California Medicare Options - California Giveback Advantage Plan Comparison

California Giveback Plan Comparison and Review

This is one of our favorite articles. It will probably be yours as well.

It's hard to get a side-by-side comparison of the Giveback Advantage plans in California and there are BIG differences from carrier to carrier.

We're going to make this all available to you!

First, our credentials:

As for the whole giveback frenzy, we'll explain what they are, when they work (when they don't), and how the carriers stack up.

They grew from 2% in 2019 of the market to roughly 13% by 2023! 600% increase.

Then, you'll have the ability to run quotes for your particular situation (doctors, meds, zip code, etc).

Here's what we'll cover:

- Quick intro to the world of GiveBack Advantage plans in California

- Comparison and reviews of Giveback plans

- How to compare the different giveback options

- How to quote Giveback Advantage plan rates

- How to apply for a Giveback Advantage plan

Let's get started!

Quick intro to the world of GiveBack Advantage plans in California

We have a big review on the California Giveback plans but a quick lay of the land.

These are Advantage plans (see how to compare advantage plans) that will send money to Social Security to offset your Part B monthly premium.

That's the amount you have deducted from Social Security or get a quarterly bill to pay by check.

The standard Part B (goes up each year like everything else except for food) is around $174.70 and it can differ depending on past year's income.

So...just under $2000 per year to keep your Part B in effect which covers doctor costs primarily.

The Giveback plans were a new entry that on top of providing medical insurance to meet the requirements for Advantage plans, would also reduce this amount you owe.

You don't get cash...you get a reduced bill!

Either way, that's more cash in your pocket! We'll look at below who this works well for since we can all use extra cash but let's get into the review.

Comparison and reviews of Giveback plans

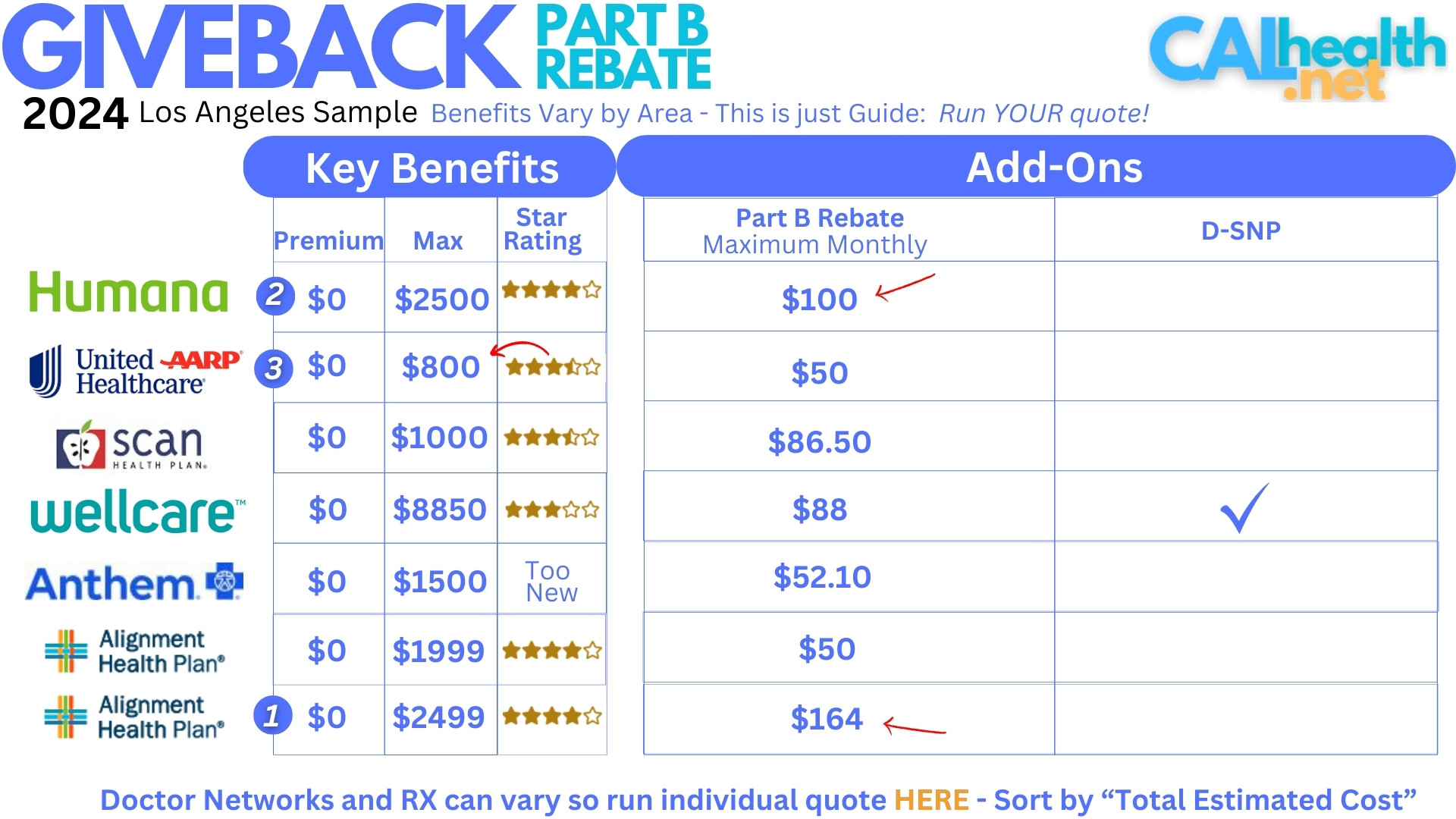

Here we go! We'll focus on Los Angeles as a sample but you'll see how to compare the options and apply it to your personal quote and area in a later section.

We're going to focus on core plans available to most seniors (there's USAA Humana plan for veterans)

Drumroll please!

A few key notes before we get into the comparison and reviews.

Let's introduce our Triple Threat Advantage plan keys:

First.they all have zero premium so we can scratch that off our bingo card.

The max out of pockets are all over the place!

- UnitedHealthcare® is the lowest and that's it big selling point (along with networks).

- SCAN isn't much higher at $1000

- The bulk of the plans hover around $2000 (we'll explain why below)

- The Wellcare max looks really high but it's medi-medi so medi-cal will offset that if you're eligible

What about Star ratings?

Pretty comparable. Humana and Alignment are winning that race and it's a pretty big one to win!

We have a review of Star Ratings but it's a measure of how existing members like the plan. Huge deal with Advantage plans to offset any "trade-offs" we take on by having one.

Three star is pretty average and in the Advantage world, average is not great.

Every ½ star is a pretty big difference in satisfaction. We really need to take this into account or the Giveback benefit won't mean much.

In other areas, you may not have all these options or you may have others so we'll show you how to compare your specific Giveback plans. The important pieces are the same though!

Now...let's really get into the nitty gritty.

How to compare the different giveback options

We listed our favorite #1, 2, and 3 options among the Giveback field. Based on what?

Our favorite 3:

- Alignment

- Humana

- UnitedHealthcare®

Here's the calculation...

Let's focus on the Giveback benefit itself since that's why we're to begin with.

Alignment went all in here at $164/month. That's $1968/year! Let's call it $2k.

This is a huge deal if our goal is to increase our Social Security check. What's the offset since the Star rating is also very good.

Our max out of pocket is $2499. So...in a really really bad year in terms of health care costs, our net exposure is $500. That's the $2499 minus $1968 in real savings.

This is still pretty fantastic as long as our doctors and RX are in network.

Next up is Humana. The max is the same as Alignment at $2500 but we're getting less Giveback benefit at $100/month or $1200 per year.

In a really bad year, that's $1300 exposure. $2500 minus $1200 giveback.

Not as great but Humana has the 4 star rating and a solid Advantage reputation and network.

Then there's UnitedHealth. They went the other way.

The max is down to $800 and our giveback benefit is lower at $50/month or $600 annually.

So... our next exposure is around $200! This is great if we have more health care costs but still want to save on Part B.

The Star Rating drops half a star which is a bigger deal than you might believe.

Most people are choosing a Giveback plan because the annual savings is more important and they're in pretty good health.

You see why Alignment is pretty interesting for this type of plan. It speaks to why they're growing so fast:

Also, if you pay less Part B based on income, that may impact the plan you choose. For example, Alignment's $164 benefit doesn't fit as well if we're only paying $100/month in Part B based on income.

In that case, Humana or UnitedHealth might be a better fit (but the Star Rating reigns supreme).

The one thing that would swing our decision is...doctor selection!

Let's figure this into the equation now.

How to quote Giveback Advantage plan rates

We make this free, fast, and easy here:

First, under the preference box, make sure to enter:

- Doctors and hospitals of choice

- Medications and dosages

- Preferred pharmacy

Next, check "Part B Giveback" on the left to filter these plans.

Finally, sort by "Total Estimated Cost" up above. This takes into account your medication out-of-pocket costs.

Voila!

If this all sounds like a confusing mess, reach out to us and we'll do it for you. There's zero cost for our assistance.

Reach out at help@calhealth.net or pick a time to chat: https://calendly.com/dennis-jnw

The doctor networks can be different between the plans up above so MAKE sure to enter you doctors and hospitals!

We can search these down for you as well since some doctors will bill under different medical groups.

Okay...you found a plan you like.

How to apply for a Giveback Advantage plan

This is even easier.

From the quote above, just click "Add to Cart".

The online apps tied directly into the carrier's enrollment system via Integrity, the dominant Advantage plan system used nationwide.

This is all free for you!

Once set up, the Giveback benefit will coordinate automatically with Social Security to reduce your Part B premium accordingly.

Each plan has a max benefit that can be rebated back to Social Security to increase your monthly amount.

We fully expect the Giveback benefit to expand and grow in popularity over the next few years.

Everything is just too expensive and we have solid options available (star rating, max, networks, etc) with this extra money in pocket.

Now you know how to really compare this option. This is what we try to do for California seniors. How can we help you?