Health share comparison and review

Health share comparison and review

6 or 1/2 a dozen - Comparing the Major Health Share Ministries

Health sharing is new to most people.

This will be less so with each passing open enrollment and round of rate increases.

We're already at the point where many people without a tax credit are deciding to go without coverage at all.

They have been sending a check to the IRS up to 2.5% of their income.

Might there be a better way than paying for other people's tax credit?

Yes.

Resoundingly yes.

Not only can be avoid the 2.5% tax penalty, but we can actually get protection for health care expenses.

Health sharing plans.

First, we need to understand what this new (but very very old) option is but also, which company is the best version of health sharing.

The information on the internet is sparse.

We need a more comprehensive comparison and review of the health sharing companies so that people can make a good decision.

Let's get started!

You can always jump to the rates here:

You can jump right to the section of interest:

- Quick introduction to health sharing

- List of Health Share Companies

- Health Care Share Ministries Comparison

- General Stats for Health Share

- Eligibility for Health Share Plans

- Statement of Beliefs Comparison

- Health Qualification Comparison

- Waiting Periods Comparison

- Rate Comparison for Health Share Plans

- Plan Comparison for Health Share Companies

- RX Comparison for Health Share Plans

- Network Comparison for Health Share

- Eligible Expense Payment Comparison

- Final Review - Who will win the health sharing race

Here we go!

Let's first touch base on what health sharing means?

What is health sharing for health care?

Before we jump into the comparison of the major health sharing ministries, let's give a quick intro.

You can always find more detail on health sharing here:

- Alternative to Obamacare

- Health sharing plans versus health insurance

- OneShare HealthShare Plan review

Let's take a top level look.

The ACA law changed the entire health insurance market place in 2014.

There were many protections that helped some people and rising costs that hurt others.

If you get a tax credit based on income, you're generally happy.

UPDATE: The income limit may be removed so it's very important to re-run your ACA quote here.

If you don't get a tax credit, your costs have roughly doubled or tripled.

Those are the people most interested in health sharing options.

In that same ACA law, there was a carve out from the tax penalty stick for not having health insurance.

They were called health sharing ministries.

These are NOT insurance plans.

They are memberships that allow members to share health care costs.

There are pros and cons to this method and it doesn't work for everyone.

BUT...

It is very popular with these people:

- Not eligible for a tax credit

- Generally in good health

- Not able to afford ACA Obamacare health plans

- Just want catastrophic coverage

- Can't enroll due to missing open enrollment

The real benefit of the health sharing companies is cost.

They are generally less than the Bronze ACA plan (if no tax credit).

In addition, they provide a certain level of protection for catastrophic health care needs.

Again, you can read quite a bit with the other articles but here are the bullet points of pro's and con's for health sharing companies versus health insurance (ACA plans).

Pro's of health sharing plans

- Much lower monthly cost if not eligible for tax credit

- No tax penalty for not having ACA health plans

- Can have robust PPO networks of providers

- Can have first dollar cost sharing in addition to catastrophic expenses depending on company

Here are some of the potential cons:

- Not back up by Department of insurance with protections therein

- Does not cover the Essential Health Benefits (such as mental health)

- RX discount care as opposed to RX benefit

- Lifetime max benefits. Per incident max benefit

- Waiting periods for pre-x and certain conditions

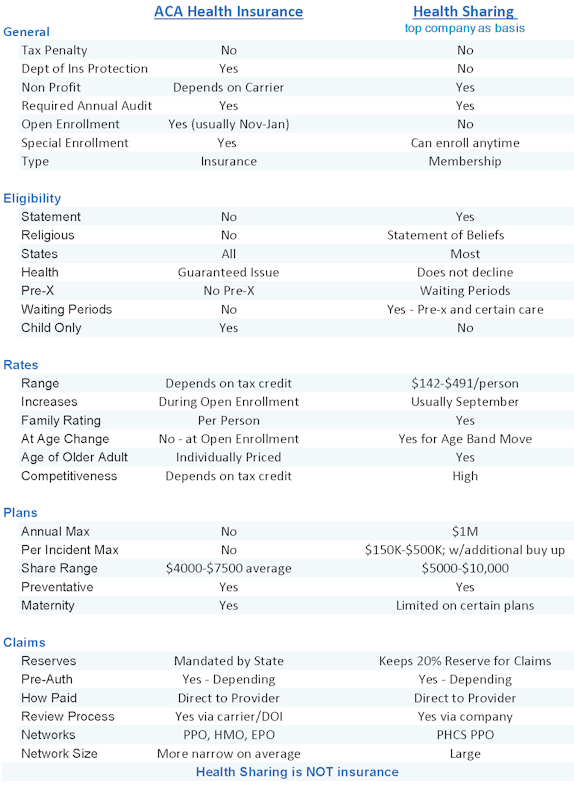

Here's a nice little comparison of health insurance versus health sharing (uses OneShare HealthShare plans as example):

This comparison depends on which health sharing plan we're looking at since they're very different.

So let's get into the comparison.

Who are the companies?

List of Health Sharing Ministries Companies

In the ACA law, there are specific requirements companies must meet in order to ACA qualified to offer health sharing plans (and the tax penalty avoidance).

Here are the key requirements needed to make the short list:

- Must be a 501c3 organization (non-profit)

- Members must share common ethical or religious beliefs

- Members cannot lose membership due to development of a medical condition

- Must have existing and been in practice continually since December 31st, 1999

- Must be subject to an annual audit by an independent CPA

So which companies made this small list?

There are only 6 that are ACA approved which is important since it means you won't have the tax penalty.

Here's the list of qualified health sharing companies in terms of current popularity and growth:

- OneShare HealthShare

- Liberty

- Medi-share

- Samaritan

- Altrua

- Christian Health Ministries

There is not a standardized plan or offering.

They are very different!

THAT'S why we need to compare them!

One note...you may ask why ministry?

On the surface, the carve out in the ACA law for this type of plan was originally based on religious opposition to the ACA requirements.

It really differs from company to company but they all have version of religiosity in their eligibility.

OneShare HealthShare is the most flexible which is one reason it's the most popular

This will be part of our comparison below.

Health Care Sharing Ministry Comparison and Review

This is what we're here for.

We were new to the whole health sharing world and we want a comparison of the 6 companies.

There are a few to focus on which we will note as we go through them.

These are dealmakers and dealbreakers based on 25+ years of health coverage experience

Let's discuss the highlights...the most important items.

General Health Sharing Stats

From our standpoint, the two most important items under general are Flexibility and Enrollment.

All the health sharing plans listed allow you to avoid the tax penalty.

They all have the same requirements in order to be ACA exempt.

The Enrollment number is the most important!

This comes from 25+ years in the health coverage business.

Size is King!

Here's the deal.

Health sharing is similar to health insurance in one key respect.

We're spreading health care expenses among a pool of people.

The larger the pool, the less chance of the company having financial issues.

If someone has a heart attack and it's $100K, we want to spread that over 100,000 people.

It's only $1/person that way.

Size matters.

Focus on that piece.

For that reason, OneShare HealthShare and Liberty are the leaders there.

OneShare is growing very quickly and we really expect them to be the dominant force in the health sharing segment for many reasons (which we'll get to).

You will avoid the Obamacare "mandate" or tax penalty with any of the 6 health sharing companies.

Eligibility for Health Sharing Plans

This section becomes more important with health sharing plans.

Each company has different ways of addressing the ability to qualify for coverage.

- In terms of health

- In terms of the required Statement.

- In terms of even lifestyle choices! (for some)

Seriously...very different.

The original health sharing carve out was based around religious or ethical belief.

Let's look at the key points here.

Statement of Belief or Standards

This is the statement an enrollee must agree to in order to qualify.

Of the 6 companies, OneShare plans and Liberty are the most flexible.

OneShare HealthShare have a simple 5 point statement rather than a religious requirements.

That's one piece.

Liberty health is next in line and the others become more strict in who can qualify and what is required of them.

We are talking about health care so what about health qualification?

Very different.

Let's look at health...that's a big one!

Health qualifications and health sharing

Some of the health sharing companies will decline coverage based on health and/or even lifestyle choices!

OneShare HealthShare plans will not decline due to health.

They have waiting periods for pre-existing conditions but of all the health sharing companies, we like theirs the best.

Make sure to read the section on Waiting Periods for ANY health share company you're interested. Get the Facts!

Many of the other health sharing companies have waiting periods from when you have symptoms or treatment which means these periods could go on forever!

Medi-Share, Samaritan, and Christian Health Ministries may all have waiting periods for pre-x from last time of symptom or treatment.

This ostensibly means that a waiting period could go on indefinitely.

Make sure to look at the member's guide in detail to understand how each company addresses pre-existing conditions.

Waiting periods (Not for pre-x)

There can also be waiting periods for new situations before a plan will share costs.

You'll see this for maternity pretty regularly.

It can also apply for more serious issues and even preventative.

For example, a given company may not share costs for 1st 12 months of membership towards certain conditions or treatments.

This is the health sharing answer to the Open Enrollment requirement for ACA plans.

You can only enroll at the end of the year or with Special triggers.

Health sharing allows you to enroll any time of the year but there will be waiting periods for pre-x and certain conditions.

They are both address the same thing...

People knowing they have an undiagnosed issue and getting coverage to address it.

That would destroy the monthly costs of either program.

Personally, we would rather have coverage for other issues (car accident, etc) that might arise while waiting for the the waiting periods than having no coverage till Jan 1st (ACA plans).

Again...narrow down your favorite and read the membership ship guide

It's best to think of the health sharing plans as more catastrophic coverage in nature.

That is what many people are looking for anyway!

Now...what's on everyone's mind.

Rates!

Comparison of Rates for Health Sharing Companies

This section is really really important.

And not in the way you think.

Yes, we need some relief from the Obamacare rate increases (if you don't get a tax credit).

That being said...

The old adage of "If it's too good to be true" holds as much weight with health sharing companies as with....

Well, anything else.

It comes down to this...

There's no free ride in the Universe.

Health care COSTS are high!

Through the roof in fact.

A simple outpatient ACL repair can run $15-20K.

Some of the health sharing companies have pricing out of step with what the plans say they cover.

We've been in the health market for years and we've seen how this plays out.

Either those companies are not paying on expenses (yet) OR they're going to have serious financial issues.

That's it.

No other way around it.

This is probably the single biggest reason we'll only deal with OneShare HealthShare

We don't want the calls where a company goes under and a person's in the middle of a serious health issue.

That's invariably going to happen with some of the member share rates these companies are showing.

Look...the health sharing plans look very similar to what we had before Obamacare.

Waiting periods. Certain restrictions. Lifetime limits. Etc.

Yes, they are not insurance (very important distinction) but the core feel mimics what we used to have.

The rates should also mimic what we had before.

The rates before Obamacare were about 1/2 to 1/3 what they are right now.

This means a $7500 health share plan should be about 1/2 what the Bronze ACA plan is now.

Some of the health sharing plans are way under this.

Liberty. Altrua.

There's a serious mismatch in their pricing and what you're expecting them to protect from.

It could end badly.

This leaves OneShare HealthShare, Medi-Share, and Samaritan as more reasonably priced to actually survive AND protect you.

If your health share plan isn't paying for reasonable medical expenses, why get the membership at all?

Again...we've had decades experience on this front.

- Companies that have pulled of the market leaving people stranded.

- Companies that wouldn't pay for treatments.

It's a horrible place to be.

We're already talking about health sharing where there is not Department of Insurance backstops of guarantees of payment and solvency.

You want the safest, cheap car in this race.

For that reason, we come back to OneShare HealthShare.

- Medi-Share and Samaritan have too many requirements and restrictions.

- Christian health ministries is just not ready for the major leagues in this space.

- Liberty is way underpriced. That's going to end badly.

Lean on our 25 years of experience and avoid the potential for tremendous hardship.

Again, it's better to pay the monthly amount then to have a questionable company.

We're happy to discuss the rates at 800-320-6269 or by email.

It's a very important topic.

Rating basis for health sharing companies

They're all pretty comparable here for rating basis:

- Single rate.

- Single + 1 (can be spouse or child)

- Family (2 adults and 1+ children; can be additional charge beyond certain # of children)

They will all have annual rate adjustments and when the oldest person moves to another age band, the rate will increase accordingly.

Pretty similar here.

Plan Comparison between Health Sharing Companies

All the companies offer various plan options.

These are the key considerations:

- Member Share Amount (ranges from $500 - $10K)

- Per Incident Max (maximum amount for a given health issue)

- Preventative Coverage (some cover - others do not)

- Waiting Periods for Pre-X and for new Enrollees (Certain Conditions)

- Maternity (usually restrictions on shared amounts, waiting periods, etc)

We listed these in order of importance.

The Member Share Amount is the health sharing equivalent of your deductible.

It's the amount you'll pay before the eligible expenses are then shared.

We recommend getting the largest per-incident max benefit.

For example, we would rather have a higher share amount (such as $7500 or $10K with OneShare HealthShare) with the Premium option (highest per incident max of $500K) than the Value or Plus options (lower per-incident).

Remember, the whole reason we're getting coverage is for the big bill.

Maternity Coverage Comparison on Health Sharing Plans

Maternity is tricky.

If maternity is even out there in the ether, we would actually recommend an ACA health plan for at least the mother.

You can piece meal it and get ACA plans for mom and health sharing for dad or other family members.

Maternity can be a very big bill.

$90K for my first born and $150K for 2nd (both healthy and somewhat happy teenagers now).

Remember...it's the big bill we want protection from.

The mix and match option seems to be the most popular with mom on ACA and dad on health sharing.

Preventative Comparison for Health Sharing

It's nice to have and really, the goal is to avoid health issues by being proactive.

The health sharing plans all have various takes on this approach as it keeps costs down for everyone.

OneShare HealthShare and Liberty have full blown preventative benefits built in (waiting period for routine physical) while others do not cover it at all.

You're probably talking about $200-300/person per year in benefits so figure that into your pricing.

RX Comparison for Health Sharing Plans

RX is a consideration with health sharing.

Most have discount RX cards as part of the offering.

Christian Health Ministries has an RX benefit but see the limits in their brochure.

If you have ongoing RX needs, make sure to take that into account when considering health share options.

Keep in mind that we can move to an ACA plan at Open Enrollment at the end of each year OR if we have a Special Enrollment trigger (usually marriage, birth, move, or loss of group coverage).

This gives us a backup option since we're really only deciding for a maximum of 12 months.

Network Comparison for Health Sharing Companies

This is pretty easy.

OneShare HealthShare, Medi-Share, and Altrua all use the large PHCS PPO network.

Liberty, Samaritan, and Health Care Ministries do not have a network.

It's much better to have a PPO network.

Why?

PPO essentially means a big bulk discount.

On average, just seeing a PPO provider will result in a 30-60% discount.

We've seen even bigger discounts for larger services such as hospital.

I've personally seen $40K bills drop to $3K.

Little known secret but the hospital can write off the difference as a loss.

PPO's the way to go.

PHCS PPO has 1M+ providers nationwide.

With the direction Obamacare networks are going (PPO to HMO, big to small, etc), we even find it to be better than what we can find on-exchange for most people.

This is a crazy reversal of fortune.

The network changes might be the biggest issue since 2014 aside from the rate increases.

That's a checkbox for OneShare HealthShare plans, Medi-Share, and Altrua.

The other carriers actually reimburse you for medical expenses.

This has proven to be a nightmare (read the reviews).

It can takes months.

In the meantime, the hospital is asking you for $30k with collections in the wings.

More importantly, when you show up at a hospital or doctor, what's the first thing they ask you?

"What plan do you have?"

Ummm....I have such and such health ministries and they'll reimburse me (maybe).

Good luck with that one.

Most hospitals will get you patched up and send you to a county hospital if you don't have a card to show them.

With OneShare HealthShare, Medi-Share, and Altrua, you show them your PHCS PPO card!

This is really a big deal but most people don't realize it until they're in a bad situation.

It can mean having the best providers or not!

Which can mean life or death these days.

You want the network and you want the PPO card to show them when you walk in.

This is our second biggest issue with Liberty that most people don't realize.

We discussed the rate issue above but we really hear about issues on the back end when a person's at a hospital or provider.

Eligible Expense Comparison for Health Sharing Companies.

This is a big one.

Keep in mind that health sharing plans are not insurance.

By definition, claims is an insurance term.

It means another entity is responsible for paying something.

Health sharing doesn't have this requirement.

This means that we have to pick the best of the lot.

The number one concern with people new to health sharing companies is...

Will they pay for big health care costs if the come?

This is a function of two things:

- How much a health share company charges members

- How much they actually pay out for health care issues

This is what makes us very leery of some (if not most) of the health share companies.

The amounts charged are too good to be true IF the company will actually pay out for health care needs AND remain financially viable.

That's Liberty, Medi-Share. And Christian Health Ministry.

In our opinion.

We're happy to walk through the rate versus stability question directly at 800-320-6269 or by email.

It doesn't pass the smell test.

The other is issue deals with process.

It's all good to evaluate plans on paper but what about when you're in the doctor's office.

Worst yet, the hospital.

This process with the PPO card and reimbursement to providers feels much more familiar to everyone involved.

We're already going off the beaten path with health share.

Let's keep what we can familiar!

Health sharing ministry Comparison and Review

We've covered a lot.

We analyzed the 6 main health sharing ministry companies:

- OneShare

- Liberty

- Medi-share

- Samaritan

- Altrua

- Christian Health Ministries

We looked at health sharing in general.

More detail can be found here:

Finally, we brought out the big guns...the comparison.

We picked the most important elements for people new to health sharing to compare.

This is based on 25+ years in the health care market.

We speak with people both choosing and using health care every day.

We know where the issues are and what to avoid.

If we're picking a health share plan for ourselves, here's the list of priorities in declining order:

- Ability (and probability) to pay for eligible expenses

- Pricing

- What doctors/hospitals can I see and how is it handled

- Ease of use

- Plan design

Those are the big ticket items.

Look...the goal is to avoid the rate increases with Obamacare plans while also dodging the 2.5% penalty from the IRS.

Also, the ability to get some type of plan right away!

We obviously want to keep rates as low as possible in this endeavor.

That being said, don't overlook the bigger issue.

Why are the rates going up so quickly for Obamacare?

Yes, there's every mandate under the sun but the cost of health care has also exploded!

There are real financial pitfalls to avoid so we also want a health share company that has some staying power.

The best chance to be the dominant health share plan a few years out.

That's what we want!

That's OneShare HealthShare.

Based on pricing, process, and size trajectory, we see them dominating this market.

We won't be surprised if 1-2 of the health share companies have financial issues and another 1-2 have significant rate changes.

They're either underpricing their plans or they're too small to survive any real expenditure.

You don't want to be caught in either situation.

We're happy to walk through any questions you have at 800-320-6269 or by email.

You can check out the

OneShare

HealthShare plan

rates here and even

enroll in

OneShare HealthShare plans online here.

Also, our Guide is in-depth on how health sharing and OneShare HealthShare. work. Great resource to educate yourself.

You can run your OneShare HealthShare health sharing plan Quote here to view rates and plans

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!