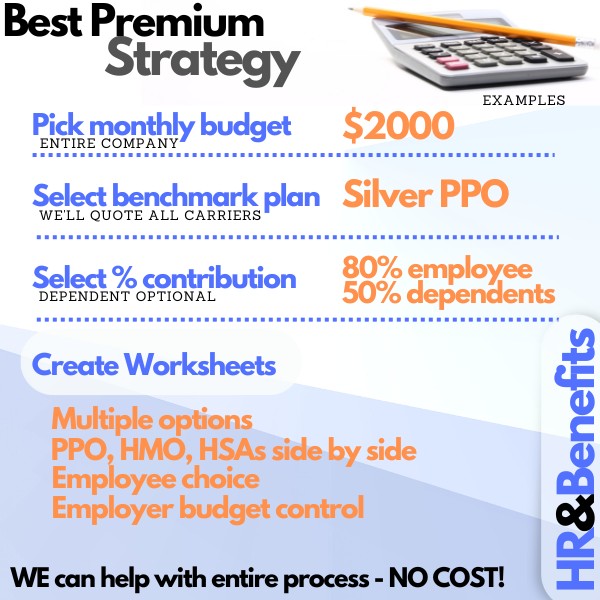

Once we zero in on the best priced carrier in their area (LA), we can run worksheets based on a defined budget you have for the month, for the California employees.

This usually matches your local contribution but keep in mind that costs in California are higher than many other States (but maybe not Hawaii :).

California employees who want to keep their Medi-Cal, Covered Ca (our State Exchange), or other employer coverage can do so! It doesn't affect our ability to enroll the other California employees.

They will have a separate ID card and policy, and the mailing address can be the home office in the other State.

So how do we run these quotes?

How to quote and compare coverage for California employees

You can run your quote right here:

Make sure to let us know you're looking to cover California employees from an

out-of-state employer so we can choose the best carriers for this endeavor.

Some carriers are much more flexible and really geared for offering coverage across different States.

We even have a few who that understand in today's world, the home address may just be an employee's address in the world of remote work.

That's why the payroll report is so important. It's official and links the employees to the employer in a capacity the carriers can rest on.

Again, we'll quote accordingly so just make a note in the quote to get us on the right path.

You'll get a full quote across the best carriers as we find our benchmark silver plan upon which we can establish our contribution.

Employees can then pick and choose plans based on their budget and healthcare needs.

This has been a winning strategy for both companies and employees!

Underwriting can get confused with these cases so it's important to have everything vetted going in.

So..

Get assistance finding coverage for your California employees

There's zero cost for our assistance and we'll hand walk you through the process!

We've enrolled thousands of California companies over 25+ years and many companies out-of-State with employees here in California.

Your credentials here:

There's zero cost for our help and we work with all the biggest California

carriers.

In these cases, there are 2-3 that really become more flexible with employees in other states.

Be it in California or California companies with employees in other States or even remote employees scattered across!

Just let us know your situation via the quote tool and we'll quickly size it up!

.jpg)