California Medicare Options - AARP versus Anthem versus Blue Shield Medigap Comparison

Shield versus AARP versus Anthem Medigap Plans in California

These three make up probably 95% of the medigap market and for good

reason.

A recent change in discounts has now made the playing field even more level.

How do we compare these three carriers to find the best value and what's the real difference in the day-to-day interaction with them?

With 25+ years experience across all three (and others), we'll bring you the full picture with our credentials here:

Let's cover these differences:

- What's the difference between Shield, AARP, and Anthem for medigap

- Who

is best priced with Shield versus AARP versus Anthem for supplements

- How

to quote Shield, AARP, and Anthem for your situation

- How to apply or switch medigap plans between Shield, AARP, or Anthem

Let's get started!

What's the difference between Shield, AARP, and Anthem for medigap

Before we jump into the differences, let's discuss how medigap levels the market.

The rules that govern how medigap plans work are Federal which means that a given plan (say the G plan - most popular) will walk and talk the same way regardless of the carrier.

- Benefits are standardized across Shield, Anthem, and AARP

- The

doctor/hospital network is identical across all three carriers - any

providers that takes Medicare

- Medicare determines what is an allowable expense; carrier just picks up their share

So...the core process of medigap plans will be identical between the

three carriers. This makes it so much easier to compare versus

individual/family plans or Advantage plans.

Then what's different?

Pricing! It's amazing to us how wide the price spread can be for the exact same plan!

Identical benefits. Huge swings in pricing.

We'll look at this below.

Then there's just dealing with the carriers.

The customer service side of things is pretty comparable between the three.

Keep in mind that Medicare is a whole separate segment of the company. You can't really look at past interactions (CoveredCa, employer plans, etc) since those are almost different companies within each carrier.

Again...with 25+ years experience, we see very little different in customer service between the three for medigap plans.

As for the broad strokes:

- UnitedHealth is the actual carrier. They just have a marketing agreement with AARP. Your actual interaction will be with UnitedHealth...not AARP for the health insurance piece of it.

- Blue Shield is a non-profit carrier with decades experience in the Medigap.

- Anthem Blue Cross is a separate carrier from Blue Shield and operates as a for-profit entity (no bearing on pricing as we'll see below).

Shield and Anthem are the two old players in the medigap market and AARP is just a juggernaut due to their marketing prowess with United Health being the designated carrier.

In the end..it comes down to pricing! Let's go there.

Who is best priced with Shield versus AARP versus Anthem for supplements

We work with all three and we can't stress this enough.

You MUST quote the plans annually to make sure you're not overpaying for the exact same benefits.

There's an interesting situation where a given carrier is best priced for the same plan at one age but another carrier is better priced at a different age.

Some carriers try to focus on specific plans (G or N for example) as well.

Let's take some examples.

First, Los Angeles, age 65:

Okay...so AARP and Blue Shield are nearly identical at age 65.

Keep in mind that all three now have a $25/month first year New to Medicare discount.

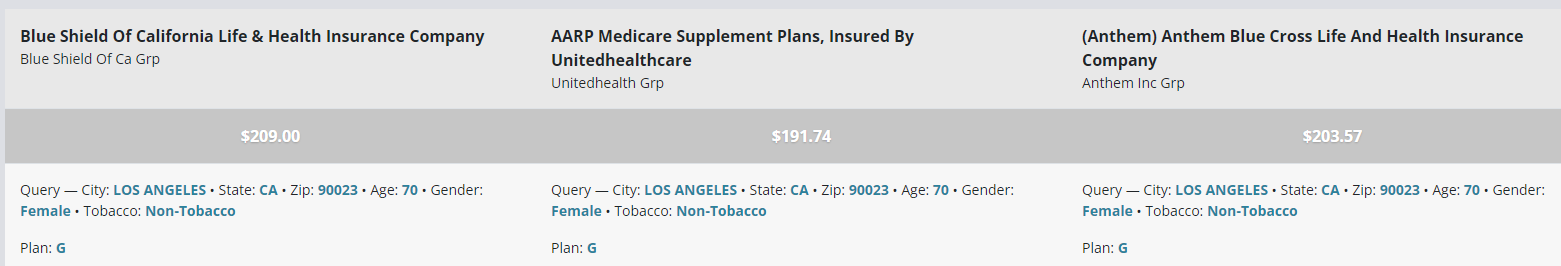

Let's go up to age 70!

Wow. Shield is now almost $250/year more than AARP's plan for the

exact same benefits.

See why we have to be on top of this.

We can do the work for you. Just email us your date of birth and zip code. We'll run the numbers across all the major carriers.

The N plan (next most popular plan) is even more extreme in price

swings:

That's almost $500/year difference between lowest/highest for the same plan.

And 10's of 1000's of seniors are probably paying this difference! They're all giant carriers with lots of members.

Again, our favorite pastime is helping people find savings for the same core benefits.

What about quoting yourself?

How to quote Shield, AARP, and Anthem for your situation

We make this easy.

You can run your quote here across the major carriers (we'll send AARP separately and do a full proposal for you to make sure there's no better option).

The most popular plans are:

- G plan

- N plan

- A or high deductible G plan for catastrophic option

Learn how to compare what Medigap plans cover.

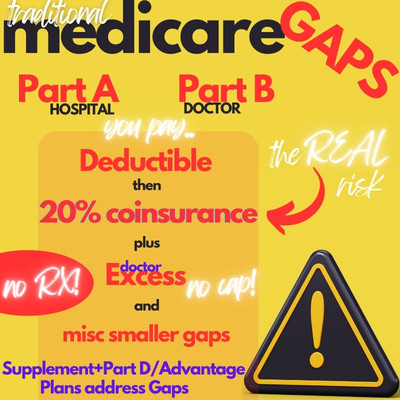

All of these will address the real risk of Medicare alone which is the 20% coinsurance.

Again, we're happy to help and we can work with all the major

carriers:

What about if we find an option with one of the carriers that's the

best value?

How to apply or switch medigap plans between Shield, AARP, or Anthem

We can send online applications or even paper apps to you directly based on your plan of choice.

More importantly, we'll hand-walk you through the process and help with any questions at ZERO cost to you.

Medicare has a language all its own so lean on our 25+ years experience.

We can technically apply for medigap plans (or changes) any time of the year.

Once we're outside our open enrollment window, it is subject to health but we can take advantage of the birthday rule to change plans to a equal or lesser plan.

That means if we're on a more expensive G plan say with Shield, we could move to AARP around our birthday.

We can help you take advantage at this and there's zero cost for our assistance!

It should be clear that with AARP, Shield, and Anthem, it's really a question of pricing and the market needs to be re-quoted periodically to make sure we're not just lighting money on fire (examples above!!).