California Medicare Options - Compare United Health AARP versus Anthem Blue Cross Advantage plans in California

AARP United Versus Anthem Blue Cross Advantage Plans

Talk about two big players going up against each other.

On one hand, you have United health, one of the biggest nationwide carriers with the the marketing prowess of AARP at their back.

On the other hand, you have one of the two California carriers with decades of experience in all segments of the market.

Now...add in the fastest growing insurance type with Medicare advantage plans!

To date, one is clearly leading the way but don't count out either in such a dynamic market.

We'll compare actual markets to give you a good overview of how they're approaching the competition.

These are the topics we'll cover:

- A quick overview to AARP United and Anthem Blue Cross in California Advantage market

- Comparing AARP United Health and Anthem Blue Cross across California Advantage markets

- What is Anthem Blue Cross' advantage

- What is United's advantage

- SNP plans and Anthem versus United

- Quoting Anthem Blue Cross and United side by side

- How to enroll in Anthem Blue Cross or United Health

Let's get started!

A quick overview to AARP United and Anthem Blue Cross in California Advantage market

We have Guides for both AARP United California Advantage plans and Anthem Blue Cross Advantage plans separately.

Here, we want to compare them directly!

First, let's introduce the players according to what actually matters to you.

United Health is the carrier and AARP is the marketing arm for the most part. This means that your coverage is ultimately with United Health.

In fact, you don't need to be an AARP member to enroll in these plans.

But boy has been a wind at it sail in California!

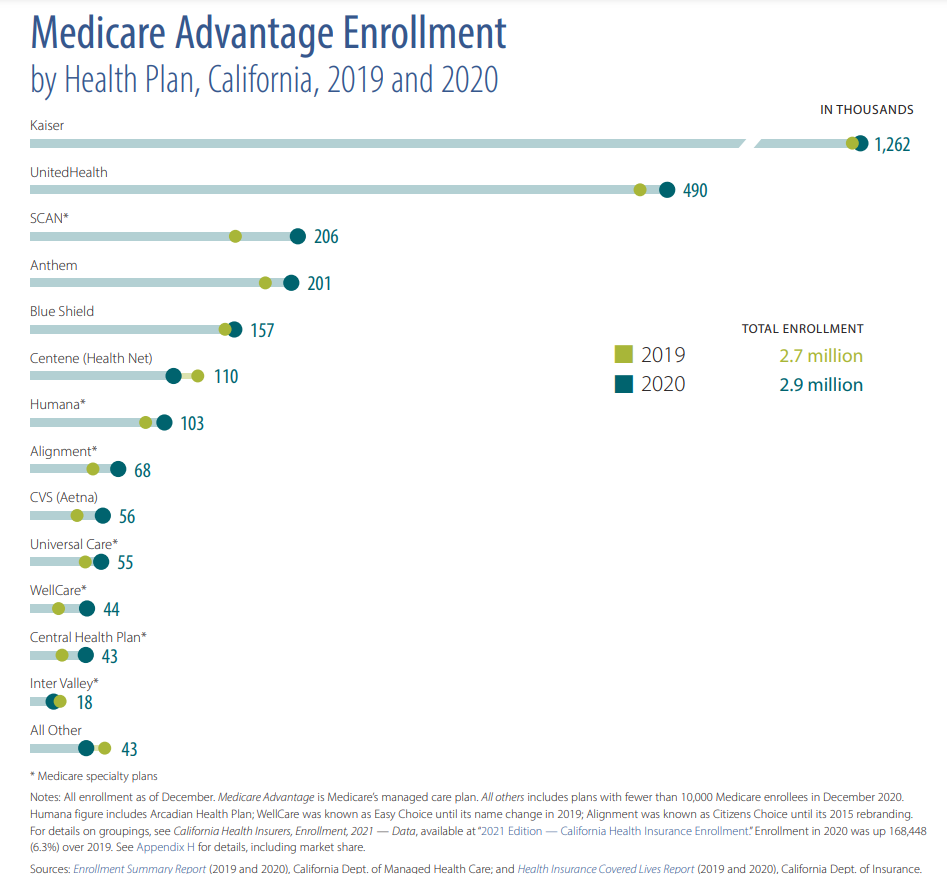

United Health (AARP) is the dominant carrier outside of Kaiser by a long shot and this speaks to AARP's powerful presense among seniors!

United also bought SecuredHorizons which was the original Advantage plan powerhouse in California (see Pacificare Advantage plans).

Anthem Blue Cross is not as strong in the Advantage market...yet!

They've been a powerful force on the medicare supplement side of things for decades now along with Blue Shield of California.

In fact, the two are routinely best priced for the all-popular G plan and that hasn't changed in years.

United Health (AARP) used to gobble up the supplement market with their pricing strategy but that hasn't been as strong for years now.

Advantage plans are completely different and United has a few core strengths which we'll cover below.

The so-called "Triple Threat":

- Low or now cost premium

- Star Rating of 4+ stars or higher

- Max-out-of-pocket under $1000

These variables can really differ from area to area but Los Angeles generally showcases different carrier strengths since it's so competitive.

Let's go there now and really see how the two carriers fare out!

Comparing AARP United Health and Anthem Blue Cross across California Advantage markets

We'll look at 3 big California markets:

- Los Angeles

- Bay Area

- San Diego

First, LA!

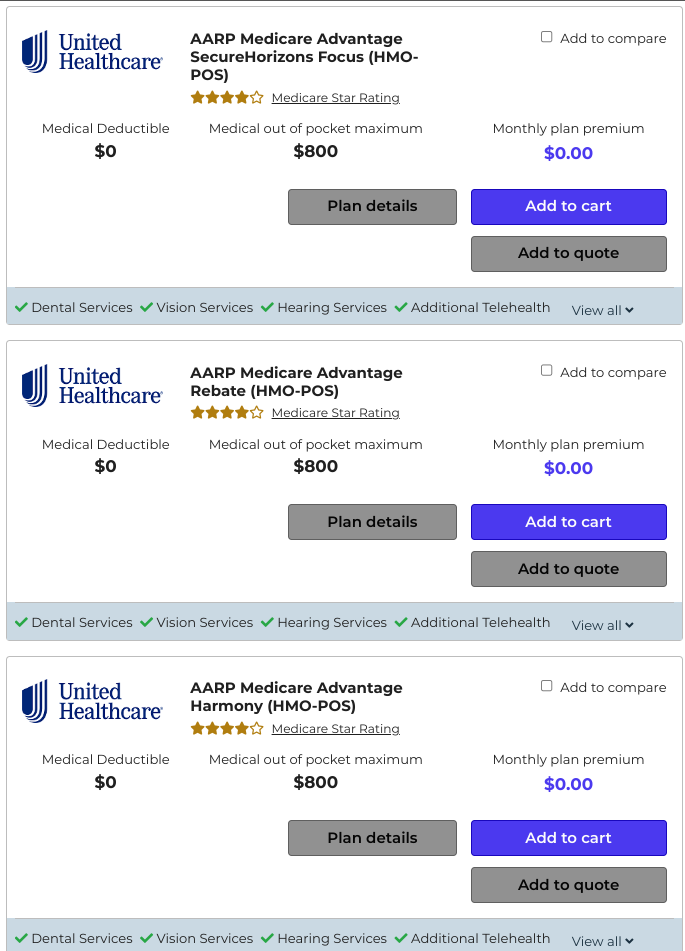

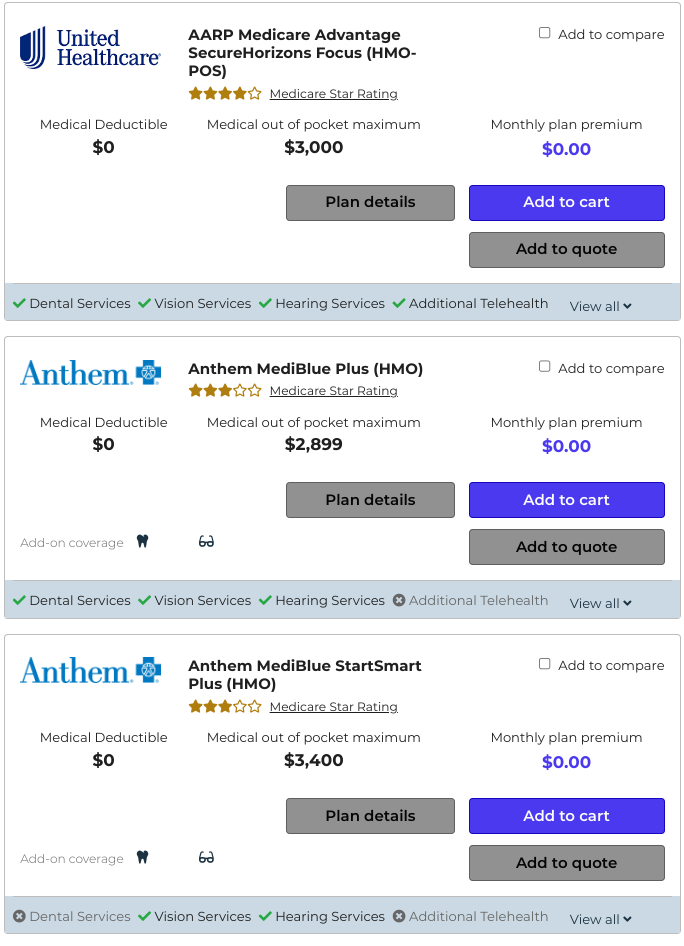

When we look at the total market (90023 zip and 67 year old; your quote may differ!), United has 3 plans rounding out the top 10 and Anthem is a few pages down.

Let's filter for just United and Anthem:

You see their original Secured Horizons (Pacificare's old plans) up top. To

learn about the actual plan differences, check out the

United Health Advantage

plan guide.

Their Rebate option (called Medicare Advantage Rebate) may be the only one we're fans of since they kept the out-of-pocket-max below $1000!

We're not willing to gave a few $100/year at the expense of $1000's on the backend exposure if we get sick or hurt.

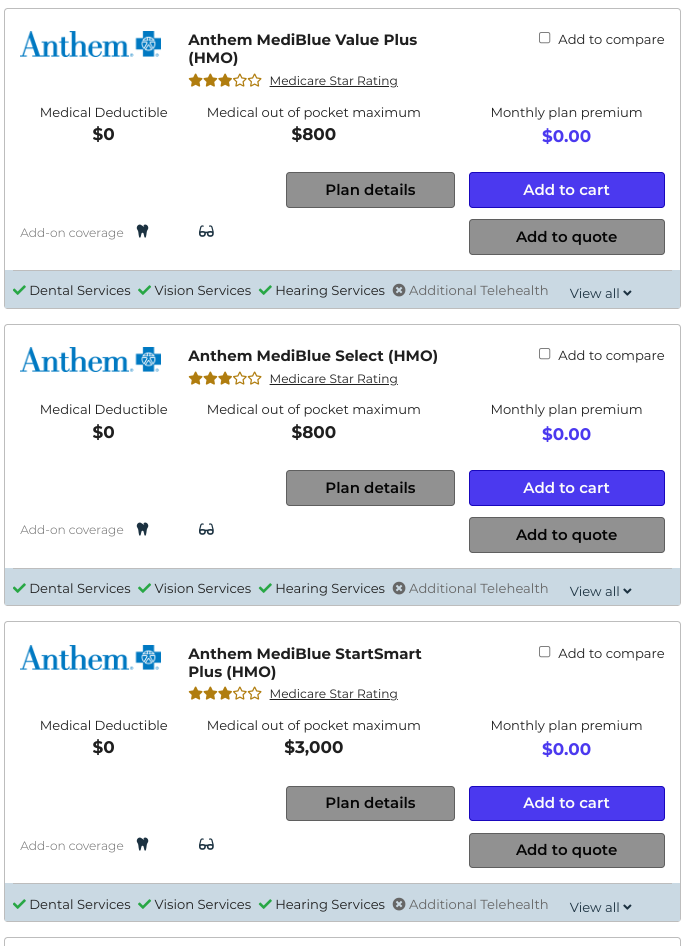

Learn about Anthem's Advantage plans at our Anthem Guide.

So...United's top 3 plans lead the pack and Anthem's follows. Why?

It's that Star Rating.

4 Stars versus 3 Stars is a big difference!

Remember, our Triple Threat?? They both have plans with zero premium and max-out-of-pockets under $1000. In fact, they're the same at zero and $800.

This speaks to why United has so many more enrollees than Anthem for standard plans since Advantage plans are more "managed" than supplements.

The Star Rating basically reflects how this actually feels to enrollees and the average is around 4 stars so Anthem needs to get that rating up to really compete in Los Angeles!

Now....there can be network differences so when you run your quote, make sure to enter your doctors and medications into the system or reach out to us at help@calhealth.net and we'll chase it down.

What about the Bay Area?

Different but similar!

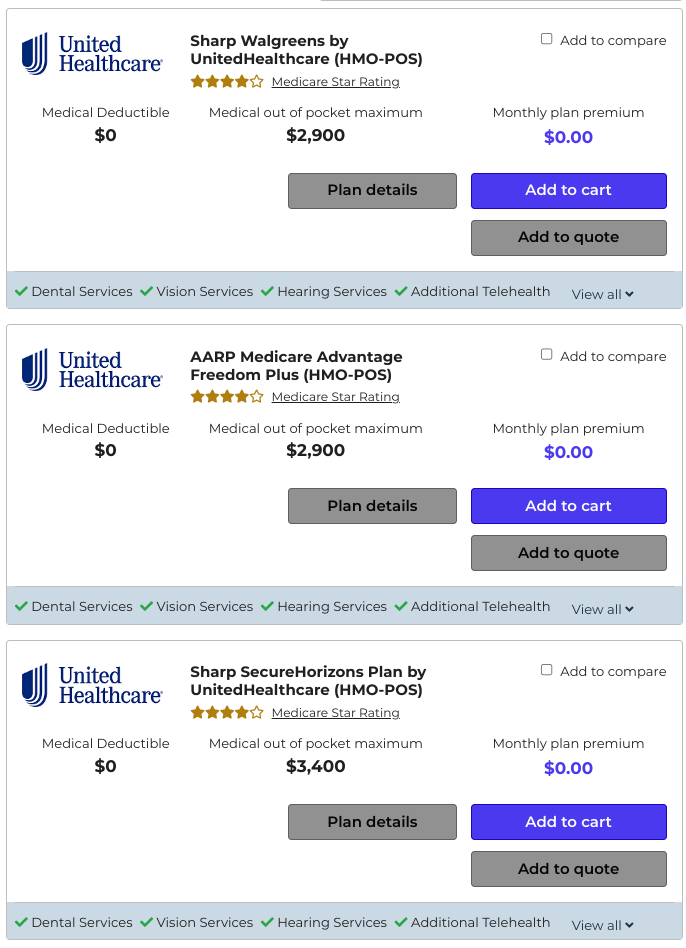

When we filter for the two carriers, we see United's core offering followed by Anthem:

Notice that the Max out of pocket has really jumped up now! Around $3K.

This means that Advantage plans are not able to negotiate as well with the providers...especially the hospitals.

LA is much more condusive to the entire model (HMO at its core).

We still see the Star rating difference (4 star versus 3 star). That's a tough difference to bridge if the provider networks are similar.

What about San Diego?

San Diego's tough!

You have Kaiser, Scan, and Sharp with really high rated plans! We work with SCAN and their 4.5 star rated plans there.

When I filter for United AARP and Anthem, I get the following top 3 for each:

So..we can see the out-of-pocket-max is like the Bay Area and has come up quite a bit!

Check out our How to Pick Best Medicare plan or Medicare supplements versus Advantage plans to learn why this makes supplements more attractive.

Same Star Rating difference (4 stars versus 3 stars).

A few notes.

You see the newest trend in Advantage plans with United's first plan.

They're partnering with a massive pharmacy company Walgreens.

We looked at how CVS bought Aetna (and not the other way around) to show this trend.

Basically, it should mean lower pharmacy costs when you use that chain (Walgreens in this case).

Again, learn about the different plans within each carrier at their guides:

- United AARP Advantage plans Guide

- Anthem Blue Cross Advantage plans Guide

Let's see why some people pick one or another

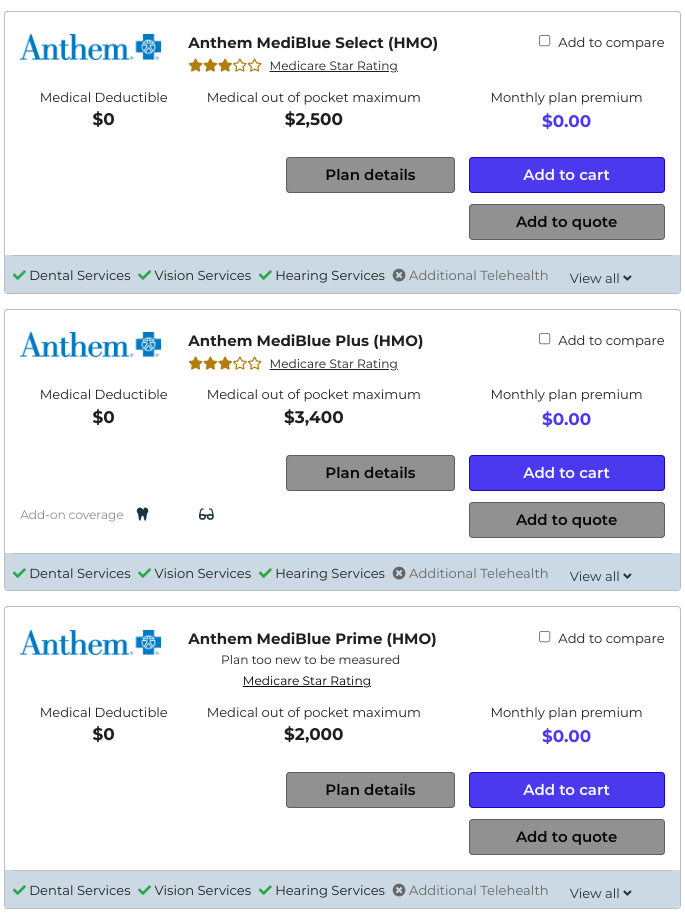

What is Anthem Blue Cross' advantage

First, Anthem is a dominant carrier in other markets and many people will come to Medicare from an Anthem employer plan or Covered Ca option.

Their providers (doctors, hospitals, etc) may work with the Anthem Advantage plan so it's an easy move over when Medicare eligible.

Each year, the Star Ratings are re-evaluated from the prior year's experience so we look to see if they can level that playing field.

They really have focused on the SNPs - Special Needs Plans which we'll cover below.

If you're Medi-cal eligible or have a chronic illness, this can be a big difference.

Make sure to enter your medications and doctors to see if that swings it one way or the other. Anthem's networks are generally on the stronger side across different areas.

What about United?

What is United's advantage

First, it's the Star Rating. For a large network, that 4 Star rating puts them in contention across all markets.

It's our best estimation of how the day-to-day is going to feel as an enrollee.

This gets updated each year so make sure to run your current quote below.

United's biggest feather in the cap is their network.

They boast the largest doctor network across Advantage plans and we see this quite often.

Remember, with Advantage plans, you have to stay in-network since most of them are HMO by design.

This makes the breadth and quality of the network incredibly important when picking a carrier!

That speaks a great deal to why United is #2 behind Kaiser.

Let's touch on the SNPs though.

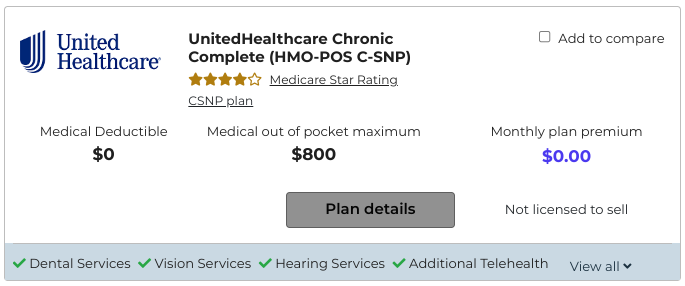

SNP plans and Anthem versus United

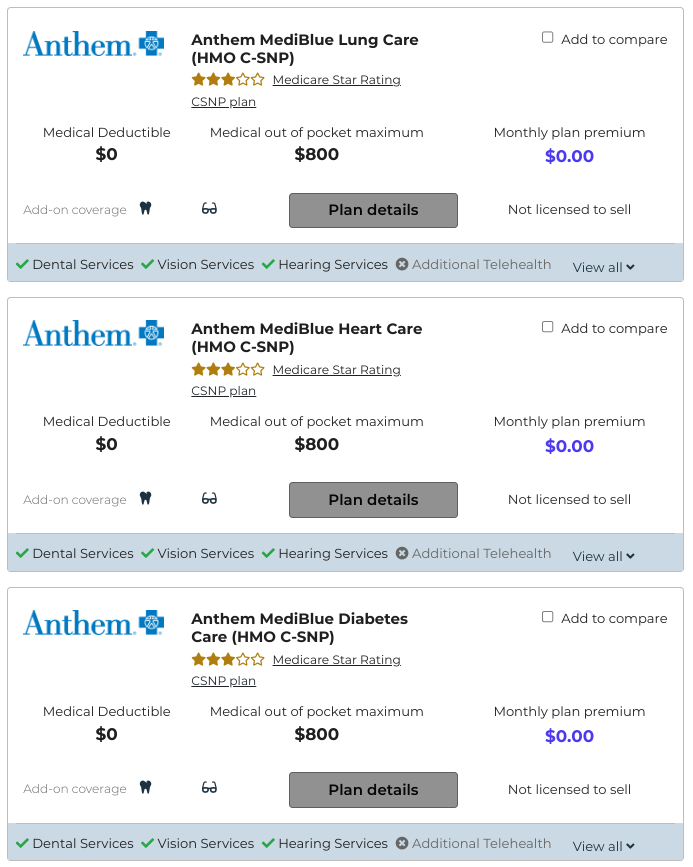

If we filter for SNPs in the Los Angeles quote, we see a different strategy.

First, United's offering:

Their plan for people with chronic illnesses (C-SNP).

Anthem's gone a different direction with very specific plans by disease:

Lung, Heart, and Diabetes are their first 3.

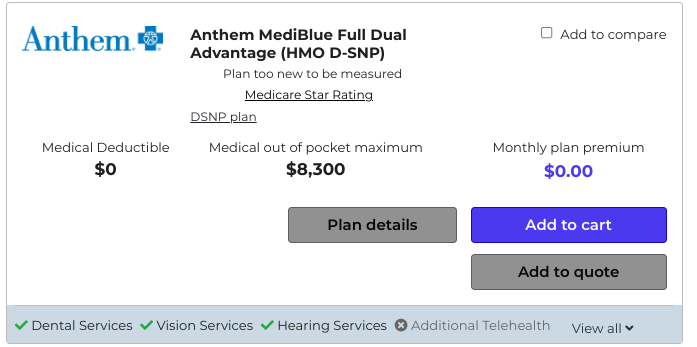

The next plan up is D-NSP for people with full dual eligibility (Medicare and Medi-cal).

You'll notice the max is very high but if you're fully eligible for Medicare and Medi-cal, there can be zero costs for many services.

Let us know if you might be eligible for SNPs so we can quote accordingly. You can also click on "See special needs plans" when you run your quote.

Let's go there now since these are all generic quotes by area.

Quoting Anthem Blue Cross and United side by side

You can get you personlized quote including both United AARP plans and Anthem Blue Cross all together.

Run your quote here:

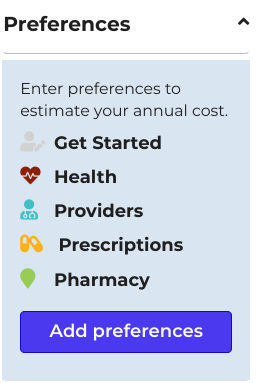

From there, you can quickly see the rates and plans available for your situation.

Make sure to add your doctors and medications in the filter:

Remember, the networks are different and this addresses complaint #1 and 2 with Advantage plans:

"I can't see my doctors and my meds aren't covered!"

You can also filter for Anthem Blue Cross and/or United Health.

We work with the biggest carriers in the market for a reason...Advantage plans are usually HMO and that model requires lots of enrollees in order to have strong enough networks.

United and Anthem are definitely in this elite grouping with strong nationwide and California specific options.

Of course, we're happy to help with any questions and there's zero cost for our assistance!

Check out our Google Reviews to see what we do for people.

What about if you find the right plan for you.

How to enroll in Anthem Blue Cross or United Health

This is our favorite part coming from decades of triplicate forms and extremely difficult applications.

Next to either United AARP or Anthem plans in the quote system above, you'll see an "Add to Cart".

Yes! Add to cart and enroll right online!

Again, no cost to you for this feature but here's the best part.

Each year at Open Enrollment, your info's already in the system. Just update changes, doctors, and meds.

You can easily quote and/or switch plans right there!

This should save you 45-50 minutes in the process! Reach out with any questions or schedule a time to call at help@calhealth.net