California Medicare Advantage Options - Guide to Advantage plans

Your Insider's Guide to Medicare Advantage Plans

If you want to read the full 128 page Medicare and You Handbook, we won't get in your way.

However, if you would like to get the gist of what really makes Advantage Plans different, well...Hello!

We're going to cut to the chase of what we're gaining and losing with Medicare Advantage plans in a way that takes advantage of 25+ years in the senior market.

We'll cover some of the basics just to get a lay of the land but we'll zoom into the real big decision to make around Advantage plans and finally...how to compare the 10 billion options.

Let's also touch base on the most popular Advantage plan out there now... the Part B Giveback plans!

Otherwise, hust the facts, mam!

These are the topics we'll cover:

- A quick intro to Medicare

- How Medicare Advantage Plans address the "gaps" in Medicare

- Medications and Advantage plans

- The real consideration with Medicare Advantage

- The very popular Part B Giveback plans

- How to compare the different Advantage plans

Let's get started!

A quick intro to Medicare

Let's set the table first before the big meal.

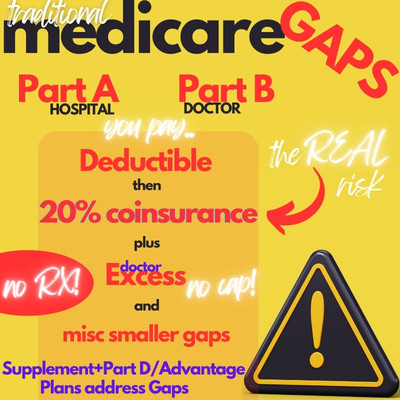

Medicare works like an 80/20 plan with a deductible build in for hospital and a separate one for doctors.

This means, you need to pay a certain amount up front (deductible) and then you start paying 20% of the remaining bills for the rest of the calendar year (Jan-Dec).

Not too hard so far, right??

Medicare does not cover medication (other than in-patient) so we need to address that as well...especially in today's world.

There are other little "gaps" but really, the deductible and 20% coinsurance (amount you pay) are the big gaps along with medication.

Medicare just loves its technical language so let's give everything it's correct name.

- Part A - the hospital benefit - usually automatic and already "paid" from payroll taxes during life

- Part B - the doctor benefit - requires a separate monthly payment, usually from social security

- Part D - a stand-alone RX plan; paid separate

- Part C - Advantage plans! The new HMO player on the market

Yes, it's a bit out of order but "Part C" is what we're focusing on here. Let's go there now!

How Medicare Advantage Plans address the "gaps" in Medicare

So...we have "traditional" medicare above. Then came "medicare supplements" which fill in the holes to varying degrees.

Then came Advantage plans. Essentially, Advantage plans are new HMO kid on the block!

The goal was to offer coverage to seniors with Medicare at a lower cost than supplements which can run a few $100 per month.

They did that!

Most monthly costs for Advantage plans are zero to low cost.

As a trade-off, we're agreeing to work within an HMO model (for most of them).

This generally means:

- Smaller networks based on a geographic region that we have to stay within

- More "managed" care - decisions are partially driven by the insurance carrier

Some people are very familiar with HMO plans from their pre-65 days. Others will only deal with PPO type plans where there's more flexibility (that's the medicare supplement side of things).

We have a huge comparison of Supplements and Advantage plans.

This is really a key driver of which way to go to address the holes of medicare. We looked at why you definitely want to have some additional protection to stand-alone Medicare.

Of course, we're happy to help you compare your options including Advantage or Supplements!

There's no cost for our assistance and our Google reviews tell the tale!

What about RX and Advantage?

Medications and Advantage plans

This can be a big difference.

A person with Medicare can buy a stand-alone Part D plan to cover medication.

Most Advantage plans will include RX coverage right in the medical plan!

This can generally save $10-$50/month depending on the Part D plan in question.

As with all HMOs, you'll have more management of the RX benefit with an Advantage plan but not by much these days.

For example, a generic may be required versus a brand or a different course of treatment may result in the beginning versus a Part D.

In today's world, that's not necessarily a bad thing where many new brand drugs are slight modifications to existing medications to extend or renew patents.

There may be situations where a new-fangled medication (very very expensive) is not offered with an Advantage plan UNLESS there's no alternative.

Keep in mind that Part D plans will also have some "management" as well so the difference may not be sizable.

You can run your drugs and Advantage plans here free:

Now...let's really roll up our sleeves and cut to the chase with this whole decision!

The real consideration with Medicare Advantage

You're getting dozens of calls (not from us!!!) and then a small birch tree in mailed flyers for Medicare options.

What's the real deal here?

When considering Advantage plans versus supplements, it really comes down to a "shift" in cost.

Everyone's pushing and selling but they're probably not telling you the full story.

We really need to understand the trade-off:

- With supplements (especially the G plan), we pay more monthly but have very little out of pocket

- With Advantage plans, we pay less (or nothing monthly) but have to share more when sick or hurt

That's the rub. That's where the tire meets the road.

So...how on Earth do we compare this?

First, we have many people coming off of Covered Ca with very low premiums due to tax credits.

It can be a question of cost where they just can't (don't want to) afford $150+/month in premium for a supplement.

It's not even a question.

For many people though, they're "sold" no cost Advantage plans without any explanation of the "back-end".

That's a big red flag. We're not anti-Advantage plan but you really need to understand the trade-off.

Focus on the out-of-pocket max (OOP). That's your worst-case exposure in a calendar year (in-network of course for covered benefits).

It's generally around $1000/year (but can go much higher).

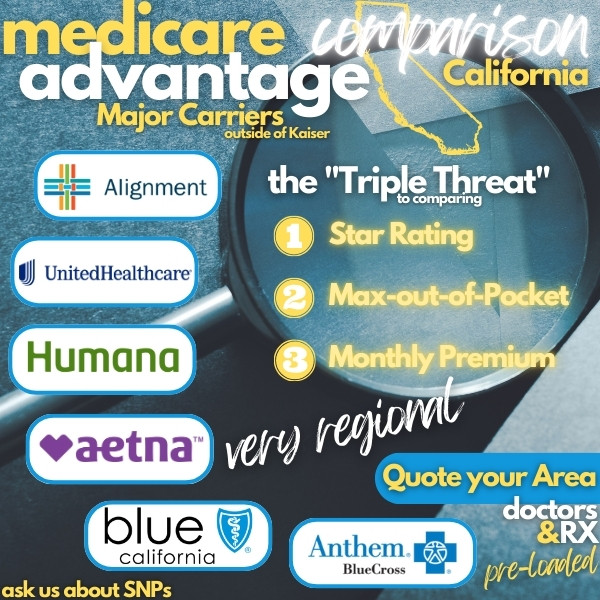

Here's our "Triple Threat" which we describe in our How to Compare Advantage Plans:

So...let's take a hypothetical example at age 65.

- G plan - $130/month

- Advantage plan - zero/month; $1000 max

If we're in good health, the Advantage plan will work out great. We're saving about $1400/year (let's say $1000 assuming some minor health care costs).

What if we have something bigger?

Okay...now the real out of pocket is $1000 (OOP max is hit). Still not bad compared to the $1400 savings so the consideration is more on the network (who we can see and what health care will be allowed by the HMO) and control of care.

The problem is that there are Advantage plans with max-out-of-pockets of $1000s!! Even up to $8-10K

Let's say we have a $2000 max out of pocket and we have bigger bills.

Now, the "real" monthly premium equivalent is around $180/month!

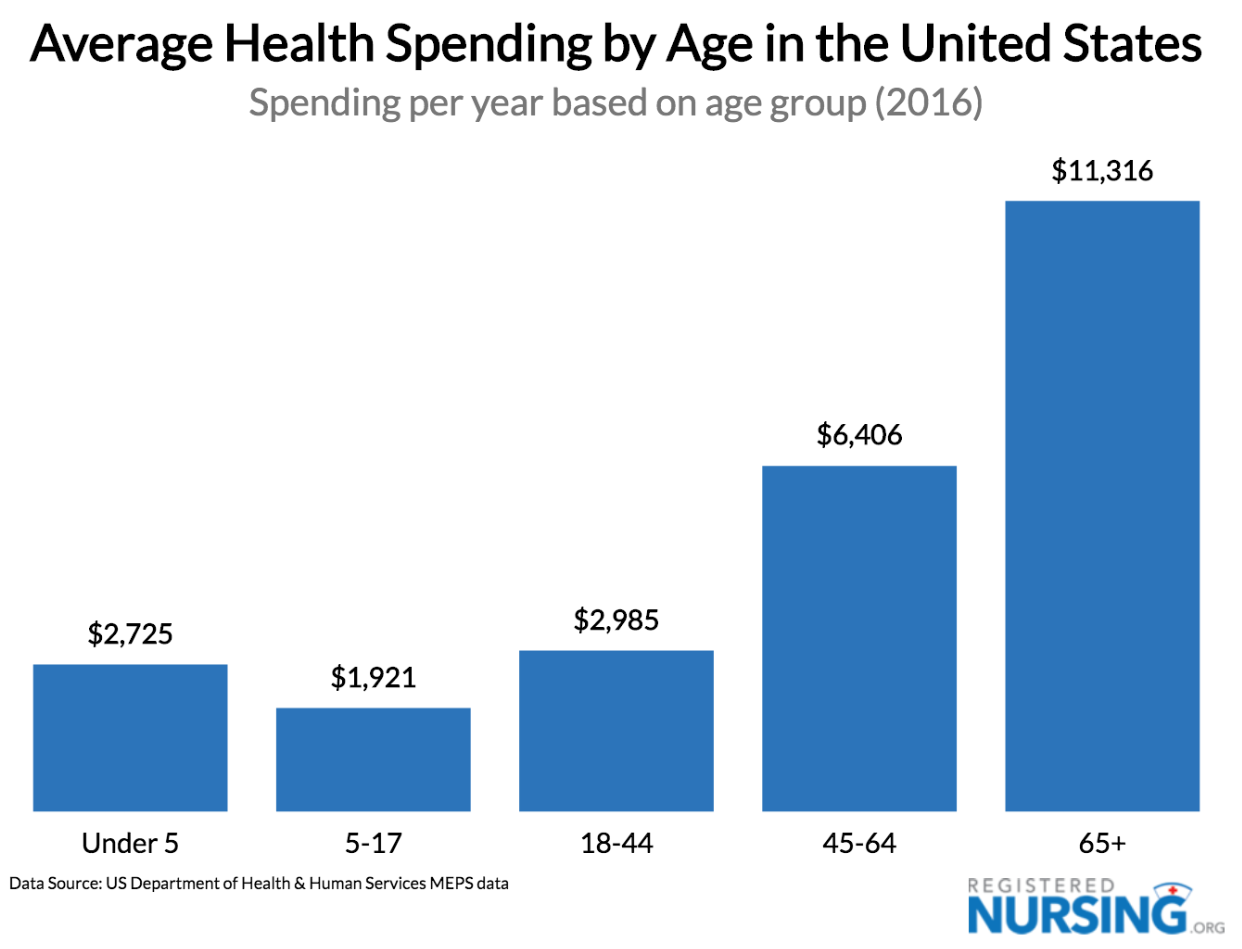

Here's the deal...our healthcare costs double with each decade of our life so taking the "bet" of lower costs is a losing hand generally age 65 and over.

Again, everyone's situation is different but just understand the trade-off between paying now (monthly premium) with supplements or lower OOP advantage plans and paying later (copays and cost sharing) with the Advantage plans everyone's pushing.

So...how on earth do we compare all the different "flavors" of plans out there?

How to compare the different Advantage plans

A few broad strokes to help you on your way:

- Max out of pocket versus premium

- Networks

- Medication benefit

- Carrier satisfaction

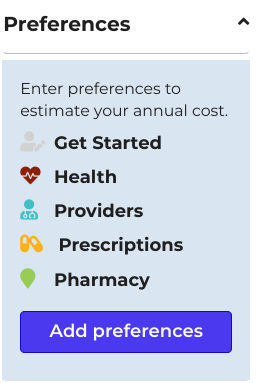

First, you can run your quotes here with tailored options according to doctors and/or medications! It's really pretty fantastic.

Make sure to enter your medications/dosages and doctors under Preferences and then sort by "Total Estimated Cost" up top.

Let's hit the highlights and you can always reach out with any questions. There's no cost for our assistance as licensed Medicare Advantage agents.

Advantage plan Out-of-pocket max OOP) versus premium

Since we're comparing against Medicare supplements at around $1500/annually, we would hope to cap our exposure under that amount or we're rolling the dice we'll be healthy.

So...aim for a max-out-of-pocket around $1000/year. This "savings" even in a bad year makes up for the more restrictive network/care considerations with Advantage plans.

Yes, you can get richer "up-front" benefits but watch out for the big stick if something more serious happens with max's in the $1000's! (why didn't they explain that in the sales slick??)

One note...some of the plan with $8K+ maxes may be medi-medi plans where medi-cal will help with this backend if you're eligible! Learn more about SNP Advantage plans.

There's a lot of slinging gym memberships and vision benefits while forgetting to mention the $3000 out of pocket max.

Again, we're happy to walk through this with you since there are so many options!

Next up...(maybe first up??)...networks.

Advantage Networks

If there are doctors/hospitals you want access to, best to check what plans they participate with first.

Our system will automatically do this for you here!

You may find that a trade-off needs to be made..."I can have these two doctors but not this one".

That's a function of Advantage plans but in many areas (especially more populous ones), we can find plans that work with most and even all doctors.

We have a massive Comparison of Advantage plans with actual examples.

Hospitals also figure in so make sure to enter those as well or check with us!

We can do this legwork for you as well! Just email us at help@calhealth.net There's no cost for our assistance! Zero. Check out our Google Reviews!

Keep in mind that there's geographic constraint on doctors and medical groups. Usually around 45 miles depending on the area (and density).

Kaiser is a totally separate beast. If you want doctors outside of Kaiser, you would run your quote here.

Let's detour to the new Advantage plan that's eating up the market.

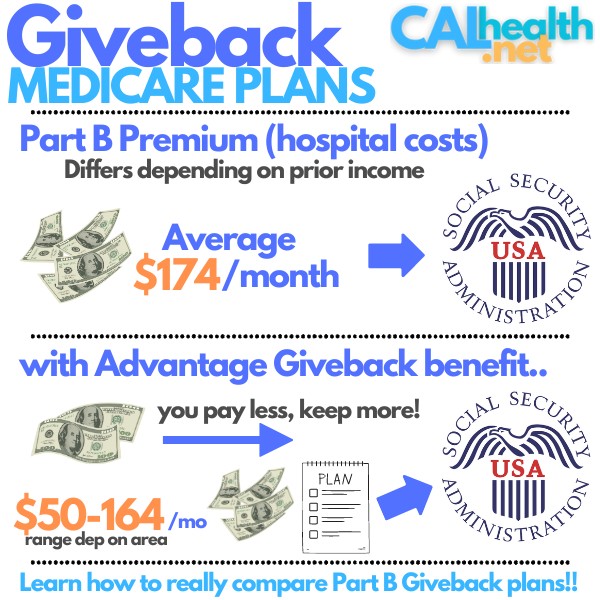

The very popular Part B Giveback plans

These plans have jumped from 2% of the market to over 15% in a few years. This will only continue with all the cost pressure on seniors!

We have a big explanation of Part B Givebacks and even a Giveback comparison but here's the skinny...

These plans will pay towards the Part B premium you have monthly to Social Security.

This can mean more money in your pocket!

This can mean up to $2000 in people pockets depending on what their Part B is and it speaks to why Alignment has been so popular lately.

Learn more about how they work. Humana and UnitedHealthcare® also have strong offerings here.

What about medication?

Medication benefit on Advantage Plans

Almost all Advantage plans include a medication benefit or Part D plan build in. This makes it easier but also adds one more "layer" of requirement when comparing Advantage plans.

We make this easy!

Just enter your medications along with your doctors and our quoting system will automatically generate the plans that participate and cover your meds.

Run your quote and you can enter your doctors and medication to track down the best-priced plans that work with you!

The pharmacies are all pretty easy since 90% of them work with the big Advantage plans.

It's really about zeroing in on your particular meds.

Finally, how to avoid a lemon.

Carrier satisfaction for Advantage Plans

Though not perfect, the Star Ratings are slowly starting to capture people's actual experience with the various companies offering Advantage plans.

Both good and bad!

We can use this as a benchmark once we determine which plans will work with our doctors and medications.

We have a whole Advantage plan California comparison but the big players Statewide that contract with independent doctor/hospitals are:

- UnitedHealthcare®

- SCAN

- Alignment

- Anthem Blue Cross

- Blue Shield of California

- Humana

- Health Net

There can be regional players and we're happy to help you compare. Our system has access to major plans in a given area.

Here's the issue...the real driver of Advantage plans come down to the networks and as with any HMO, networks come down to carrier size and strength.

Really...the ability of the carrier to negotiate in a given area is based on how many members they have.

That's the raw math of it so the bigger carriers tend to have bigger/better networks and better pricing.

This, after all, is the whole point of the HMO model itself! Manage costs by managing care and this only works with large groups of people!

That's why you don't find great Advantage plans in rural areas (if at all).

Again, we're happy to compare all the strong carriers in your area according to your doctors, hospitals, and medications!

No cost to you. It's what we do (and we do it well). See Google Reviews.

Also, no question is a bad question. Medicare's complicated so we're happy to walk you through it!

Related Guides:

- Compare Medicare Supplements and Advantage Plans

- How and when to sign up for Medicare

- The Trade-off Between Supplements and Advantage Plans

Call 800-320-6269 or email us at help@calhealth.net

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.