California Medicare Options - Alignment Cash Back plan review

Comparing Alignment Health's Part B Rebate or Give Back Plans

It's been all the rage since they've come out.

So-called Part B rebate or Give Back plans for Advantage.

We're all well too aware of the monthly deduction or quarterly payments to Social Security for our Part B with Medicare.

The average is just under $200/month and it goes up each year with inflation (which has been on a tear lately).

For people in pretty good health, the Part B rebate plans have been a big deal with savings up just short of $2K a year!

Now combine this with the new up-and-coming status of Alignment health and we have a winner.

We'll get into both aspects below as well as compare the two current plans that have a built-in cash back benefit for Part B.

Our credentials in case you're wondering:

This is what we'll cover:

- Quick intro to Part B and the Medicare Give Back benefit

- Alignment health plans core stats

- Comparing Alignments two Part B Give Back plans

- SmartHMO Alignment Plan with Part B Rebate

- AVA+ Instacart Alignment plan with smaller Part B Rebate

- How to quote the Part B Rebate plans

- How to apply for the Give Back plans

Let's get started. We've already spent the Give Back!!

Quick intro to Part B and the Medicare Give Back benefit

First, Part B is the piece of Medicare for doctors that we have to pay a premium for.

Part A (hospital) is usually free as we've paid for it all our lives via payroll taxes.

The Part B premium is usually automatically deducted from Social Security or requires a premium payment on a quarterly basis.

For 2024, the average is $174.70 but it goes up each year based on CPI or inflation.

Your income can also cause pretty big changes in this base level up or down. Seems that up is the bigger trend lately!

That's the bad news. Over $2K out of pocket each year.

This is where the Part B Give Back plan benefit comes into play.

You don't get it is as cash but the plan will pay towards this Part B expense directly to Social Security if you're on a qualified plan.

There can be different levels of "Give Back" and you'll never get more than your total Part B expense (no extra cash) but as we'll see, the amounts are usually designed to hit the sweet spot of the average Part B noted above.

You may see this reimbursement level track upwards each year as Part B premium also rises.

It always rises after all!

There are many different Give Back plans on the Advantage market and we work with the big ones (UnitedHealthcare®, Humana, Anthem, Shield, etc).

Why look at Alignment? After dealing with all the carriers, we're pretty blown away by how they work and that's saying something with insurance carriers (like pulling teeth generally).

Alignment health plans core stats

We have to interact with the Advantage carriers daily from an agent's perspective.

It's usually a frustrating affair (has customer service generally just imploded since the pandemic??).

Our interaction with Alignment has been...refreshing:

- Questions

- Enrollment

- Customer Services

You name it. More importantly, if you've read any of our reviews (how to compare Advantage plans or Top 10 Tips to save on Medicare), you'll know we really focus on the key attributes that matter.

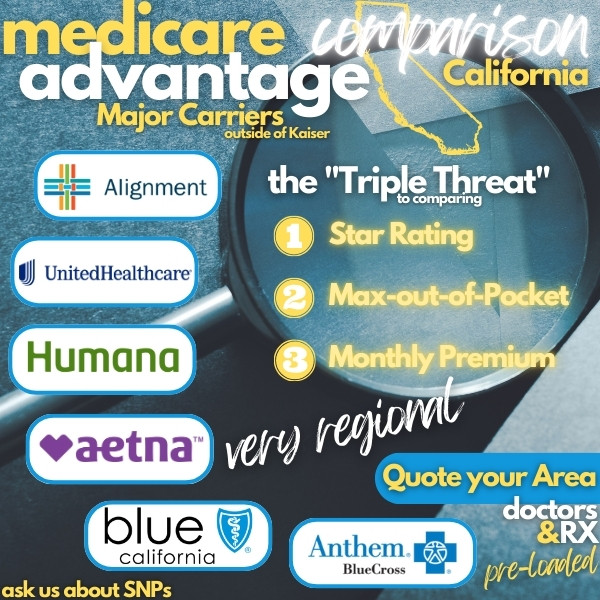

The Triple Threat:

- Monthly Premium - how much it costs monthly

- Max out of Pocket - how much it costs if you get really sick or hurt

- Star Rating - how existing members feel about the plan and carrier

Alignment is crushing it on this front!

- Zero premium on most plans

- One of the lowest max out of pockets on the market (Premium+ Instacart plan at $198) for the State!

- 4 Star Rating across the board on most plans

That's our starting block but the real coup is the doctor network.

Most of our conversations start with...

"What Advantage plan can I use with X doctor or medical group??"

This really drives the Advantage decision more than anything.

Networks may be Alignment health's secret weapon as they've pulled off coups across the State.

Just to name some very popular requests from enrollees.

You'll be able to quote the plans according to your doctors below but let's look at the Give Back plans from Alignment in detail. There are two.

Comparing Alignments two Part B Give Back plans

Alignment currently has two plans with a Give Back benefit.

Let's look at the SmartHMO and AVA+ Instacart options.

First, the SmartHMO Alignment Plan with Part B Rebate

The core Give Back plan is the SmartHMO plan with a $164/month Part B Give Back benefit (check quote below...will change every year).

The primary (maybe only reason) to get this plan is the Part B Rebate but this one item has made it one of the top plans from Alignment.

Apparently $2K annually is a big deal!

The trade-off versus the other very popular plan (Platinum+ Instacart) is the out-of-pocket max at $2499 (versus $198).

So how do we really compare this?

If you know you have very large bills expected (think surgery, hospital, or even extensive RX), this offsets the $2K max Part B benefit.

So...really, we're comparing over $2K in backend exposure if we get really big bills versus a guaranteed max benefit of $2K in cash.

In the insurance world, that's not a bad trade-off. We do this kind of calculation for people all day long.

"We'll save $2K annually but have a net $400 more exposure if we get something big".

The goal with insurance is to "Cap" our exposure in case of big bills. A $2K savings for a potential $2400 expense IF we have really big bills is...

A pretty great trade-off.

The only other caveat is the network.

The SmartHMO has a smaller network than the other plans including missing Optum, Regal, and Heritage.

You'll be able to run your quote below with your doctors to see if this matters but just a head's up. We're happy to chase down your preferred doctors or medical groups at help@calhealth.net.

Next up is a hybrid plan with a small Part B give back benefit.

AVA+ Instacart Alignment plan with smaller Part B Rebate

This is an interesting hybrid plan with a hodge-podge of different benefits all compressed together.

First, AVA stands for Alignment Virtual Agent. This is an attempt to catch big health problems before they happen with more interactions via telehealth and other methods first.

They're going to slowly work in AI to this and it may very well be the future. The plan does have a 4 star rating so clearly, it's not a negative for enrollees.

The positive reviews may be more due to the Instacart add-on benefit!

This provides money for grocery DELIVERY at $100/quarter if you qualify based on chronic illness.

Finally, they added in a $50 Part B Rebate to the mix. This is a lower level but may just hit the spot for people who have reduced Part B premiums based on lower income.

The max is $2K now so we have to take that into account against $600/annually in Part B give back and $400 in groceries.

So $1K in savings versus the potential $1800 in back end exposure (versus the Platinum+).

Not as great a setup as the SmartHMO calculus BUT we get to keep the bigger network including Optum, Regal, Heritage, etc.

This plan seems to fit the following:

- Eligible for Instacart based on chronic illness BUT

- Not expecting too heavy medical expenses where we get to the $2K max AND

- Lower Part B premium based on lower income so the $50/month actually touches the sides

Okay...those are the two Alignment Part B Give Back plans!

So...let's see if they're available in your area and how they stack up against other options.

How to quote the Alignment Part B Rebate plans

We provide a completely free-to-you quoting tool here:

A few notes.

First, make sure to enter your doctors, rx/dosages, and preferred pharmacy in the Preference box.

This is important with the SmartHMO since it has a different network from the other Alignment plans.

Sort plans by "Annual Estimated Total Cost" at the top. This takes into account your RX out-of-pocket expenses.

You can filter by "Alignment" under carriers but more importantly, you can filter by "Part B Rebate" to see the market.

What's interesting before filtering for Alignment??

They come up #1 and 2 when filtered for cost. Followed by Humana, UnitedHealthcare®, Scan, Wellcare, and Anthem.

Goodness...good company and leading the pack.

You might see this such as our sample quote in Los Angeles with "Part B Rebate" selected:

One note. If you qualify based on medi-cal/LIS or chronic illnesses, select "See Special Needs Plans" up top as they can really be cost-effective for people who are eligible.

There's zero cost for our assistance and you'll notice we don't pound you with calls/emails which is probably why our Google ratings are so high.

help@calhealth.net or schedule a time to chat by phone: https://calendly.com/dennis-jnw or even by online chat!

Alright...you like what you see.

How to apply for the Alignment Give Back plans

This is easy. Right from the same quote tool above, you just Add to Cart!

This system is operated by the largest Medicare tech company (called Integrity...the dominant provider everywhere).

The Alignment online application is:

- Free to use

- Secured

- Easy (this is really down to Alignment's way of processing)

- Fast

You'll get the fastest processing available as it ties directly into Alignment's enrollment portal.

Again, you can access the Alignment application and quote here:

Let us know if we can help in any way.

See why we're big fans of what they're doing after 30 years of helping seniors evaluate options??

Big Reviews on Alignment health plans and How to Compare Alignment plans.