Health sharing plans - health sharing versus health insurance

Health sharing plans - health sharing versus health insurance

Health share plans versus Obamacare health insurance

There's a new kid in town.

Health sharing plans are a completely different way to address health care costs.

In the past two years, the number of Americans that have gone this direction tops 2 Million.

That number will only grow with each round of rate increases for the ACA plans.

But what are they?

Keep in mind that health sharing plans are NOT health insurance.

How do they work?

Most importantly, how are they different from health insurance.

Great questions.

Important questions!

Many people are looking at health sharing plans because the rates are usually half of un-subsidized health insurance plans.

We'll look at every aspect of this question but you can always jump to a category here:

- Introduction to health sharing plans

- How do health sharing plans work

- Health sharing versus health insurance comparison

- The future of health sharing and health insurance plans

- Pros of health sharing versus insurance

- Cons of health sharing versus insurance

- Best health sharing plan on the market

You can always quote health sharing plans here:

Let's get started.

Introduction to health sharing plans

The benefits may look similar but health sharing plans are a different way to address to health care expenses than health insurance.

First, where did they come from?

Health sharing ministries as they are called have been around for a while.

The ACA law is what really caused them to grow from a small piece of the market to an exploding phenomenon now.

Why?

It has more to do with the ACA effects on health insurance for a part of the population.

There's really a divide now with ACA plans (Obamacare).

The Have's (tax credit) and the Have Nots

The real thrust of the ACA law is the tax credit.

It's based on income and if you qualify, it can really knock down the cost of coverage.

We have people whose premium is $1/month (the lowest by law).

We see $1000's of tax credit per year on average depending on age and area.

Those are the have's.

They came out okay with the law.

What about the Have Not's?

If you don't qualify for a tax credit (primarily based on income), it's not so pretty.

The individual/family rates have roughly doubled or tripled since 2014.

That's only accelerating.

With each year's open enrollment we're seeing double digit increases.

We're not surprised...it was all baked right into the law!

That doesn't make it easier to handle.

The stick is the tax penalty!

If you don't get coverage, you could be looking at a tax penalty up to 2.5% of income.

Ouch!

Let's be clear...there were lots of changes with the ACA law on the eligibility and benefit side that were extremely beneficial.

Everything from guaranteed issue (can't be declined due to health) to mental health and Essential health benefit standardization.

This has been a huge benefit for many people.

But it comes with a cost.

If you have a tax credit, you don't see that cost.

If you don't...well...that's a different story.

The problem is that we're seeing premiums now on the Bronze plan at $800-$1000 for older individuals.

That's crazy!

If you make $50K (over the tax credit limit), that's 25% of your gross income!

For bronze plans!

Undoable.

That's the response we get from those people.

I can't afford that.

I don't want to go uninsured and I don't want to pay the penalty.

What can I do?

That should frame up why health sharing plans exploded onto the scene.

Let's look at this piece!

Health sharing plans make their entrance

For the segment of the population left behind by the ACA law essentially, health sharing plans attracted lots of attention.

Deep in the ACA law (remember...it's 1000's of pages) was a carve out for "health sharing ministries".

It was a concession to social conservatives essentially for religious based objectors.

For example, if you're forcing all health insurance to cover birth control and abortion, these senators won't vote for it unless you give religious people way to avoid this mandate.

Voila!

Health sharing ministries.

There was a series of requirements in order to qualify and there are only 6 ACA qualified health sharing companies:

- Must be a 501c3 organization (non-profit)

- Members must share common ethical or religious beliefs

- Members cannot lose membership due to development of a medical condition

- Must have existing and been in practice continually since December 31st, 1999

- Must be subject to an annual audit by an independent CPA

This narrows the list significantly since we only want to consider companies that meet the strictest requirements for this type of coverage.

Most people think of these entities as Christian based health coverage.

That's true for some but not all.

OneShare is our favorite because it's the most flexible.

They just have a statement of beliefs and they are the most inclusive.

This fits us better and it's fits the U.S. better.

Health sharing plans are NOT health insurance.

Let's look at how they work and then we'll dive into the comparison with health insurance.

How do Health Sharing Plans Work?

Health sharing plans are essentially memberships.

Members agree to pay a month amount and share health care expenses with other members.

In some ways, health insurance is the same way but there are very big differences (we'll get to in the comparison section below).

Health sharing plans are not allowed to use health insurance terminology.

Here are some common examples:

Membership Dues - Health sharing plans do not have Premiums.

Eligible Expenses - Health sharing plans do not have claims since that term denotes a responsibility of a 3rd party to pay. Health sharing companies hold membership dues in an escrow account and pays for eligible expenses.

Member Share Responsibility Amount (MSRA) - Health sharing equivalent to deductible

Practically, what is the difference between health sharing and health insurance?

Here are the big differences that are important to understand.

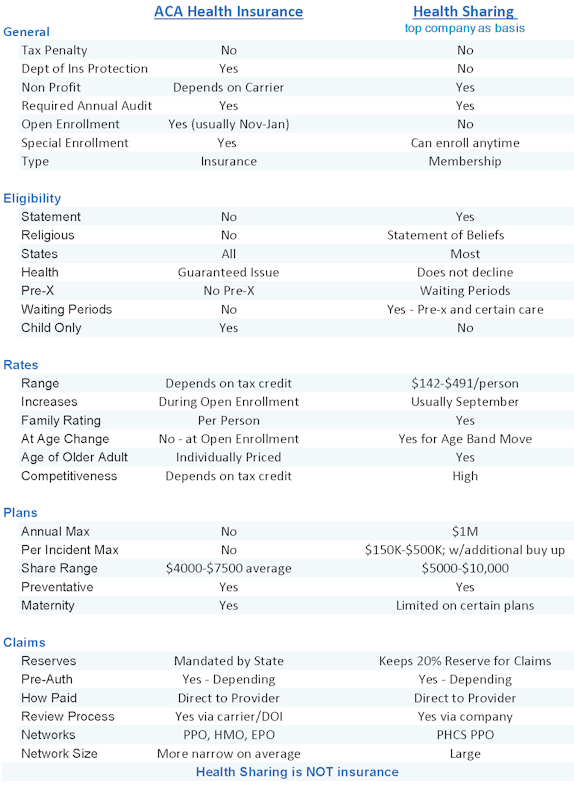

Health Insurance versus health sharing (our favorite health sharing company, others may not apply)

Let's look at each of these comparisons separately for health insurance versus health sharing.

We'll use OneShare as our health sharing company since they're the strongest and most flexible.

General Differences between Health Sharing and Health insurance

There are some important considerations here.

Health sharing plans are NOT insurance.

Part of being insurance is that there is a Department of Insurance which regulates the companies and market.

They also provide a backstop in case a carrier goes bankrupt or doesn't pay claims.

Health sharing plans do not have this backstop.

They also don't have the requirements that go along with health insurance.

Some of these requirements are important but they have also exploded the cost of health insurance, especially with ACA law.

Another piece of the DOI protection is that health insurance carriers must keep a certain level of reserves in case of big claims.

Health sharing plans are not required to.

Eligibility Differences Between Health Insurance and Health Sharing

There are some big differences in terms of qualifying for coverage:

- Health insurance plans are guaranteed issue and do not have waiting period for pre-existing conditions.

- Health sharing plans have requirements in terms of beliefs.

- AlieraCare is the most flexible with just a Statement of Beliefs.

- They also have waiting periods for pre-existing conditions and waiting periods until certain specified benefits are paid out.

For this reason...if you have ongoing health issues, health sharing plans might not be the best approach.

We're happy to walk through this with you as we can deal with either health insurance or health sharing options.

When can you enroll?

This is a big difference.

For health insurance plans, you can only enroll during open enrollment or if you have a special enrollment trigger (usually marriage, birth, loss of coverage, or move).

You can enroll anytime during the year for health sharing.

We get countless calls after January where people are trying to avoid the tax penalty.

Health sharing plans might be the only option here. Check with us to see if you may be eligible for ACA plans now.

Let's look at Rates.

This is why many people are considering health sharing plans to begin with.

Rate comparison between health insurance and health sharing plans

First, a caveat.

If you are eligible for a tax credit through Obamacare, that's probably going to be the better way to go.

Depending on how much tax credit!

You can run your ACA quote here with tax credits and here with health sharing.

For the tax credit quote, make sure to enter the following in order to see the tax credit:

- Household size - everyone that files together on a 1040 tax form

- Income - best estimate for household income - roughly line 7 on the 1040 form

With those two pieces, we can compare.

If you have more complicated income situations, please call us at 800-320-6269 or email with questions.

We want to get this right!

There's no cost for our assistance!

So...

If you don't qualify for a tax credit, the health sharing plans can be much less expensive than the Bronze ACA plan.

Less than 1/2!

That's a huge deal especially if you're in your 50's or 60's and it amounts to $1000's/year in savings.

As we mentioned above, health sharing is probably not a good fit if you have ongoing health issues or pre-existing conditions.

For people in good health with no tax credit, there is a great deal of interest in health sharing.

For good reason.

A few further notes on rates.

You'll notice on the health sharing quote page, that the rating is pretty simple.

No area effect on rates.

Each person isn't individual rated as with health insurance.

We still have the "family rate" with health sharing plans.

The rate is based on the age of the older adult.

What about rate increases?

For health insurance plans, rate increases generally occur at open enrollment time (end of year).

Rate increases due to changes in age also occur during open enrollment.

For health sharing plan, rate increases generally occur in September or in birth month.

Rate changes due to age (the older spouse) will occur at time of birthday.

Benefit Comparison between Health Insurance and Health Sharing

We have some big differences here.

10 Essential Health Benefits

After the ACA law (Obamacare), health insurance plans are mandated to cover the 10 Essential health benefits.

Very specific requirements on what is covered.

Health sharing plans do not have this requirement.

For example, health sharing plans will not cover mental health.

RX is also handled with an RX discount card as opposed to defined benefits.

We're happy to walk through your situation.

Ultimately, you have to compare the monthly savings against paying more of this out of pocket when comparing the two.

There needs to be significant savings to take on this additional risk

You can access the member's guide through quote engine for more information on what is covered and how it's treated.

This is true even for State specific information like Covered California versus health sharing.

Lifetime and Per Incident Max

After the ACA law, health insurance does not have a lifetime or per-incident max.

Health sharing plans can have 500K-$1M lifetime max benefits and different per-incident maxes depending on plan choice.

We like the OneShare Premium due to its $500K per-incident max.

Remember that we're getting coverage for the big bills anyway.

Keep in mind that we can change to the ACA plans during open enrollment (end of year) and if we have big life changes (marriage, birth, move, loss of eligible coverage).

One note on Maternity.

If Maternity is even out there in the ether, health insurance plans are probably the best fit.

At least for mom!

We can mix and match with mom on an ACA plan and dad on a health sharing plan.

Let's look at networks.

Doctor network comparison between health insurance and health sharing plans

This is one of the reasons we like OneShare the most of the health sharing plans.

They use a bonafide PPO network (PCHS search here).

PCHS has over 1 Million providers across the US.

Very legit.

Unlike some of the other health sharing companies, OneShare reimburses the doctor/hospital directly.

This is much more familiar to members as well as providers.

If you can't show a card to the hospital, they may treat you differently.

That's just the way our current system is now.

What about networks for health insurance companies?

It depends.

In general, there's been a shrinking of networks since 2014 both in terms of size and in terms of type.

By type, we mean PPO, EPO, HMO.

There's been a steady slide from PPO type plans (most flexible) to EPO (less flexible) to HMO (least flexible).

On top of this, we've seen networks shrink by about 1/3rd from pre-ACA plans.

This has probably been the biggest issue with the Obamacare rollout for people.

This is actually a huge advantage for health sharing.

Some of the other health sharing companies have confusing setups where members reimburse other members directly and the person has to pay up front with the doctor or hospital.

We don't like these setups and for that reason alone, we favor OneShare for health sharing.

You can check the Provider search here.

You can check the ACA (Obamacare) Provider search through the quote here (a link is available under any given plan).

Claims Comparison between health insurance and health sharing plans (AlieraCare)

There are some similarities and some big differences in terms of reimbursing medical expenses between health sharing and health insurance.

First, keep in mind that "Claims" is an insurance term.

Health sharing doesn't have claims. They call it eligible expenses or sharing expenses.

Health insurance carriers are heavily regulated in terms of coming through on claims.

- An insured person always has the DOI (Department of Insurance) to take disputes to.

- The DOI also backstops the member in case the company goes bankrupt.

Health sharing companies do not have this protection since they are not health insurance.

We also think this market will dominate a part of the health payment market.

Why?

Let's look into our crystal ball.

The future of health insurance versus health sharing

We have been helping people navigate the health care market for over 25 years.

1000's and 1000's of clients.

There has never been a time when the market is such jeopardy as right now.

There is no telling what will happen over the next 5 - 10 years.

Nothing coming out of Washington will address the core cost issues of the market.

The ACA law sped it up.

I wouldn't be surprised if we end up with single payer only because the market falls apart.

What does health sharing have to do with this?

You're going to see a lot of healthy people move to this option.

Health people with no tax credit will start to move this direction because they can't afford the annual rate increases for ACA health insurance.

With every healthy person that leaves the ACA marketplace and moves to health sharing, the ACA market gets weaker.

As a result, rates go up faster.

Which means more healthy people leave.

And the rates go up even faster.

Do you see the pattern?

We've seen it many times before in our 25+ years.

We don't know if health sharing will be the end game but it's definitely going to become a force over the next 5-10 years until the dust settles.

We're happy to help you understand this new option at 800-320-6269 or by email.

You can always quote health sharing here.

Pros of Health Sharing Plans versus Health Insurance

These are the big draws for people who are moving to health sharing in order of importance:

- Much lower monthly rate than unsubsidized ACA health plans

- No tax penalty

- More catastrophic in nature

- Large PPO network

- Combination of sharing for large bills and first dollar coverage

The main draw is the pricing and the lack of tax penalty.

Cons of Health Sharing Plans versus Health Insurance

Here are the common cons of health sharing in order of importance:

- Not protected by Department of Insurance

- New option that is unfamiliar

- Waiting period for pre-existing conditions and certain conditions

- Does not cover Essential health benefits including mental health

- RX is discount care only

The main concerns for people new to health sharing are the lack of protection that insurance is required to have and waiting periods for certain coverages.

Best Health Sharing Plans

In our view, there's really only one option we feel comfortable with.

It's OneShare.

Keep in mind our background.

We've been health insurance agents for over 25+ years.

We've received calls from people who have had bad situations from bogus companies out of Texas that would pressure sell people terrible policies.

$600/daily caps in hospital.

Really?

You can hit $50-100K in one night at a hospital.

It makes us angry.

That's our background.

I've called the DOI on those companies and they never could do anything because they were domiciled outside of California.

So...

As more of our clients are considering dropping coverage altogether due to the double digit rate increases, we are very cautious about new ways of covering health care costs.

- We have 1000's of clients.

- Some dating back to 1995.

- We are also a top 100 agent for Covered California.

We can help people in many states with health sharing including compare Covered California versus health sharing.

We investigated the health sharing landscape and there is only one company we're willing to get behind.

OneShare.

We've written extensively on why OneShare is the best health sharing company but here are the bullet points in order of importance:

- One of the largest health sharing companies and growing very fast

- The most flexible in terms of who they accept and what's required

- Uses a great PPO nationwide network

- Walks and talks the closest to health insurance (keep in mind that health sharing is NOT insurance)

- Does not decline coverage (has waiting periods instead)

- Competitive rates and correct plan design for what people want

- 20% reserves for paying claims

- Straight forward members guide on claims payment and process

- Most sophisticated membership process and members services

These are some of the highlights but we feel the most confident that OneShare becomes the face of the health sharing market.

Here's a comprehensive guide to comparing the main health share ministries.

It's going to be a face you hear quite a bit about in the next few years.

Health sharing versus Health Insurance Review

We've covered a lot.

Health sharing plans are an entirely different breed in terms of paying for health care costs.

Make sure to see the member's guide and plan details we provide to new enrollees to make sure they really understand what they are buying.

It's important to us that you are empowered!

Health sharing is new to many people but it won't be that way for long.

The ACA rates are going to continue to spiral if you don't get a tax credit.

It will eventually become a question of paying $1000/month premium or...

Health sharing.

Always check to see if you can get a tax credit since those rules can change.

Many people can't afford not to go this route.

There are many questions.

We're happy to help with any questions at 800-320-6269 or help@calhealth.net

You can run your health sharing Quote here to view rates and plans