insurance for retirement - Approaching Medicare and Beyond

Retirement and California health insurance

Congratulations!

Maybe it's been 30 years as a Federal employee.

Or maybe 15 years at the State or with an employer. Self-employed freelancer out there on the grind??

We're going to save you some of that dearly earned free time that comes with retirement.

Let's understand your health insurance options after retirement.

Everything has changed with the ACA law passage so let's get started.

Age affects the options available to California retirees so we'll start there.

We'll contrast the options with retiree benefits and Cobra typically available to many people. Of course, Medicare may be here or around the corner (or years away you lucky soul??).

We have wonderful tools for people entering Medicare...so you can manage the onslaught of flyers and brochures you're about to get (so much for saving trees)!:

- How to pick the best Medicare plan

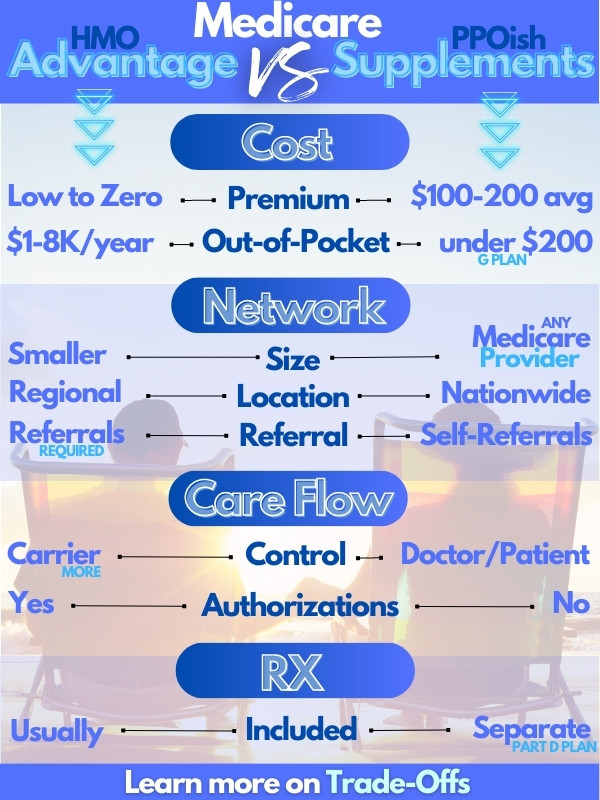

- The trade-off between Advantage plans and Supplements

- How and When to Enroll in Medicare

Don't take our word for it...

Finally, you can quote marjor carriers and plans in your area (Advantage, Supplements, and Part Dbased on your doctors/RX here:

So...what about the half dozen other options? Let's go there.

Health insurance options for Retirees under age 65

So you are retiring from work. What are the common options available to you?

Most people have some continuation of the group health plan.

The type of offered coverage depends on where you are retiring from?

These are the Common continuation options:

- Cobra coverage - allows continuation of employer sponsored health plans

- Federal retirement coverage or FEHB

- California State Retirement Benefits of CalPERS

- Retiree Benefits from a Union or Company

Each option has its own set of eligibility requirements and you will likely receive confirmation of the plans and rates available to you.

Here's the deal.

The options can be really expensive!

This is especially true for Cobra which is basically the full cost of the employer health plan that you pay now.

FEHB and CalPers can also be very expensive depending on how long you worked there, vested amounts, and the like.

So...are there options to reduce our health care costs after retirement?

ACA Law and Retirement Health Costs

The big issue we had before the ACA law passed had to do with health eligibility.

Before Jan 1st, 2014, you could be declined based on health.

Most retirees were FORCED to keep their continuation of coverage options such as Cobra, CalPers, or FEHB.

That's all changed.

More options is always better.

That goes for Retirement benefits as well.

So what changed?

ACA Law affects options for Retirees

With the passing of the ACA law, coverage is now guaranteed issue:

- This means that you cannot be declined based on health.

- There are no waiting period for pre-existing conditions

- There are no rate-ups for health status

All good news.

But wait! (we're not going to offer a bonus anything if you act now!)

Even better than another set of steak knives.

There are now Tax Credits available based on income.

This really is the deciding factor.

ACA Tax Credits for Retirees

If your income is within this range, you'll likely qualify for very large tax credits.

We're finding that retirees are qualifying for very large tax credits for

two reasons:

- Their income after working usually falls

- Older Californians are qualifying for larger tax credits than younger individuals since age drives cost of the underlying plan

Let's look at each piece for a retiree and then we'll look at any downsides.

Retiree income and tax credits

A few key points specific to retirees when it comes to income levels:

- We need to look at household income (including spouse) even if not enrolling

- Untaxed Social Security is included in the number

- Investment gains are included if taxable (as opposed to drawing down accounts)

- Non-tax interest is included

- We want to look at the year's income in which you will be insured (and credited)

We're basically trying to estimate the AGI on the 1040 tax form (household is everyone that files together on a 1040 whether enrolling or not) for next April's filing. So...this year's income.

You can quickly run your quote here:

Email help@calhealth.net or Call 800-320-6269. Our services are free to you as Certified Covered Ca Agents

Household Income

We need to include spouse's income in the calculation even if they are not enrolling.

The tax credit is based on household income.

When trying to calculate your tax credit, estimate your w2 income for the full calendar year.

Self-employment income is the net business income (after business expenses are removed). This can have a big impact on the final number.

The number that flows to the 1040 for self employment income (including rental income) is what we want to use for our estimate. Again, the AGI on the 1040 is the target for MOST people.

What about split year income during and after retirement?

Keep in mind that your tax credit will likely change the following year.

Many retirees find that their current income is higher since they still have income for a partial year.

The next year might be very different!

Working income goes away and most individuals or couples rely on retirement income, interest, and Social Security.

We may have one tax credit for this year another one for the outgoing years.

Again, we can analyze all of this for you and change each year!

Even though Social Security is generally not taxed (doesn't show on the 1040 line 7), we still need to include it in our income estimate (the untaxed portion)

Investment Gains

This can be trickier. Is the gain taxable?

That's the key factor. Many retirees are taking gains or assets from retirement accounts such as 401K's.

If the money is taxable, we include it.

If not, we generally do not.

This becomes a tax issue. The AGI on the 1040 is a good indicator except for tax free interest which should be included.

Again, there are many wrinkles to everyone's income situation so shoot us an email!

5 Minutes at 800-320-6269 or a quick email and we'll have you all squared away.

Retirees are the big beneficiaries of the Covered Ca tax credit

Here's the little secret that became pretty obvious after funning a few 100 tax credit quotes for Californians.

Older Californians (age 50-64) are getting huge tax credits!

Why is this?

It has to with the structure of the law but there's actually a thought process behind it.

Health insurance rates have always been tied to age.

On average, a person's health care costs double with each decade of their life

Rates became really expensive as we got into our 50's and 60's.

The law looked at ways to protect Californians that are getting doubly hit

- Health insurance rates are their highest

- Retirement income is the lowestRetirement income is the lowest

People in their 60's were finding that they could not afford to retire purely because of health care cost!

The ACA law basically says this:

A person shouldn't have to pay more than 8.5% of their income towards health insurance.

For a retiree, the rate could be $800/month for a Silver plan.

If a person has retirement income of $2400/month, health insurance would eat up 1/3 of gross income!

That's the issue for many retirees and the ACA addressed it.

In the above situation, the premium might be capped at $240 worst case.

We actually see many premiums for lower income at $100/month.

Sometimes lower. It's on a sliding scale now.

So let's see what you might eligible for. Retirees are definitely one of

the intended groups that the ACA law is designed to help.

Any considerations for Retirees with the new Individual/Family plans?

There is one item we want to check first.

The doctor networks between Individual/Family (including Covered Ca) and Employer or Federal/State health plans is smaller.

We want to check doctors first to make sure that critical doctors or hospitals are in the new network.

There's no way around this since both Covered Ca and off-Exchange plans have the same narrow networks.

Run your quote and you can click on "Provider Listing" by any plan to check networks. Or...call your doctor and ask "what Covered Ca plans do you participate with"?

The drug formulary or list of doctors is also smaller so we'll want to check this as well.

In most cases, the premium savings is so large, the network and drug formulary difference becomes a secondary issue.

Retiree health benefits for Californians age 65 and over

There's a big difference for people over age 65.

Medicare

Have you heard of it?

If you're nearing 65, you probably get attacked with brochures.

Literally. Like the Harry Potter owl mail delivery scene.

If you are over 65 or older, the calculus changes in terms of retirement and health benefits.

Now, we can get Medicare (Part A and B), a Supplement or Advantage plan, and a Part D (for RX).

We have wonderful tools for people entering Medicare...so you can manage the onslaught of flyers and brochures you're about to get!:

- How to pick the best Medicare plan

- The trade-off between Advantage plans and Supplements

- How and When to Enroll in Medicare

Don't take our word for it...

Finally, you can quote major plans in your area (Advantage, Supplements, and Part D) based on your doctors/RX here:

All told, a 65 year old is probably looking at $300/month (G plan, Part B premium, and Part D plan) on the supplement side. Less on the Advantage side.

A person should have very little out of pocket for medical expenses with this set-up.

For people who are more budget constrained, the Advantage plans can be low or no cost.

You can quote both Medicare supplements and Advantage plans and even Part D.

Medicare versus Retirement benefit plan networks

What about doctors?

Basically, if the doctors take Medicare, you're fine with a supplement.

That's a huge nationwide network available to you.

Advantage plans work more like HMO's so they will have more narrow options but the trade off is that the pricing can be....well ZERO.

- So Med Sups...nationwide Medicare network.

- Advantage plans....smaller local networks but low/no cost as a trade off.

Really check out the "Trade-off" between Advantage plans and supplements so you can make an impartial decision.

Again, you can quote both Medigap and Advantage plans here or email us with questions or set up time to call.

We can look at your particular situation and find the best value for your

situation. There's ZERO cost for our assistance!

Recap on Retirement health insurance options

Make sure to speak with a professional before losing for forgoing retirement benefits.

For most retirement options, if you decline the coverage, you may not be able to get them back.

It's important to know the pro's and con's of each plan.

Put together a list of your doctors (and their cities). The quote system will allow you to enter doctors and meds so the quote takes this into account.

There's no cost for our service as licensed California health insurance

agents. Call us at 800-320-6269

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.

.jpg)