California Medicare Options - Should I switch my F plan for G plan?

California Medicare Options - Should I switch my F plan for G plan?

Comparing the old F medicare plan and the G plan. Should I switch?

The F plan made up a good 80% of the medicare supplement market back in the day.

It was by far the most popular and we fully understand why (see our most popular medigap guide or Insider's Guide to Medicare supplements).

It covered all the major holes of Medicare including Excess, which is becoming more and more of an issue.

After all..it's uncapped!

Interestingly, there's still plenty of people on the old F plan who just never made any changes. For years now!

Although we're big fans of the F plan, there's a definite consideration to be made these days in regards to the G plan.

Or even within the F plan itself! (more on this below).

The savings can be significant and we'll show how to really compare the F and G medicare plans.

First, our credentials:

Here are the topics:

- How does the F plan compare to the G plan for Medicare

- How to compare the cost difference between the F and G plan

- Can I switch from the F plan to the G plan

- Can I switch to another F plan

- Using the birthday rule to switch from the F to the G plan

- How to quote the G plans versus the F plans

- How to switch and enroll supplement plans

- The new G extra and add-on benefits

Let's get started!

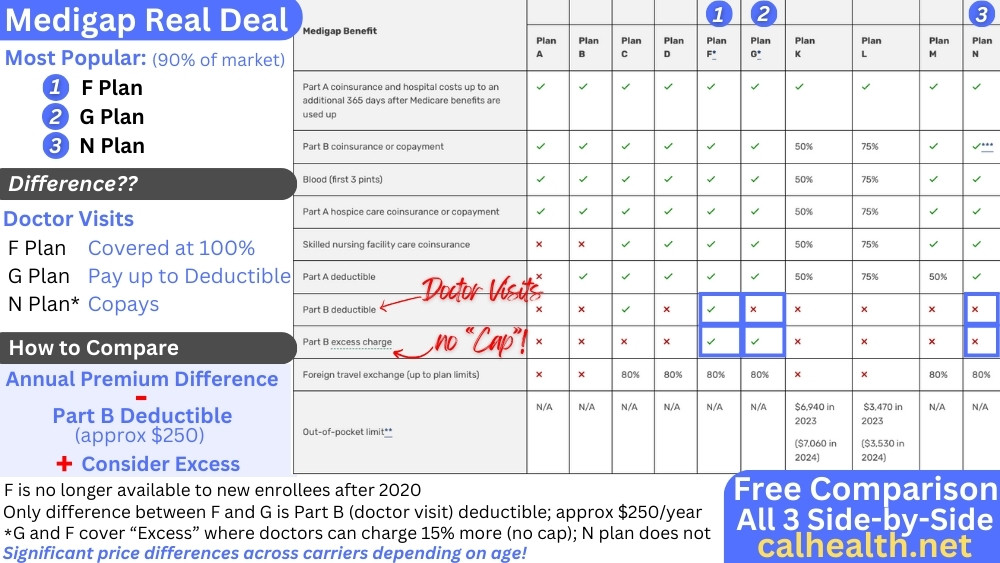

How does the F plan compare to the G plan for Medicare

The F plan was the most comprehensive of the medicare supplements until Jan 2020 for new enrollees.

It covered all the major holes of Medicare:

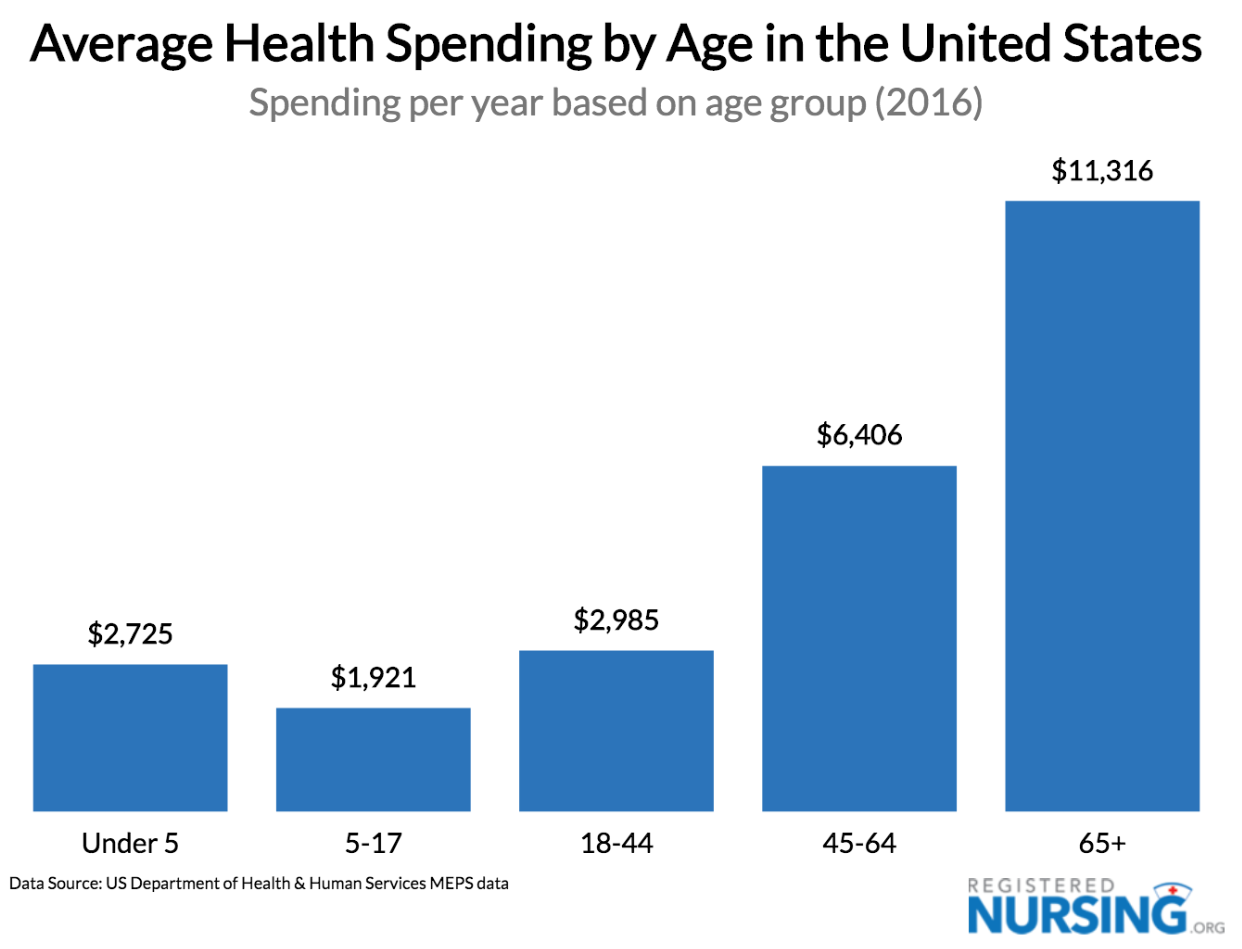

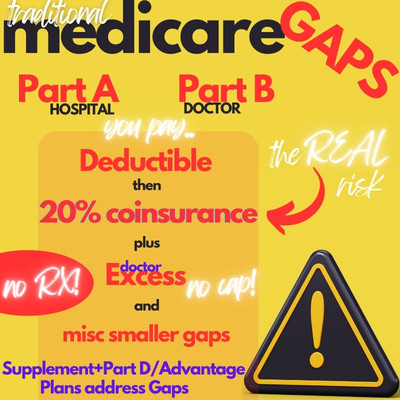

We've looked at why the 20% is the real risk in our Medicare alone guide. There's no cap to this 20% exposure and this is the wrong time to take on that exposure.

The F plan also covers Medicare Excess, where doctors are allowed to charge up to 15% more than what Medicare allows.

There's no cap to this exposure as well!

That's why the F was so popular but many people have just renewed their plan without shopping the market.

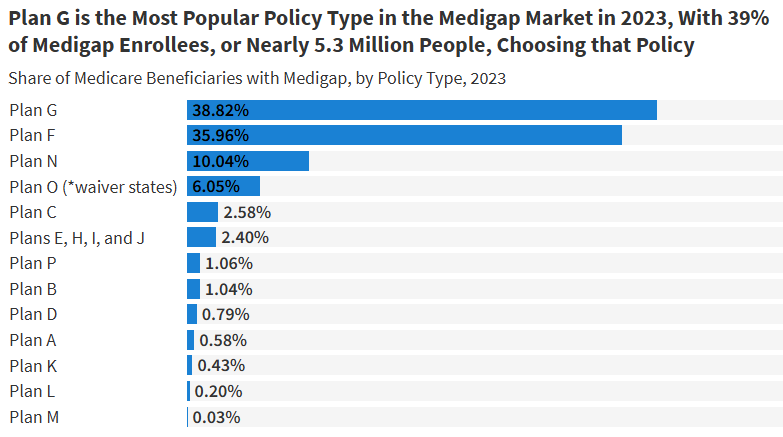

Since Jan 2020, the G plan has taken the mantle as the most popular medicare supplement plan.

The G plan covers everything that the F plan covers EXCEPT for the Part B deductible.

The current Part B deductible (for doctors) is around $283/year (goes up each year).

This means you would meet the $283 deductible year year and then expect the G plan to operate just like the F plan of old.

Same doctors and hospitals. Same way of working (self-referral, etc).

This makes our comparison very easy now! Let's go there.

How to compare the cost difference between the F and G plan

Let's take an actual example from the market.

We'll quote a sample 65 year old in Los Angeles since there are a few of them there.

Let's look at 3 of the biggest (and best priced carriers) for the F plan

- $238-253/month

Okay. So just around $250/month! Some people are paying much more with other carriers.

And the G plan...

- $172- 183/month

Around $180/month.

So a recap:

Cheapest F plan $238

Cheapest G plan $172

___________________

Minimum Monthly difference: $66

Annually?? $792!!

Keep in mind you may not be on the cheapest F plan. There are many others that

are more expensive.

So...our final comparison.

We're spending almost $800/year to potentially save $283/year (part B deductible).

Goodness. There's NO way this every comes out in your favor and it's the opposite of insurance (paying a smaller amount to protect from a bigger risk).

Best case....you're only losing $575/year.

Keep in mind that this comparison of the G and F plan is for a 65 year old. The "spread" only gets bigger as we get older. This means more savings.

Don't beat yourself up. There are 10's of thousands of Californians that still have the F plan and even the old I or J plan (even more savings).

Now...what to do about it.

Can I switch from the F plan to the G plan

Yes!

In California, we can try to switch plans anytime during the year.

Worst case, it requires an application (more on that below) but the underwriting questions are not too bad if we're outside an open enrollment period (likely if we still have the F plan).

Since the savings is so significant, we recommend submitting the application right away and worst case, they'll say no and we'll wait till the birthday rule kicks in (more on that below).

This brings up another question we see quite a bit.

Can I switch to another F plan

If you have an F plan already, you can switch to another F plan or even one of the new F plan extras which add-in other benefits like vision and hearing aids.

The question is...why would you?

Sure, you may be able to find cheaper F plans on the market but not cheaper than the G plan as we saw above.

We're happy to help you compare all these options side-by-side for your situation at help@calhealth.net or pick a time to chat.

What if we can't qualify based on health. Hello California!!

Using the birthday rule to switch from the F to the G plan

California seniors can take advantage of a birthday rule where they can move from a plan to another one of equal or lesser value with no medical underwriting!!

That means you can go from an F plan to another F plan or to a G plan around your birthday each year.

We generally enroll the month before or after the 1st of the month of your birthday.

This even allows us to change carriers which is critical since some carriers are so ridiculously expensive for the very same benefits (medigap plans like the F or G plan are standardized - same benefits and network!).

Let's get to brass tacts.

How to quote the G plans versus the F plans

You can run your quote here across all the Medicare supplements from major carriers in your area:

You can even filter the G plan on the left side but reach out to us with any questions on how to compare the medigap plans.

On the left, you can filter the plan selection such as G plan or by carrier. Keep in mind that the networks and benefits are the same across the carriers so it's really a question of pricing and ease-of-use.

Blue Shield, Anthem, and United Healthcare® have been competitive for years now depending on your area and age but Cigna and Humana shine in certain areas!

Again, we're happy to run this quote for you reflecting all the major carriers!...just check out our Google Reviews.

What about switching?

How to switch and enroll supplement plans

This is our favorite part.

We work with the biggest Medicare supplement carriers and plans at no cost to you!

Shield, Anthem, Cigna, Humana, or United Healthcare® have dominated the field over the past decade.

You can simply "Add to Cart" and enroll right online!

When you get approval, make sure to cancel your current Supplement but we'll guide you through the entire process.

Part D is handled separately but also available right through the quote portal here:

The Part D tab up top will change the type of plan but keep in mind that Part D has different rules for when you can change (usually at open enrollment year-end).

This will make future changes super easy since your information is already in the system and you just need to update medications and you're ready to go.

Saves about 45 minutes to an hour each renewal and there's no cost for our assistance or to use this enrollment system.

One last stop.

The new G extra and add-on benefits

When you run your quote, you'll notice a few different G plans available.

They all have the core G plan benefits shown above.

The Extra will add in benefits, primarily vision and hearing aids.

On the the other side, there's a high deductible G plan which builds in a deductible just under $3K before the core G plan benefits kick in.

This means, you're paying the Part A deductible, Part B deductible, 20% coinsurance afterwards until the deductible is met.

That's a whole other comparison but we're generally not huge fans since the this is a bad time to take on more risk (65+).

Of course, we're happy to run the numbers for you across the different plans.

Whatever you do...don't send the carrier extra money each month by staying on the old F plan or with a much more expensive carrier.

Please.