California health insurance California Health Reform 9.5 Rule

![]()

![]() The 9.5% rate of your annual income

affects your cost for California health

premiums (detail below)

The 9.5% rate of your annual income

affects your cost for California health

premiums (detail below)![]() Subsidies will be

available up to 9.5% of gross income (detail below)

Subsidies will be

available up to 9.5% of gross income (detail below)![]() This percentage will drive the direction

of 100's of billions of dollars per year

This percentage will drive the direction

of 100's of billions of dollars per year

There's a new number that's incredibly important to how much you will be paying for California health insurance starting Jan 1st.

9.5%.

This not only affects what your monthly premium will be for the new mandated health insurance under health reform but it also may dictate which plans and doctors you have access to. Let's take a look at why 9.5% matters so much...to the tune of billions of dollars being transferred from one group to another.

The 9.5% threshold for health insurance costs

The Health Reform bill established 9.5% as the amount of income used for health insurance beyond which, it would not be an affordable. This means that if you make $40K annually,

the bill subsidizes health insurance premiums beyond just short of $4K.

The health insurance subsidies are for people who make up to 400% of poverty. If you make 401% of poverty, no subsidy and no 9.5% calculation.

If you make under 138% of poverty, you will likely have Medicaid (Medi-Cal) in California available to you at no cost to you. The most potent effects of the 9.5% calculation is therefore between 138% and 400% of poverty although the 9.5% actually goes down as you make less between the 138% and 400%. Let's sketch out some approximations of what this might look like knowing that we'll actually be able to plug in our numbers (income, etc) October 1st 2013 to see actual results.

The poverty scale is about to become common knowledge

Most people have no idea what the Federal poverty levels are. This is going to change as it will affect literally 100's of billions of dollars in funds transferring between groups of Americans. The numbers are indexed to go up each year at certain levels so we'll use easier approximations to make it easier to remember. In 2014, when the health insurance subsidies will start in full force, the Federal poverty level for an individual will be just above $12K annual income.

This puts 400% of poverty at about $46K (will actually be higher but it's a nice round number). For a family of 4, the Federal poverty number will be about $22K so 400% will be about $90K annually.

That's a pretty big number even in California so many people may find themselves within this band. In fact, the State estimates that roughly 60% of Californian's will be eligible for subsidies. If you make over these amounts, you will likely not be eligible for any subsidy and you can expect your California health insurance rates to increase probably 30-50%.

It's going to be really rough for that group on top of the extra taxes they will pay. So what subsidies can you expect if you fall between fully paid Medicaid and 400% of poverty

9.5% provides the cap for your health insurance premium expense

That's where the 9.5% comes into play.

Let's look at individual who's at 250% of poverty, or $25K annually. At about $12/hourly, that's a lot of Californians.

The rule says that no more than 9.5% (% will actually be lower) of his/her income can go towards health insurance premium. As we mentioned above, all the health insurance rates are supposed to go up significantly due to the benefit requirements also mandated by the bill so his/her policy (let's say for a 40 year old in Los Angeles) might be around $400 monthly or $5K annually. 9.5% of this person's income is roughly $2570 annually or $200/monthly.

This person's subsidy would then be $200/monthly (subtract $200 insurance premium cap from the actual insurance cost of $400). That's $2570 annually. That's how the 9.5% works. As you can guess, the more you make up to the 400%, the less the subsidy since it's based on total income.

There's many interesting effects to his 9.5% calculation which we'll discuss and also the question of doctor networks inside the Exchange where subsidies are available but those entire articles in themselves. For now, imprint 9.5% in your memory...you'll see it quite a bit in the coming years.

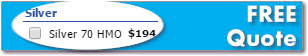

Run your quote with tax credit calculated based on income here:

You can run your Health Plan Quote here to view rates and plans side by side from the major carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!