How to Compare and Pick California Medicare Supplement Plans

The world of Medicare often feels alien to new enrollees.

DIfferent ways of saying everything and a literal alphabet soup of options (Part A, Plan G, Part D, etc).

Then there's the whole question of which plan to pick in order to fill the rather large holes of Medicare..especially the 20% coinsurance which has no cap.

Let's walk through the process and really understand how to compare the plans available.

First, our credentials:

We tackle the whole Advantage plan versus Supplement plans separately.

The networks and benefits are standardized by the law for supplements so it then becomes a question of pricing and carrier.

We'll look into that as well.

Here are topics we'll cover:

- What does Medicare not cover

- What are the different benefits offered

by supplement plans

- What is the most popular medicare supplement plan

- The importance of excess

- What about the new expanded G plans

- Comparing

Medicare supplement cost

- The Part D question

Let's get started!

What does Medicare not cover?

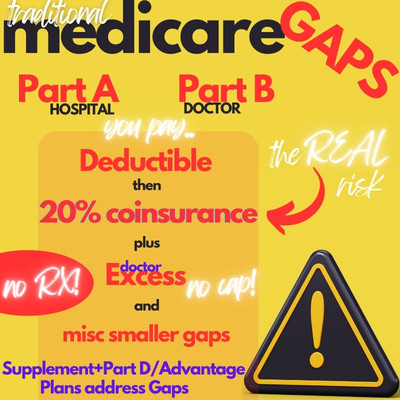

At its heart, Medicare operates like an 80/20 plan with deductibles.

Two deductibles actually:

- Part A deductible for hospital and facility charges

Part B deductible for physician costs (basically, costs outside the facility)

These go up a bit each year with inflation and you can check the current level when you run your quote here:

There are really 3 major holes to fill in with a supplement, and actually, one that's a deal-breaker.

First, you have the deductibles. This is a fixed dollar amount so we know what your exposure is.

A deductible is an amount you pay first before the plan kicks in. It's annual (Jan - Dec) regardless of when you come on board.

The real reason to get a supplement deals with what happens after the deductible is met.

That's the 20% co-insurance.

This means you pay 20% of the expenses after the deductible is met....for the rest of the year!

For example, if we had a $100K bill in the hospital:

- We would first pay the Part A deductible (approx $1736 but going up each

year)

- We would then pay 20% of $98,324 (deductible is already taken out)

That 20% share is a sizeable exposure...just short of $20,000!

There's no cap to this 20% under traditional medicare so we want to address it first and foremost.

Then there's a hidden exposure that most people new to Medicare don't know about.

Excess.

Essentially, doctors can choose to charge up to 15% higher than what Medicare allows.

This is called Medicare excess.

Here's the issue...more and more doctors are choosing to do this as the reimbursement is under pressure from Medicare due to budget constraints.

There's no cap to this as well!

That means if we have a $10K bill and the doctor charges the 15% excess, we have this additional exposure

This piece is really important and it drives the decision on what plan to consider.

So...let's start to look at Medicare supplement plans in light of this.

What are the different benefits offered by supplement plans?

The Medicare supplement plans come in a range of options from A plan up to N with many letters skipped.

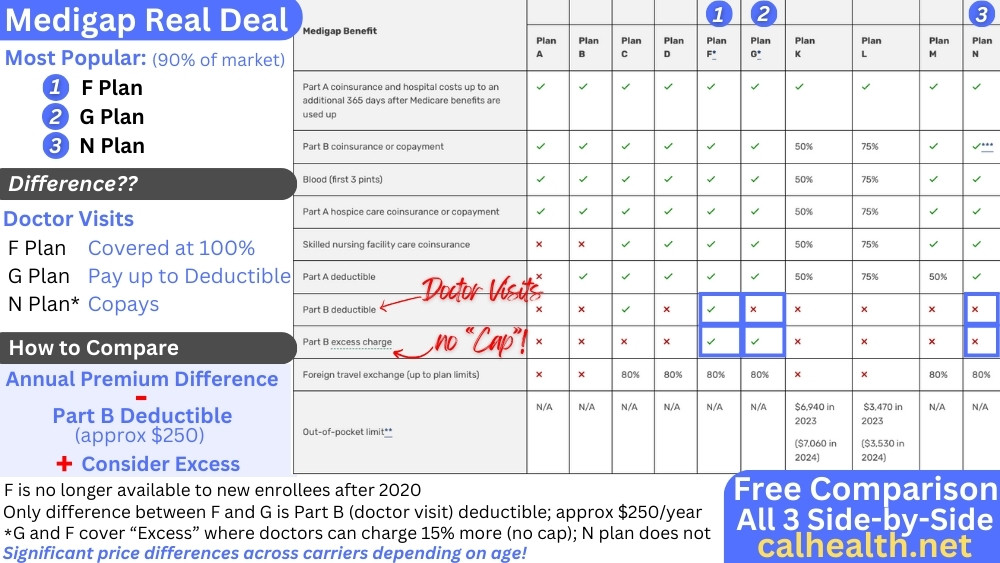

Here's a general chart for comparison:

You see the core benefits we described above plus a few others (skilled nursing facility, pints of blood, etc).

Really, skilled nursing is probably consideration #4 after our key concerns above.

A few notes:

- Only the G plan for new enrollees covers excess. Learn why this is so important here.

- All plans cover the Part A (hospital) coinsurance at 100%

This really leaves a range of different approaches on minor benefits since our 20% is taken care of.

Depending on your age, there may not be much cost difference between the various options.

The range is pretty narrow which makes sense since Medicare is essentially picking up 80% of the expenses.

This leaves us with the question...what is a solid plan?

Let's go there now.

What is the most popular medicare supplement plan?

The most popular plan is also the best plan in this case.

The G plan. We have a full review of the G plan here.

Here's the tale of the tape:

- G covers excess (the big difference)

- G covers all core risks with Medicare except for the doctor deductible which around $283/year (goes up each year)

It really comes down to excess.

The importance of excess

We have a whole review on Medicare Excess. Trading a few dollars monthly in costs for uncapped risk defeats the purpose of insurance.

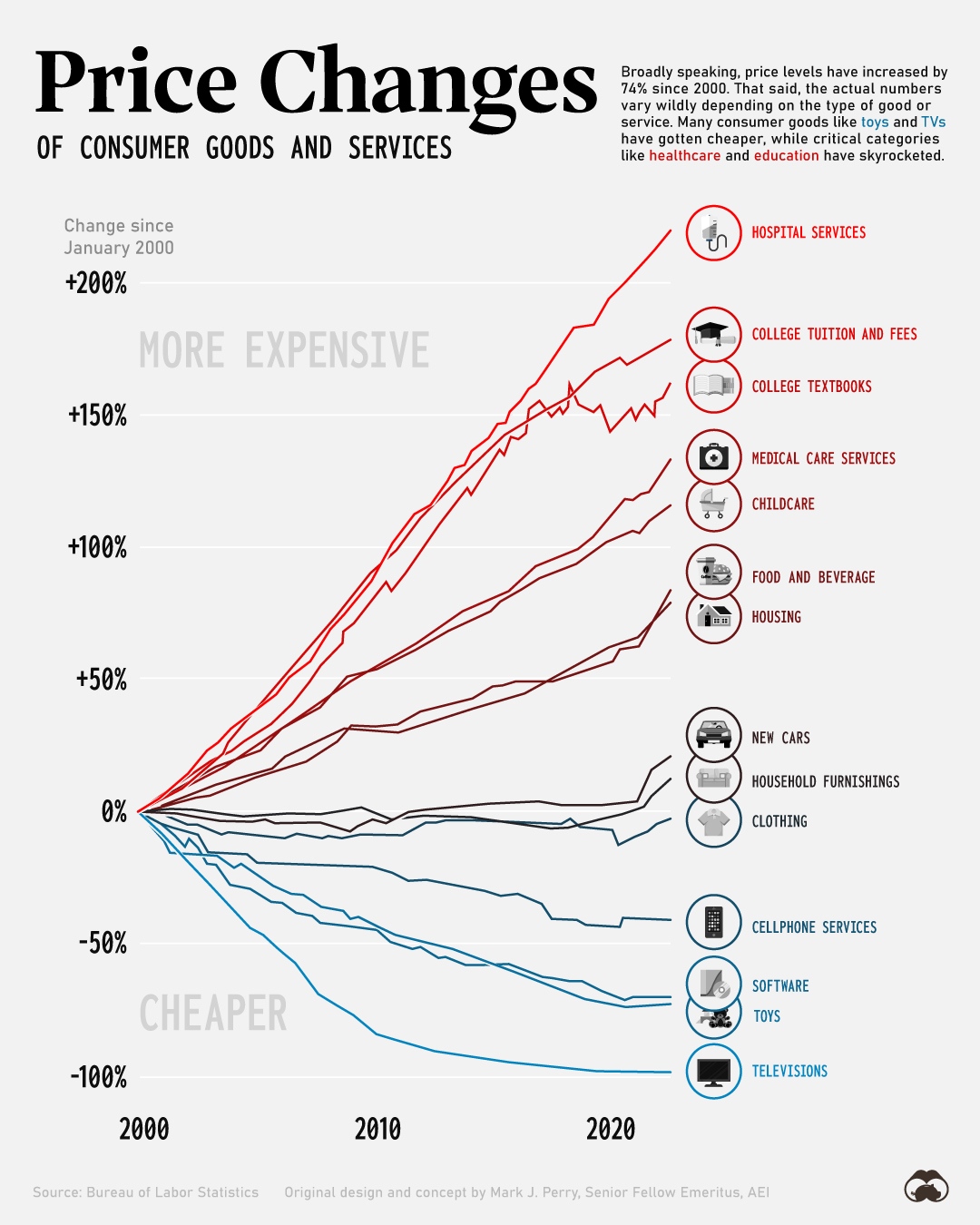

More importantly, it's fighting the tide of what's going on with Medicare and healthcare generally:

There will only be further tightening with Medicare's budgetary issues and sheer demographics (fewer working people paying for retirees) going forward.

This makes excess coverage more and more important with time.

As it is, Medicare is expected to start running deficits in 2026 for decades after.

Once we get past our initial open enrollment, window, we can't upgrade our supplement choice without health consideration.

The biggest issue with excess is that there isn't a ceiling on the exposure.

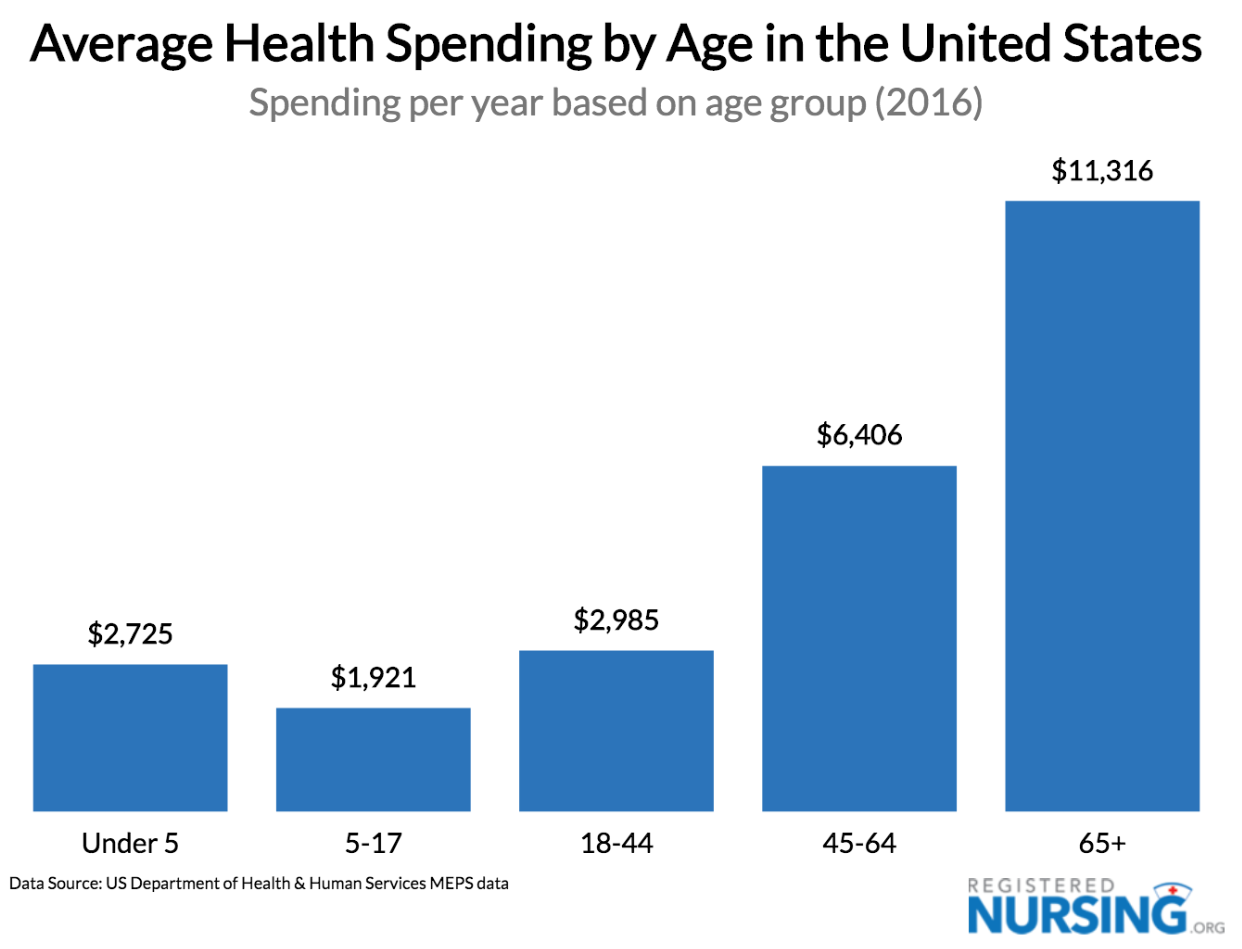

65+ is the wrong time to take this risk (Medicare alone):

The G plan is the only one that covers this risk and the cost (along with other comprehensive benefits of G) to do so far outweigh the cost.

That's why the G plan is by far, the most popular medicare supplement plan.

It replaced the old F plan with the only difference being that the doctor deductible (around $283/annual) is not covered with the G.

Based on this popularity, the carriers have started to "wrap" other benefits around the G.

Let's look at those.

What about the new expanded G plans

Some carriers have chosen to wrap add-on benefits to the traditional G plan.

These will generally have an "extra" or "enhanced" in the name such as "G plan Extra".

Anthem Blue Cross and Blue Shield of California led the pack on this one.

The gist of it is that Hearing Aid and Vision benefits have been added for generally a pretty small increase to the monthly premium.

If either of these are needed, it's not a bad way to handle it.

Run your quote here to see the difference in cost from the traditional G or reach out to us at help@calhealth.net for full details.

Delta Dental (the best networks) can be added separately if needed here. We can get VSP vision pretty cheaply here.

So, once we've narrowed the plan down, how do we pick the carrier?

Comparing Medicare supplement cost

As we mentioned, the benefits are standardized so a G plan will walk and talk the same regardless of carrier.

It then comes down to the following:

- Cost

- Ease of use

- Cost stability

Cost is easy to compare via our link here (free service).

Ease of use is a little trickier and that's where our experience with 25+ years comes into play.

Generally, Blue Shield of California and (separate carrier) Anthem Blue Cross have dominated the California medicare supplement market.

United Healthcare® is one of the top three medigap carriers in California and they can price well as we get older.

Shield, United Healthcare®, and Anthem have been the top choices for decades now.

It tends to bounce back and forth between the three of them as they compete for market share.

Lately, we've seen Cigna and Humana really shine in terms of pricing.

In general, these major carriers are pretty comparable in cost but this can differ from year to year.

One note...for people new to Medicare, you may get a $25/month discount from the rates listed below for the first year for Shield, Anthem, United Health, and even Health Net.

You can quickly compare all the carriers here:

We have to address the next big question.

The Part D question

Although we have a full breakdown on getting Part D in California, let's hit the highlights.

Part D is the prescription benefit.

The supplements do not cover RX so we need to add Part D for that coverage.

You can mix and match carriers for Part D versus the supplement and in fact, most people do.

Part D Quotes are available under the PDP (Prescription Drug Plan) tab here:

This way, you can generate a personalized Part D quote for you based on your actual costs with plan customer reviews built in!

We can change Part D plans at the end of each year regardless of health so there tends to be a period of "re-shopping" each year.

You'll just update meds/dosages in the existing system and it's off to the races. Saves so much time and there's no cost for this system!

Finally, there's a penalty for not enrolling in Part D when eligible.

It's 1%/monthly and goes on indefinitely.

This means that if you wait 12 months to enroll in Part D, it will be 12% higher!

Wait 3 years? 36% higher.

For this reason, it generally makes sense to at least get a "placeholder" plan - the cheapest Part D plan on the market to avoid the penalty.

Of course, it's also important to get the protection that entails.

For information on the process and timing of enrolling for Medicare and supplement

There is no cost for our assistance and no question is too small.

Don't take our word for it...

Be well!