California G Medicare Plans -

Medicare Excess

California G Medicare Plans -

Medicare Excess

What Are Medicare Excess Charges?

Medicare introduces seniors to a whole slew of new terms.

Let's add one to the list.

A very important term.

Medicare Excess

What is it, how does it work, and maybe most importantly, is there a Medicare

plan that will take care of it?

First, our credentials:

It's good to understand how Excess works as we go forward since it will become

more important (and costly) with each year.

Let's jump right into it. First, what is it?

What is Medicare Excess?

Here's the simple answer.

Doctors are allowed to charge up to 15% more than what Medicare allows and still be Medicare providers.

The 15% is Excess.

A little more background.

Medicare has its own list of contracted providers...similar to a PPO.

These doctors agree to certain requirements from Medicare (or CMS

really).

The most important of these rules deals with how much they can charge.

For any given medical procedure, there's an agreed upon reimbursement rate.

A schedule of allowed charges.

For example, a doctor visit with a dermatologist (just the consultation

itself), Medicare may list a rate of $80 reimbursement back to the doctor in a

given area.

The doctor must agree to a list of reimbursements based on different health

care codes to be a Medicare doctor.

If not, Medicare will not reimburse the doctor for those services to Medicare

members.

Pretty straight forward.

There's a catch (as always)!

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare.

Some doctors accept the Medicare rate while others choose to charge up to the

15% additional amount.

For example...

If the allowed Medicare rate for an office visit is $100, a doctor can charge up

to $115 and still keep their coveted Medicare provider status.

If you only have Medicare (and not a supplement), you will have to pay this 15%

in addition to the core benefits of Medicare.

15% doesn't seem too bad..what's the big deal?

Why Medicare Excess Is important

Here's the deal...there's no cap to the 15%

15% on $100 is manageable to most people.

15% on $4000 is less so and 15% on $20K will pose issues to many seniors.

That 15% does not have a cap.

Your surgeon might accept Medicare's rates but what about the supporting staff

or anesthesiologist? (from actual client experiences!!)

Again, the 15% is not curtailed by your core Part B Medicare coverage.

That's just the start of why Medicare Excess is an important consideration.

The importance will only grow with time.

Get ready for Excess playing a much more important role.

Crystal Balls and Medicare Excess

Excess is going to get much more important in our opinion.

Maybe critical.

A quick lay of the land.

There's tremendous pressure on Medicare to contain costs as its financial

situation worsens.

The biggest bat Medicare can take to its costs is the reimbursement to

doctors and hospitals.

It's been an ongoing battle.

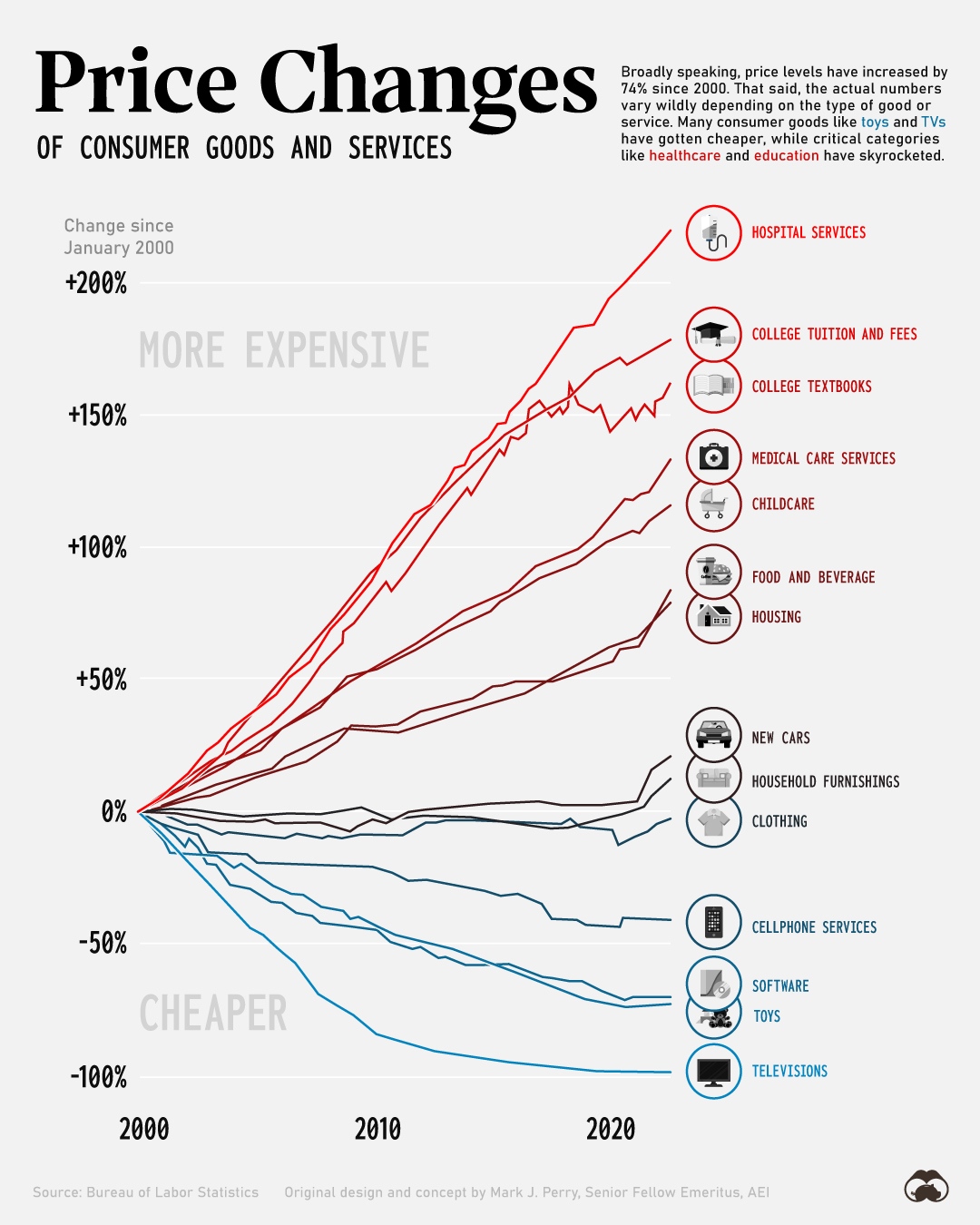

Look at what they're facing?:

Each year, Congress is faced with an existing mandate to roll back reimbursement

to doctors and each year, and out of political pressure, they choose to delay for

another year. Understandably!

The issue is that this compounds over time and just shifts the need to the

future.

The rate of inflation for doctor reimbursement is already extremely low.

Add to that a slowing birthrate (less workers to support seniors), and it's

going to get "interesting".

Why does this matter?

Expect more pressure from Medicare on doctor's reimbursements.

As a result, expect more doctors to charge "Excess".

Doctors are already under assault from falling reimbursements due to the ACA

health law.

It probably won't be unheard of to see many doctors charge excess within 5-10

years.

Alright...we established why Excess is important and how it will grow in

importance.

What can we do about it?

Enter the G plan - Excess Killer!

We help many Seniors find the right Medicare supplement plan for their situation and budget. Check out our Picking Your Medicare Plan Guide or Insider's Guide to Medicare Supplements.

One note..excess isn't an issue with Advantage plans since you have to

remain in network and they by definition, agree to medicare rates. See

our big review on the

what's the

trade-off between Advantage and Supplements.

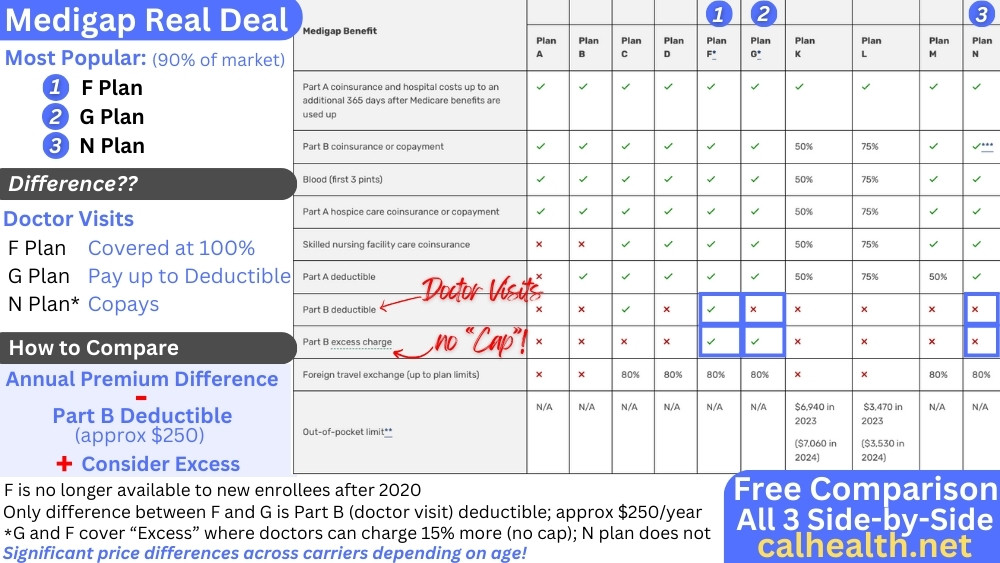

Without fail, the G plan is the plan of choice and for good reason.

Aside from the comprehensive nature of the G plan in regards to the major holes

of Medicare (deductibles, 20% coinsurance, etc), it's the only current supplement plan

that addresses...

Excess!

That's right. The G Medigap plan will cover Excess when doctors charge more than what Medicare allows.

Take a look here:

It's the only true supplement plan (as oppose to Advantage plans which force networks) that covers Excess. We have a massive review on the G medigap plan..

&

By definition, a doctor must accept Medicare if they participate in an Advantage plan.

The old F plan also covered Excess and millions of seniors are still on it but they're way over-paying for the privilege:

You can quickly quote all the major carriers for Medicare supplements including the G plan. There's zero cost for our assistance! Email at help@calhealth.net or pick a time to chat.

We're happy to walk through any questions on how the plans work and differ from each other.

The Medicare Excess Wrap-up

- Doctors can choose to charge more than 15% above what Medicare allows and still be Medicare providers./li>

- Core Part A and Part B do not cover this 15% - the member will be responsible

- The financial impact from Excess will only grow with time due to Medicare pressure on costs.

- The G Plan supplement is the only Supplement plan (as opposed to Advantage plan) that covers this 15% Excess charge.

Really...figuring out the excess piece and Part D (for medication) rounds out the decision making.

Finally, let us help you! There's no cost for our services and we have helped 1000's of California Seniors find the best supplement plan values.