California Medicare Options - What is the point of Medicare Advantage Plans?

California Medicare Options - What is the point of Medicare Advantage Plans?What is the Point of An Advantage Plan

Where most sites will try to sell you gym memberships and tupperware as pros for Advantage plans, we're going to get to the real point.

We can also look at what we're giving up but if it's Medicare Advantage versus just Medicare alone, there's a clear reason to add the extra protection.

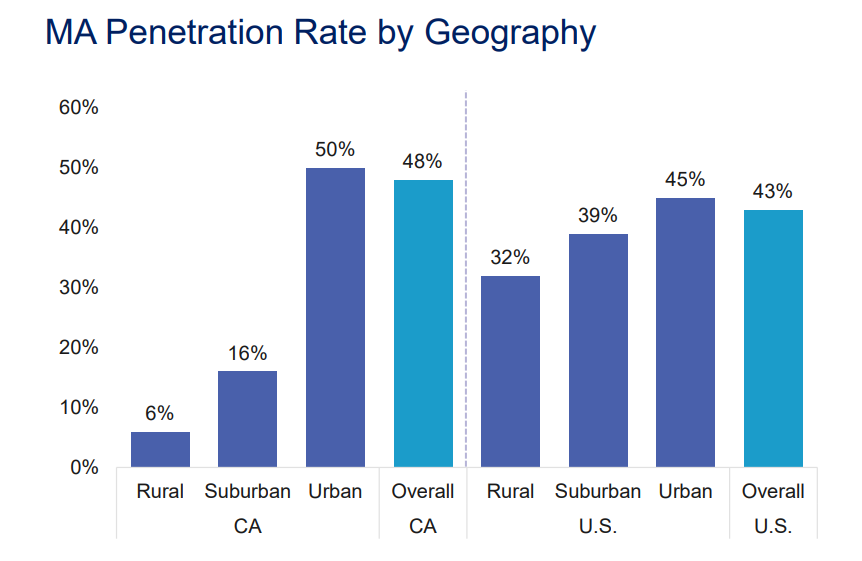

For that reason, the percentage of Californians that have opted to have Advantage plans has increased to almost half and that's expected to peak around 70% around 2030.

It's not just fancy sales tactics (we'll learn how to avoid these below).

As for our credentials, check out the Google reviews:

Here are the topics we'll cover:

- First, what is an Advantage plan

- What's the real point of having an Advantage plan

- What are we losing with an Advantage plan

- How to pick the best Advantage plan

Let's get started!

First, what is an Advantage plan

Let's start with the basics.

Most seniors are eligible for traditional Medicare. That's Part A (hospital) and Part B (doctor) for the most part.

Part A generally doesn't cost you anything and can be automatic while Part B has a monthly cost depending on your income and requires you to "opt-in" for enrollment.

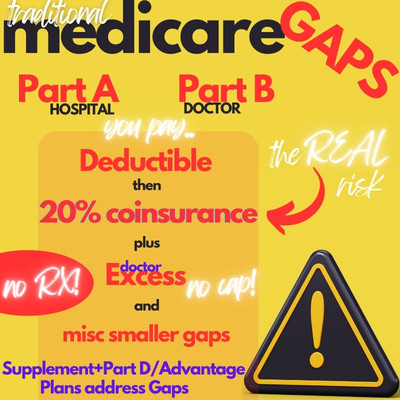

Traditional medicare works like an 80/20 plan with deductibles built in.

For example, if you have a hospital stay, you'll pay the Part A deductible first and then start paying 20% of the costs (Medicare picks up the 80%).

Pay 20% until when??

Exactly. There's no cap.

People..cut through all the marketing brochures and at least understand this one point!

What's the real point of having an Advantage plan

This un-capped 20% is the REAL POINT of getting an Advantage plan OR a medicare supplement.

We'll walk through the two misconceptions people have around this "gap" in Medicare.

- I'm healthy, not worried about the 20%

- If I do have something, I'll just pay the 20%

Let's really understand both of these in today's healthcare world.

First, the "I'm healthy, I don't need extra coverage".

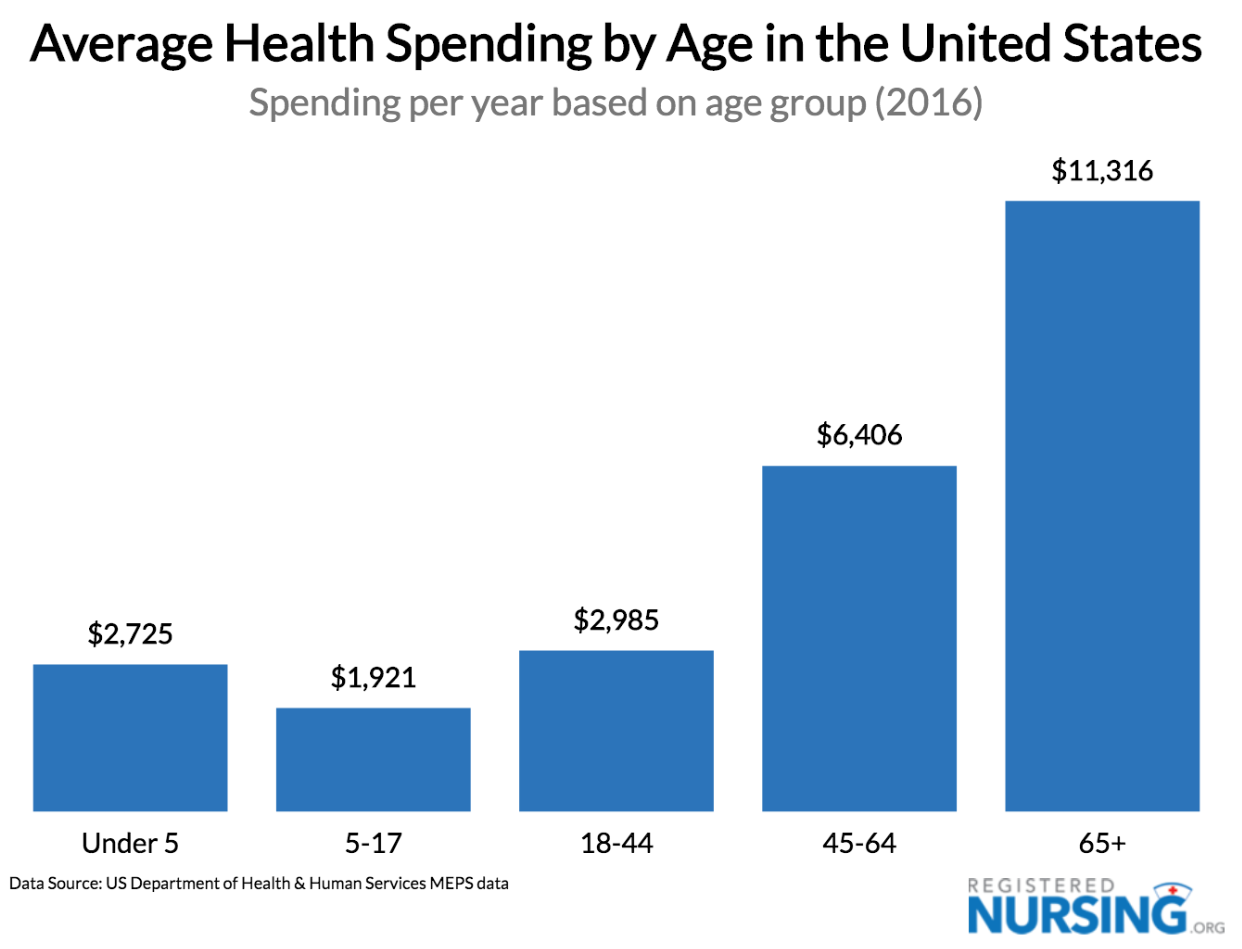

65+ is the absolute worst time to take this gamble.

Health care costs roughly double with every decade of a person's life with 65+ being the "hockey stick" moment where it can go through the roof.

We totally get having lower cost options to fill in this gap (Advantage plans or high deductible supplements) but you need to have some cap in place.

Here's where the second misconception comes in.

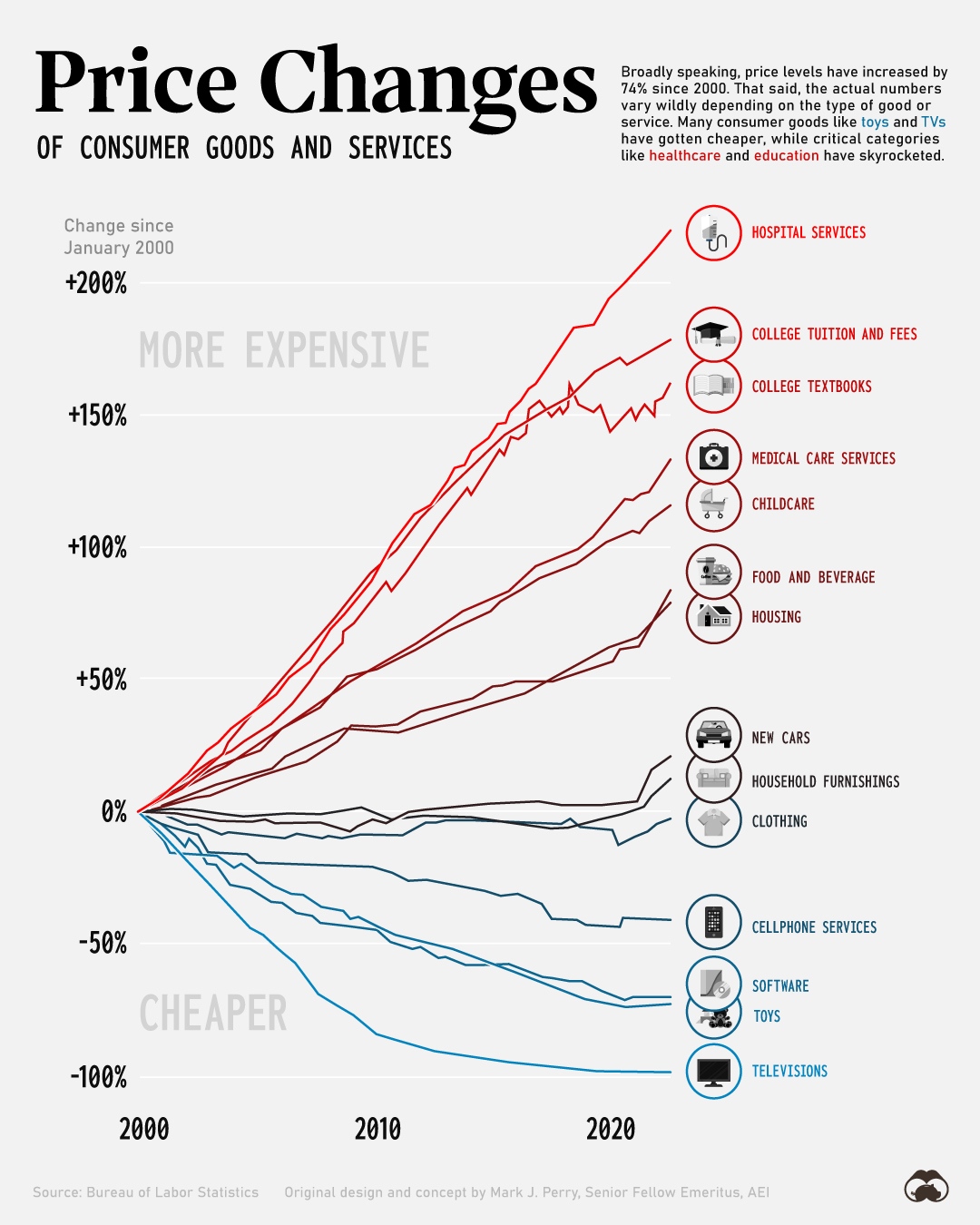

The cost of health care, especially in a facility setting, is completely insane now!

Look at "hospital". Even higher than higher education and we all know what a *@#% show that is!

"Medical care" isn't too far behind and don't get us started on medications.

We see this all the time as agents when people call in the middle of a health crisis looking for insurance. It's too late. Plans won't go backwards.

It used to be $100K was a big bill when we started (1995).

Then $250K was a bigger bill (say Heart Attack)

We have a client who had open heart surgery. When he told us the total cost, we couldn't believe it.

$5 Million! $250K for each hour his heart was offline during the surgery.

So...let's say we only have Medicare. You're on the hook for 20% of $5M??

It makes absolutely no sense to take this risk especially when we can find Advantage plans with low or no cost monthly depending on the area.

Again, we don't care about free dental or copays for the doctor. We have to cap this 20% exposure!

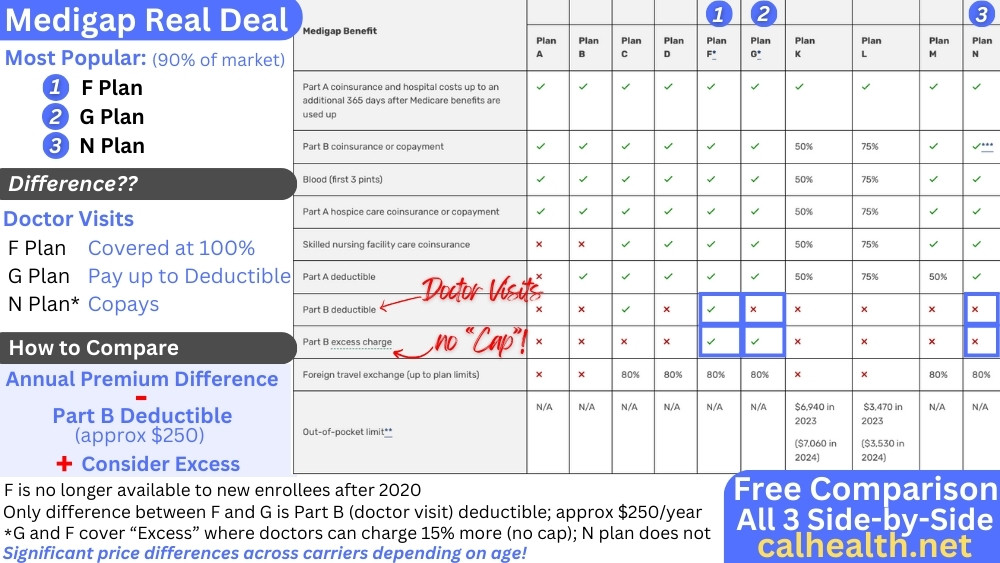

The two cheapest ways to do this is with an Advantage plan or certain type of Medicare supplements.

Advantage plans are usually lower cost monthly with a cap (called max out of pocket) on the backend where supplements cost more monthly but should have less out of pocket for the big bill.

We compare medicare supplements and Advantage plans here but most people are in the two camps (I'm not going to get sick or I don't want to pay extra) opt for the Advantage plan.

We look at how to compare Advantage plans here but let's do what other websites seem to forget about.

What are we losing?

What are we losing with an Advantage plan

Most Advantage plans are HMOs. Due to this, there are two constraints:

- We have to stay within a network of providers, usually tied to our area

- Care can be more "managed" meaning decisions on healthcare have a cost constraint built in

This is true of all HMOs including Advantage plans of that model.

So...how do we evaluate this?

First, people generally have a sense of whether they work with the HMO model from prior experience.

Second, they work better in more populous areas (like LA county, etc).

Finally, if we want the full Medicare network and more of a PPO feel, you can get a medicare supplement that's either high deductible (like the high deductible G plan) or one of the supplements that have built-in max-out-of-pockets.

You can run quotes for the supplements here and we'll send form after for doctor/RX info in order to quote the Advantage plans more precisely.

One note on Medication.

Traditional medicare doesn't cover medication. That's a separate policy called Part D. We'll be able to quote this through the link above as well.

Most Advantage plans (HMO) include this Part D benefit which is another feather in the cap for people who want to cover the risk of only having Medicare versus the monthly cost issue.

Medications are also exploding in costs like hospitals so it's important to have this covered!

Alright...if we get that the point of an Advantage plan is to cap our risk in case of big bills at the lowest cost, how do we pick the best one for us?

How to pick the best Advantage plan

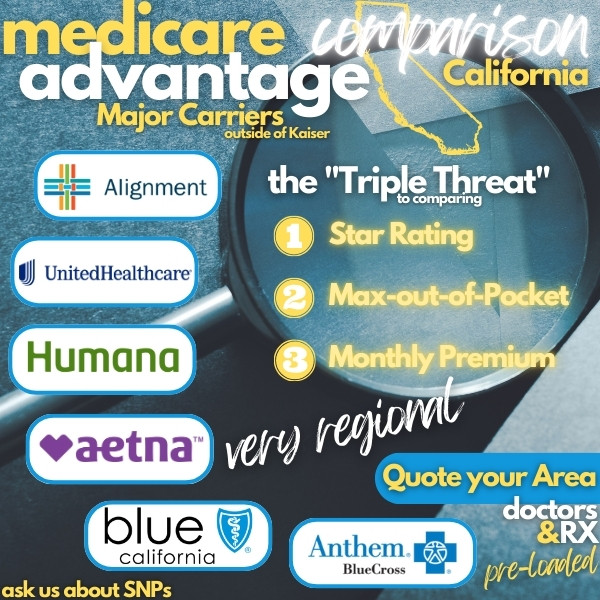

We have entire reviews on How to pick the best Advantage plan or how to compare supplements and Advantage plans but a few highlights.

Look...when eligible for Medicare, you're getting bombarded with flyers and and even cold calls (not allowed by CMS by the way) but here's the secret sauce.

Focus on the "Triple Threat":

- Low or no cost monthly

- Max-out-of-pocket under $1K if possible

- 4 Star Rating or higher

We explain why these are so important in our how to avoid bad Advantage plans.

- Low cost matches people who are looking to cap the back-end exposure.

- The max under $1K speaks to comparing well against the high deductible supplements.

- 4 Star Rating or higher reflects how well enrollees on the actual plans see the plan.

The last item is critical to addressing "what we're giving up" with Advantage plans from above.

Of course, we're happy to walk through any questions when comparing Advantage plans or even supplements.

The net takeaway is this:

Don't split 10's (BlackJack reference) and go with only Medicare alone.

That 20% uncapped exposure is a terrible bet in your 60's+. Fill in the hole with either a Medicare Advantage plan or a high deductible supplement.

That's the real point despite everything that's being "sold" to you.

Email us at help@calhealth.net or call us at with any questions!

No cost for our assistance and we work with the biggest Advantage plans in California!: