California health insurance -

Health Reform in California -

400% of Federal Poverty Level

California health insurance -

Health Reform in California -

400% of Federal Poverty Level

400% of Federal Poverty Level

UPDATE: the 400% cap on income for California has been removed so check with us regarding your situation!

This is the number you really need to know going forward into the Covered California changes.

Are you under 400% of the Federal Poverty Level for your estimated current year's income?

That lone fact will dictate whether you receive sizable California health insurance subsidies or whether you pay much higher premiums..

We are talking about billions of dollars flowing to and from (through taxes) millions of people.

This is the HEART of the ACA Law.

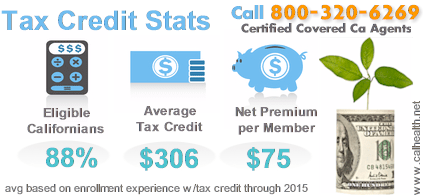

Here are some stats:

Let's check out the 400% Federal Poverty limits and also really understand what's at stake.

We can send you an updated income grid for the current year...just email help@calhealth.net

We specifically built the grid to reflect

the important jump points that affect plan

options and costs.

Let Us look at each and why they matter.

FPL. This is the Federal Poverty Level for the 50 core States and

most importantly to us, California. All the the important numbers are multiples

of this key rate.

138%. This is the California adjusted number which acts as a dividing

line between Medi-cal eligibility and the standard plans for adults 19 and

over. Below this amount, adults will likely be eligible for Medi-cal. Above

this amount but below 400%, you will likely be eligible for a standard plan

or Enhanced Silver plan and some tax credit.

138% - 150% Adult eligibility for the Silver 94 plan. This is the richest

plan on the market. These people will be eligible for the richest tax credit

(which decreases on a sliding scale until 400%). Children under 19 eligible

for Medi-cal.

150% - 200% Adult eligibility for the Silver 87 plan. Children under 19

eligible for Medi-cal.

200% - 250% Adult eligibility for Silver 73. Children under 19 eligible

for Medi-cal.

250% - 266% Adult eligible for standard Metallic plans (Silver 70) and

children eligible for Medi-cal.

266% - 400% Adults and children eligible for standard Metallic plans

(Silver 70).

The tax credit is on a sliding scale from 138% to 400%.

There are situations where income is under 400% but there is no tax credit. This typically occurs for younger adults with income in the higher range (but under 400%).

These numbers are specific to California since Covered Ca adjusted certain

benchmarks to make them richer than the ACA law requirement.

You can run your Covered Ca quote with the tax credit included here:

It's best to look at a person's particular income, household, and health

care need situation. We can quickly evaluate how much tax credit you might

eligible for and evaluate the plan options.

Call us at 800-320-6269 to find out what you are eligible for specifically.

Why 400% of the Federal Poverty Level?

The ACA bill sets 400% of the FPL as the dividing line between those that will qualify for a subsidy and those that will not.

If your MAGI (Modified Adjusted Gross Income...think both active and passive income) is under 400% of the the FPL number, you may qualify for subsidy.

The subsidy is based on keeping your share of health insurance premium below a certain amount (9.5% at the most) of your income.

For example, if you make 350% of the FPL and your premium is $1000 with an income of $3,000 monthly, you may receive a subsidy of approximately $700. Your net premium in this simplified example would be $300/monthly of the original $1000.

We'll provide a calculator at the bottom of this article.

What if you make over 400% of the FPL?

Due to Covid, the following may not apply. Check with us or run your quote here.

You receive no subsidy.

It's a very steep line...there is no gradual scale but a drop off and those making over 400% of poverty can expect health insurance premiums to be quite a bit more expensive. This is why the 400% rate is so important.

It's literally the difference between $1000 of dollars in health subsidies versus none.

We expect to have two distinct camps of health care shoppers...those with a

subsidy (pleased) and those without (irate). It's going to be an interesting 12

months in the California health insurance market!

Settlement of subsidies received

If your income goes up significantly during the year that you are receiving the

health subsidy, you may have to pay back part of the advanced subsidy as part of

your tax filing in the following year.

The amount to be paid back is based on your % of FPL and the amount you received.

People who still make under a certain level will not need to pay back

the full amount they had received.

We can quickly size up what income to look at, what period to consider, and

what makes up your household so that you get the most tax credit possible.

Call us at 800-320-6269.