California Health Insurance - Compare UnitedHealthcare®and Anthem Blue Cross in California

Anthem Blue Cross versus UnitedHealthcare®Comparison

There's been a lot of nationwide consolidation in health insurance and these two carriers have led the way.

- What are the benefits to being with a big, nationwide carrier?

- What about the downside?

- How do they compare against each other?

We are talking about #1 and #2 nationwide in membership.

What really matters is how you are treated individually in your area with your doctors!

Let's evaluate these options and and then we'll compare UnitedHealthcare®and Anthem Blue Cross side by side.

First...some credentials Please!....

The health insurance market is really broken into different segments.

Carriers have very different performance by category so it's important to look at the one that pertains to you.

Here are the three main categories:

- Individual and Family (including Covered California)

- Small Business (1-100 employees) and Large Group (100+ employees)

- Senior - Medicare Supplements and Advantage Plans

You can jump right to your category comparison of UnitedHealthcare® and Anthem Blue Cross.

Otherwise, let's compare the two carriers from a top level view.

Enter the heavyweights!

UnitedHealthcare®and Anthem Blue Cross Path to Today

Many years ago, the CEO of then Wellpoint (was bought by Anthem later) said that a carrier will need to have 10+ million members to survive going forward.

Soon after this, Anthem bought Wellpoint (Blue Cross of California) and continued to grow in many States across the U.S.

They now have Blue Cross Blue Shield in multiple States.

In California, Anthem Blue Cross is separate from Blue Shield of California (a peculiarity or our State) for the three segments we're looking at.

Most of the other carriers in California are only in California or a handful of States.

UnitedHealthcare® is the other carrier with a nationwide presence!

UnitedHealthcare®used its strength in large business to spread across to many States where Anthem purchased and accumulated Blue Cross Blue Shield's across many States.

Either way, they are consistently in the top 3-5 largest carriers nationwide.

Before we look at each one specifically, let's speak to how this "nationwide" presence affects you.

You can always quote either carrier side by side here any time:

UnitedHealthcare®and Anthem Blue Cross Nationwide Affect on You

There are pro's and con's to the carriers' race to size.

These are the positives that come from their size:

- With large member size, they can negotiate aggressively with providers

- They may survive the current health insurance transformation

- Their doctor networks should offer nationwide footprints

- They can offer a full array of plan designs and options

- Rates should reflect economies of scale

Let's really look at these.

Provider networks for Anthem and UnitedHealthcare® Health

Here's the theory.

You need lots of members (millions) to fend off the big hospital networks.

These negotiations are brutal!

Two behemoths go head to head.

UnitedHealthcare®or Anthem Blue Cross sit across the table from Dignity Health or the U.C.'s .

It gets ugly.

Keep in mind that these private health carriers have a profit margin typically of a 2-4%. 1% negotiated from the hospital chains can be a huge deal!

In theory, this then flows down to premium savings which is partially true since by law, the carriers must spend a certain percentage of total premium towards actual health care.

Large carriers should equal lower rates.

But only if they're well managed.

The Costco model doesn't exactly translate to health care.

Survive current Health insurance Transformation

Starting with the ACA law, every day's something new.

Health care (really health insurance) is front page news almost daily.

The bigger carriers like UnitedHealthcare®and Anthem Blue Cross are better positioned to survive all this change and turmoil.

If one State becomes a mess, they have are protected by having business in many States.

Both Anthem and UnitedHealthcare® are in this category as they participate in many States across the U.S.

This brings up their biggest asset.

Doctor Networks

Doctor Networks between UnitedHealthcare® and Anthem Blue Cross

Anthem Blue Cross takes advantage of the Blue Card network for most of their PPO and EPO networks.

This is a huge deal since it allows you a true nationwide network.

UnitedHealthcare®contracted with their own network throughout the U.S. and it's pretty similar in scope and depth.

Each market is different now since the ACA law so it's important to look at your individual comparison when it comes to networks.

Plan Options with UnitedHealthcare®and Anthem Blue Cross

PPOs. HMOs. HSAs. HRAs. Medicare Supplements. Advantage plans.

You name it!

UnitedHealthcare®and Anthem offer it.

They have a wide array of options available at the individual, group, and senior level.

That comes with the size of scale they can operate with.

Rate Comparison between Anthem Blue Cross and United

In certain markets (Group for UnitedHealthcare® for example), we do see some rating strength but on whole, the savings do not reflect their scale.

It's not like Walmart.

The underlying cost to insure a person is pretty comparable from carrier to carrier since the benefits are mandated now across much of the market.

They do have specific niches where they excel and we'll discuss this in the individual market comparison.

We'll also talk about the weaknesses.

Let's get started.

You can jump to your specific market for UnitedHealthcare® and Anthem Blue Cross comparison:

- Individual and Family

- Small Business market (1-100 employees) and Large group

- Senior (Medicare market)

Individual and Family comparison between UnitedHealthcare®and Anthem Blue Cross

In California, this is a one-way comparison right now.

UnitedHealthcare®has pulled out of the California market individual market including Covered California.

What about Anthem Blue Cross?

Anthem was a strong leader in 2014 for both Covered Ca and off-exchange business.

Run your quote to see what's available in your area!

This is a huge deal since they make up roughly 1/3rd of the market!

Let's go through the key points:

- Pricing

- Network

- Membership

- Claims

Anthem Blue Cross Pricing

This really differs from situation to situation.

Typically, the big comparison is between Anthem's EPO and Blue Shield of California's PPO.

They're usualy the only non-HMO available plan in most areas.

It's not uncommon to see Anthem is cheaper in one area and Blue Shield is cheaper in another one.

You really have to run your quote here for your zip code and age:

Network Comparison for Individual/Family

UnitedHealthcare® doesn't participate so that's pretty easy.

Anthem's network in remaining counties is a mixed review.

This is true for all the ACA health plans since 2014.

The networks are about 1/3rd the size of the old networks (which companies still have access to).

There's no way around this for individual/families.

It's good to check with your doctors and ask what "Covered California" plans do they participate with.

By law, the networks have to be the same for Covered Ca and off Exchange plans.

No way around this. Can be very frustrating.

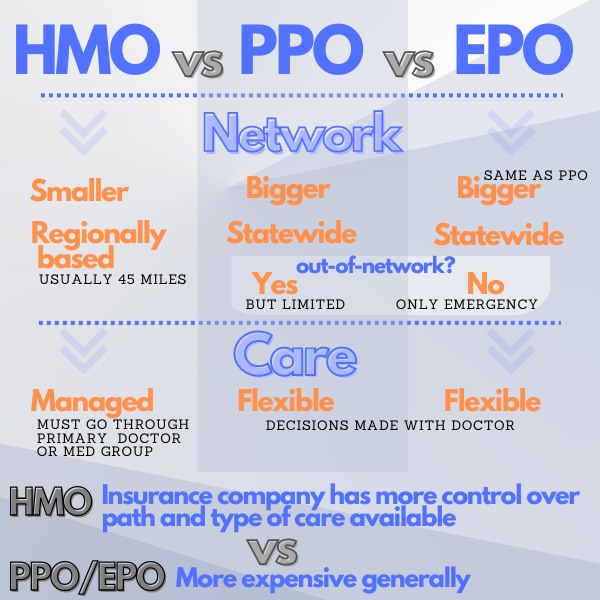

Anthem went to the EPO (Exclusive Provider Organization) from their PPO a while back.

You can get more detail on EPO versus PPO here but basically, the difference is that you do not have benefits off-network in a non-emergency.

Check with your doctors or click the Provider search link in the quote here: Individual Family QUOTE

Customer Service Comparison for Individual Families

This is an issue with larger carriers like Anthem Blue Cross and United.

It's just more difficult getting issues resolved with either carrier although no carrier is great these days.

Anthem used to be really easy to deal with.

That changed when Anthem took over and started making decisions from Indiana.

The California health insurance market is much more competitive and members expect more responsiveness.

The new carrier tends to move more like a life insurance company.

It can be frustrating.

This is true for UnitedHealthcare® as well (although they're not in the market right now).

Contrast either one with a more regional carrier like Blue Shield of California or some of the HMO's such as Western Health, Sharp, etc and you used to really feel the difference. Less so since the pandemic.

Each State is different and it's not uncommon to get stuck with a nationwide rep who knows very little about our State's market.

That's the downside for nationwide carriers.

Claims falls in the same category as membership issues.

Let's all agree...health insurance claims are a terrible process!

Now throw in the bureaucracy of a large company and introduce head to wall.

Both carriers are pretty comparable on this front and it's not fun with either one.

Online Services for UnitedHealthcare®and Anthem

Both carriers have stepped up their online account abilities.

This might be one advantage of being a large carrier.

The options available to members through their online accounts are pretty robust:

- Claim information and history

- Individualized Doctor network search

- Premium and payment options and detail

- Benefit details

These are the critical components you want from your online portal and both UnitedHealthcare®and Anthem offer this (if they offer individual/family coverage in your area!)

Individual and Family RX list

This has been an issue on the individual market.

The RX list available to individuals and families have been pared back for Anthem Blue Cross.

They're using their new Select formulary which is pretty stripped down.

If you have ongoing meds, it's probably best to look at Blue Shield of California since they're drug list is more robust.

Of course, our services are 100% free to you as Certified Covered Ca agents so let us know how we can help.

You can quote the available Individual/Family plans here:

Now, let's look at the Employer health benefit comparison!

Small Group Comparison for UnitedHealthcare® and Anthem Blue Cross

This is where the two carriers really compete.

Both have extensive shares of the employer health market in California with strengths and weaknesses depending on the specific niche.

We're going to give our feedback on which one is doing the better job.

First, let's set the stage.

Anthem and UnitedHealthcare® Group Offering

Both carriers offer a large array of health plan options for companies to choose from.

HMO's. PPO's. HSA's. HRA's. Dental. Vision. Life.

Both carriers allow a great deal of flexibility in what you can offer employees.

We'll discuss how this is THE way to offer group benefits now and keep everyone relatively happy.

Both have extensive Doctor networks for the group market throughout the State and throughout the Country!

So let's get into the individual elements when comparing the two:

- Price

- Customer Service

- Network

- Online Services

- RX

Here we go!

Pricing Comparison for Employer Coverage - Anthem Blue Cross and UnitedHealthcare® Health

It's really important to check your company's rate here:

We can quote Anthem and UnitedHealthcare® side by side at a specific level so that we get correct information.

It's not uncommon to see a given area and age make-up swing rates to or from a carrier.

That being said...

Right now, in many situations we quote for companies, UnitedHealthcare®has the advantage for pricing.

We usually start with a Silver level plan (since it's standardized) to compare apples and apples.

UnitedHealthcare® has two full network options...Direct and Select.

The Direct adds essentially a hospital copay but the rates have been great.

The Select is the more standardized option.

They have two select at the Silver...one doesn't have copays (which should be part of Silver level) but it's richer in other areas.

We usually quote the standardized plan with copays since people are expecting that.

This UnitedHealthcare® PPO plan is generally less expensive than Anthem's equivalent plan but double-check!

Anthem has a few Silver plans to choose from with different deductibles.

We'll quote all of them to give companies a range.

Of course, we can offer other levels of coverage but the Silver gives us a good view of pricing competition since the Silver plan is so popular.

We'll discuss below how to take advantage of this information!

That's PPO. What about HMO?

Same holds true for HMO.

Generally speaking, United's full network HMO is less expensive than Anthem's HMO network.

Important note...we've seen United's group health plan pricing be 10-30% less than equivalent plan with Anthem.

They're very aggressive!

This can change of course (although you'll have 12 month rate guarantee in most situations) but right now, UnitedHealthcare® is really leading in pricing.

Against Anthem and most other carriers!

Run your Group health quote and we'll see how they stack up for your situation.

Group health customer Service for UnitedHealthcare® and Anthem

Blame it on their size.

The member doesn't feel too many issues in the day to day policy interaction but neither carrier is fun to deal with from an administrative point of view.

They both have online services available to companies and members.

The members portals work better.

UnitedHealthcare® has always operated like a life insurance company...just tougher to get things done.

More bureaucratic by nature.

Anthem was easy to deal with up until about 2012 when more and more decisions started to move to Indiana (Anthem's home State).

This is not unexpected since California's market is much more competitive than Indiana's.

California companies expect more!

Again, the members do not feel this membership lag with either claims or policy needs but the employer (which means the agent, us since we handle all the membership stuff) does.

It's not a deal breaker if their pricing is significantly better for comparable coverage but it's worth noting.

Underwriting and renewal are particularly trying times...especially for United.

Once we get through that, it's usually pretty smooth.

Employer Plan Networks - Anthem Blue Cross and UnitedHealthcare®

Both carriers are very strong here.

Not only do we have the usual flavors of networks...PPO's, HMO's, EPO's.

We have many version of them to choose from!

Both carriers offer narrow network HMO and PPO options to help keep the price down.

If your chosen hospitals and doctors participate, you can save 10-30% on average.

That's a huge deal.

Best yet, there may be options to offer many plans side by side.

UnitedHealthcare® really opened the flood gate on this option where each employee can pick from different plans and different networks side by side.

Total flexibility and really unprecedented.

Anthem offers different networks as well but doesn't have United's ridiculous flexibility.

As for the full networks. Both are comparable with very rich Group health plan networks of providers.

You won't have the issues you have with individual/family coverage.

When you run your group health quote below, we can send over provider directories to check for both.

Online Services for Anthem and United

Both carriers are pretty comparable for online portals.

The member portals are definitely better with pretty seamless access to claims, payment history, doctors, etc to employees.

Very robust and helpful.

The employer portals are good but not as good as the member's one.

Many membership changes can be handled this way.

As agents, we take over most of the work for the company anyway so we know the two portals very well.

UnitedHealthcare® again, has the upper hand in the employer portal sector.

Prescription Formularies - Group plans with Anthem and United

This may be a deciding factor.

Anthem Blue Cross rolled out their Select Formulary to most of the small group health market in California.

This is a much smaller formulary...the same one they offer to Individual/Family plans including Covered California.

There are major holes in this list...some that are surprising.

UnitedHealthcare® offers a more robust drug formulary that you would expect for Employer health plans.

The move of Anthem to the Select formulary was really a big deal.

Group Comparison Wrap Up

You can quickly run your Employer health plans quote for both carriers side by side here:

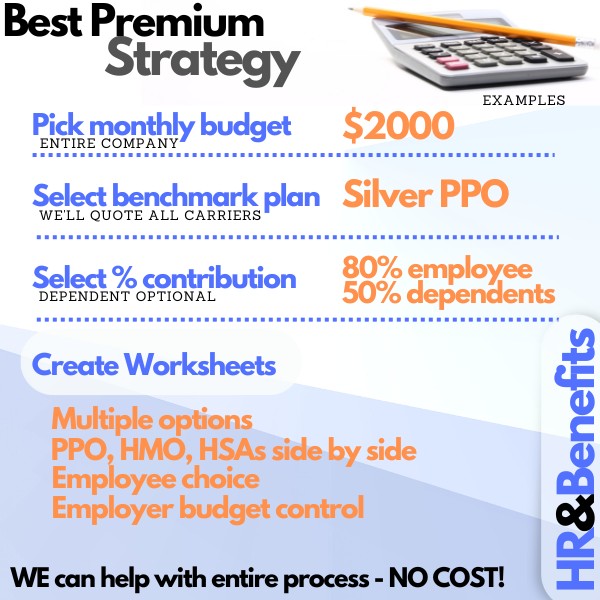

One final tip and this is a big one!

The best approach with either carrier is to determine a fixed percentage or amount of money the employer will pay towards a given plan.

The employees will then get a worksheet showing their cost for many different options (HMO, PPO, HSA, whatever you want to offer).

This locks in the employer's budget and gives total freedom to the employees!

It really lets small companies compete with larger companies in benefit offerings.

When we run the quote, we can show you how to do this.

There's no cost for our services as licensed California health agents!

Medicare Comparison for Anthem Blue Cross and United

Here, we have fierce competition as well between the two carriers.

- Both are offering a full suite of Medicare supplement plans.

- Both are offering Medicare Advantage plans.

For a comparison of Supplements versus Advantage plans.

Medicare supplements are standardized so the benefits are the same.

Supplements can (and do) vary in cost and benefits but they have generally hit certain thresholds.

Another type of standardization.

We'll look at United's stand alone offerings.

- Pricing

- Customer Service

- Network

- Online Services

- RX

Medicare Pricing for UnitedHealthcare® and Anthem

For Supplements, Anthem generally has UnitedHealthcare® beat on pricing.

This is especially true for the G plan which is becoming the de facto replacement to the most popular F plan.

For Advantage Plans, UnitedHealthcare® is the dominant carrier in California! It really depends on your area and age for who has the better option.

You can quote both types of plans here (we'll send link for doctor/RX and "opt-in" required by law to quote Advantage plans):

Now...for Advantage plans (and Part D for medication), that's a whole different ballgame.

After you enter your doctor/RX info and "opt in", we'll send a full quote of all the plans in your areas! Even ones we don't contract with.

The networks, benefits, and rates can all be different with Advantage plans so check out our How to Compare Advantage plans or our Insider's Guide to Advantage plans to learn more.

We have big reviews on:

Our services are 100% free to you as licensed California agents and Certified Senior agents for both UnitedHealthcare® and Anthem.

Customer Service for Senior Plans

This is more a knock on the Medicare segment itself.

There is so much protection of Seniors (rightly so) that membership moves slowly and methodically.

There's no way around that and both UnitedHealthcare® and Anthem Blue Cross must play by the same rules.

Ultimately, claims is driven by Medicare and the carrier pays accordingly so that is pretty comparable with Supplements.

For Advantage plans which operate more like HMO's, the carriers are more involved.

Both Anthem and UnitedHealthcare® can be a little more difficult to deal with than regional player like Blue Shield of California but they both compare closely on that front.

For Advantage plans, really look at the Star Ratings on the Guides above to get a sense of how happy enrollees are with each plan and carrier!

Senior Networks

Supplement network comparison is easy for supplements.

Does the provider take Medicare?

That's all you need with a supplement and it will be the same from carrier to carrier.

For Advantage plans, you will want to check with your doctor/hospital to see who they participate with.

Advantage plans are mostly HMO so they will have defined networks you have to remain within.

Our quoting system (below) will automatically include your doctor and RX info that entered by email after you run the quote!

Both UnitedHealthcare® and Anthem have extensive networks in the category but there will be differences depending on area.

When you run your quote, you can check provider listings for each plan.

Anthem Blue Cross versus UnitedHealthcare® Wrap

Okay...we have two dominant carriers in California.

The health insurance equivalent of the major chain restaurants!

That brings some advantages and some disadvantages to you the member.

- Pricing and Networks should benefit.

- Day to day membership and ease of use might suffer.

That's our experience from dealing with all the carriers for more than 2 decades!

It really depends on which market segment you're in:

- Individual/Family including Covered California

- Small Business 1-100

employees

- Senior - Medicare Advantage and Supplements

We had to break out each segment for that reason.

Of course, we're happy to walk through any question you have.

And there will be some!!

Again, there is absolutely no cost to you for our services. Email us at help@calhealth.net or 800-320-6269 Today!

.jpg)

.jpg)

.jpg)