California health

insurance quote

- Carrier

Comparison - HSA versus PPO

California health

insurance quote

- Carrier

Comparison - HSA versus PPO

HSA versus PPO? Is there a difference?

What's the Difference between HSA and PPO

We get the question every day.

Especially within Covered California where there are two Bronze plans; one being HSA (has HDHP in title).

When you run your quote below, you'll see different plan options.

Some will say HSA and others will say PPO.

What's the difference between HSA and PPO in terms of coverage?

Great question and it's important to understand since the HSA may be the direction that health care goes.

Let's get into the distinction and most importantly, why the HSA makes so much sense (and saves dollars).

HSA versus PPO Networks in California

The whole "versus" is a little confusing.

First, let's understand what the two terms mean.

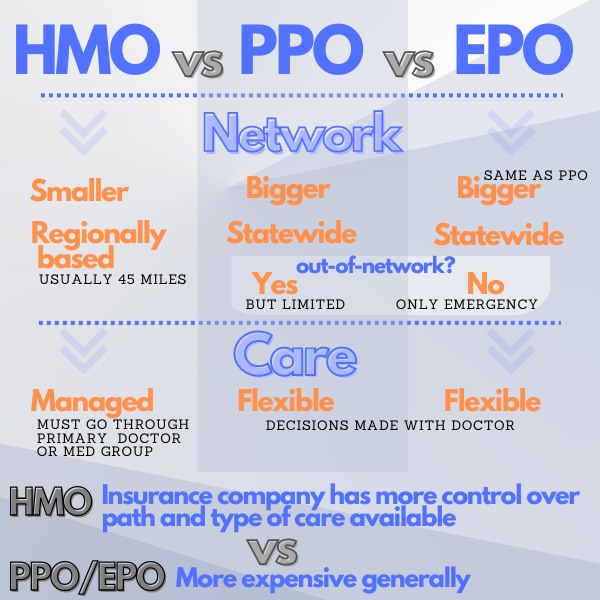

PPO - Preferred Provider Organization

PPO basically refers to the network (list of doctors and hospitals you can access).

You can find more on how PPO's work here but essentially, it's a large list of provider you can access and get preferred pricing.

It's a big group discount essentially.

The PPO also allows more control and flexibility in terms of how you access care.

Generally, you refer yourself out.

The EPO plan is a slight variation of the PPO in that there are no benefits off the network (other than a true emergency). You can find out more on the EPO versus PPO differences here.

The net net is that EPO's and PPO's work very similarly except for out of network.

The big "competitor" to PPO is really HMO.

HMO is much more restrictive in terms of whom you can see and how that is managed.

You can understand the differences between HMO and PPO here.

So what is HSA?

First of all, most of the HSA health plans use the PPO network!

I know, that's very confusing.

In fact, most HSA plans on the California market for both individual and family are...

get ready...

PPO plans!

So, what gives?

Why give it a different designation?

Where the HSA is different from other PPO plans

The HSA is a special breed of PPO plan.

An HSA compatible plan is really a plan that meets certain Federal requirements.

By meeting these requirements, a person can then fund tax-free money into a separate HSA account.

He or she can use these pre-tax funds for qualified medical and dental expenses during the year.

More information on how the HSA works is available here but it's very popular.

It may get quite a bit more popular coming up.

So now that we know how the PPO and HSA networks work, what about the actual plan benefits.

HSA versus PPO Plan Benefit Differences

This is really the reason that there's even a separate name for HSA plans.

The "requirements" we talked about earlier that allow people to stash away pre-tax money for medical/dental expenses.

That's the reason we have an "HSA" name by some plans.

Here are the critical differences.

1. One Deductible to Rule Them All

With the HSA, all services except for preventative is subject to the main deductible.

This is really the big difference in terms of core benefit design between the current HSA plans and other PPO options.

You generally feel this difference with office visits, RX, lab, and x-ray.

Many PPO plans will have some kind of copay for these services before the main deductible is met.

2. Embedded deductibles

This gets a little technical but here's the main gist.

Some HSA plans (but not all) will have a family deductible.

This means that if one family members has large bills, they have to meet the full family deductible before getting help.

Most other PPO plans (and some HSA plans) have embedded deductibles. One note...the market has moved towards embedded deductibles for HSA plans as well.

With this set-up, each person has their own individual deductible (usually 1/2 of the family deductible) up to two people in a family.

The first option (family deductible) is fine if you have multiple family members with big bills but usually, it's one family member with big bills in a calendar year.

For that situation, you want the embedded deductible.

Apples and apples, we prefer the embedded deductible since the back end is the same for large family bills.

We can help you navigate this difference when you run your quote here:

Those are the core plan differences between HSA and PPO.

That's only half the story!

Let's look at the real benefit HSA has over traditional PPO plans.

The HSA tax difference with PPO plans

The whole reason to get HSA's (especially these days) is the tax benefit.

You can find more information on the HSA tax benefit here but the quick recap:

With HSA plans, you're allowed to fund a special tax-favored checking account...the HSA account.

You can then use this money for out of pocket eligible medical and dental expenses.

As long as you use the funds for qualified expenses, you get to write it off up to the calendar year contribution level.

The standard PPO plans don't allow this option unless your medical expenses go above a certain amount which is hard to do for most people.

That's probably THE difference when comparing HSA and other PPO plans.

Here's why.

Let's say we have a PPO plan and an HSA compatible plan we're reviewing.

Let's even suppose they have the same rates and comparable deductible/max out of pockets.

For an individual, if we fund $3K in the HSA account for the year and have a tax bracket of 30%.

That's roughly $900 in real annual savings.

We don't have to pay the tax on the $3K which amounts to a very real $900 in our pocket.

That's akin to a roughly $80/month discount in our monthly premium.

It's a big deal.

For two or more people in a family, the contribution level doubles so we could go up to $6K in our example above.

Now we're saving roughly $1800/year in real money.

Standard PPO plans do not have this tax advantage.

The HSA Account Advantage over PPO plans continues

Furthermore, if you don't use the funds in the HSA account, you don't lose them.

They roll-over year to year and grow.

Interest and investment is tax-deferred.

At this point, it's almost like a retirement account with the added advantage that you can pay out medical and dental expenses.

So what's the net net of the PPO versus HSA comparison?

Funding HSA Account is Difference Between HSA and PPO

Can or Will you fund the HSA account?

This is a question of cash flow..do you have additional funds to put in the HSA account?

If you don't, then the HSA is much less advantageous and standard PPO plans may work out better.

If you do, then the HSA is hard to beat...especially if you're in better health do not have many ongoing, smaller health care bills (think medication).

There are some differences in how the plans work for smaller bills (subject to HSA deductible) but they generally treat the large bill the same.

The tax difference is the real focus between PPO and HSA plans.

The networks are generally the same (most HSA plans are PPO plans after all).

Of course, we're happy to walk through your specific comparison.

We can usually size up what the best value will be in 5 minutes.

Either call us at 800-320-6269 for your HSA/PPO review or run your instant quote for individual/family or Small Business HSA.

The HSA qualified plans have "HDHP in their title" across Covered Ca and exist at the Bronze levels. Employer plans may have different HSA options...even up to silver plans.

Our services are 100% free to you as licensed California agents and Certified Covered California agents.

We have helped 10's of 1000's of Californians across the State make this same comparison.

We're getting pretty good at it! Check out our Google Reviews here:

Quote both HSA and PPO health plans to view rates and plans side by side for both carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!

.jpg)

.jpg)