California Medicare Options - How do you Qualify for Medicare

Giveback plans

California Medicare Options - How do you Qualify for Medicare

Giveback plansHow do you qualify for Medicare giveback benefit

We have some good news on this front.

The Medicare giveback benefit is available to anyone with Medicare Part A and B as long as the plan is available in your zip code.

We'll look at how to check your area but let's walk through who qualifies, how to compare the plans, and check out a sample quote of options.

If you just want to see if the plan is available in your area, you can quote here:

Filter for "Part B Giveback" for the type of plan.

To get the best quote:

- Under preferences, enter your doctors and hospital

- Enter your medications and dosages

- Enter your pharmacy

- Sort by "Total Estimated Cost"

If you need help, we're happy to do this all for you at help@calhealth.net or feel free to chat.

We have big reviews of Giveback Plans explained or how to compare Giveback plans.

For now, let's touch on these:

- How do you qualify for Medicare giveback benefit

- A quick intro the Medicare giveback benefit

- How to compare Medicare giveback benefits

- How do get the giveback benefit

- How to quote and enroll in Medicare giveback benefits

Let's get started.

How do you qualify for Medicare giveback benefit

Giveback refers to an add-on benefit that some Medicare advantage plans offer.

Medicare advantage plans are generally HMO plans that people with Medicare are able to choose and we look at Advantage plans versus traditional Medicare for more guidance.

In order to have any Advantage plan, you need Medicare Part A (hospital) and Part B (doctor).

So basically, there are two requirements to qualify for a giveback plan:

- Have active Medicare Part A and B

- Have plans in your area that offer the giveback benefit

That's it!

The giveback plans have exploded in popularity from 2% to over 13% of the Advantage market in a few short years so clearly people are taking notice.

What exactly is the interest all about?

An introduction is in order.

A quick intro the Medicare giveback benefit

If you want the Giveback benefit explained with more detail but otherwise, let's look at basics.

People on Medicare generally have a Part B premium that they have to pay either with auto deduction from Social Security or via quarterly billings.

The average amount now is around $185 but goes up each year with inflation. That's over $2K each year!

The Medicare giveback plan will pay towards this bill up to a certain amount.

You don't get the cash but your Part B bill is reduced so it's still cash in your pocket.

How much and how do you qualify for different levels?

This is a big part of our giveback comparison.

How to compare Medicare giveback benefits

First, we have to keep in mind that the giveback benefit is ADDITIONAL to the core Advantage plan health benefits.

It doesn't make sense to choose a so-so advantage plan to get more giveback benefits.

We have a big review on how to compare Medicare giveback plans but here are the key points.

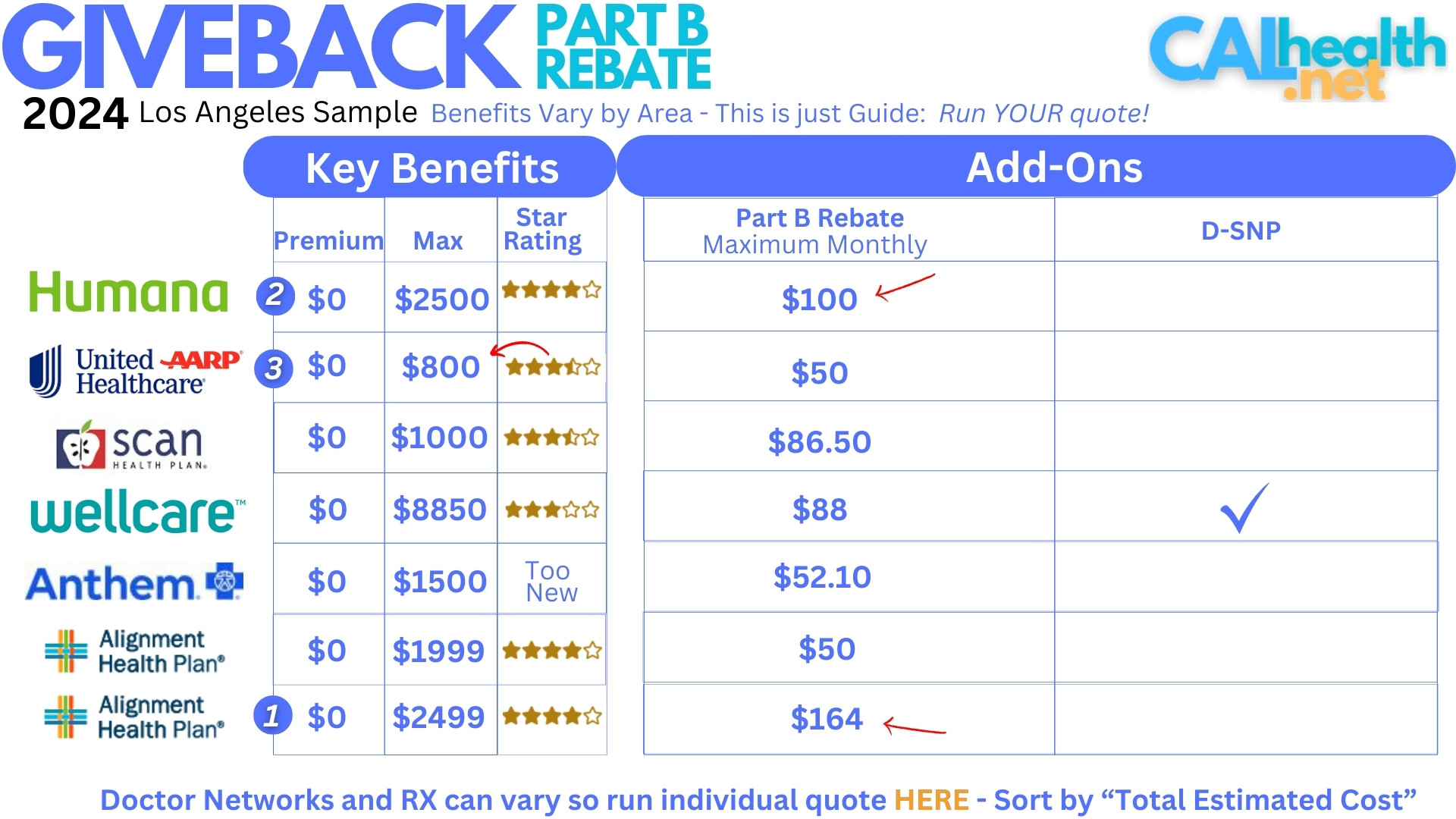

First, let's run a sample quote in Los Angeles (your area and situation will be different):

These are the points we'll focus on:

- Medicare giveback amount

- Star Rating

- Max-out-of pocket (minus the giveback amount...we'll explain)

- Networks

This gives us a good footing. Let's break these down.

Medicare giveback amount

In the example, the giveback benefit differs from $50 to $164 per month!

Big range. Why?

Remember how your Part B premium may differ depending on your prior income up or down from the standard $185.

You can only get as much giveback as you pay in Part B.

Meaning...if your monthly premium is $80 and you choose a plan with $100 giveback benefit, you'll only get the $80!

Obviously, we want as much giveback as possible but...all other things being equal!

Star Rating

This is really where rest our head. How do actual members feel about their experience on that Advantage health plan.

We want 4 Stars or higher ideally. 3 is pretty mehh and each ½ a star makes a big difference.

That narrows the field quite a bit already!

Next up, the out-of-pocket max.

Out-of-Pocket Max (minus the giveback benefit)

Notice that the Alignment plan has the highest giveback benefit at $164. It also has a higher max!

The max tells you how much you'll pay up to if you have really big bills in a year.

Notice UnitedHealth has the lowest max (for giveback plans) at $800/year but a lower giveback benefit.

Humana is blend between the two.

If you subtract the giveback benefit from the max, you have your net exposure.

For example, the Alignment max is $2500. Giveback is almost $2K/year. So your real exposure in a bad year is around $500!

That's not bad at all. And if you're in pretty good health, you can expect to keep most of the giveback benefit.

This can get confusing so we're happy to analyze it for you at no cost! Just email at help@calhealth.net or pick a time to chat.

Finally, a big piece of the equation with Advantage plans.

Networks

If you have doctors/hospitals that you must have, we have to check to see which plans they work with.

The networks can be quite different and may sway you one way or another. You'll be able to do this in the quote sanction below.

Same thing goes for your medications. Are they covered with a given plan?

So recap:

- Giveback benefit as high as possible up to your Part B premium

- Star Rating of 4 stars or higher ideally

- Lowest net exposure (max-out-of pocket minus the giveback benefit)

- Doctors and hospital in-network (with medications covered)

Okay. So what's the actual mechanics of the giveback itself? It's not in Denny's giftcards, is it?

How do get the giveback benefit

Let's look at a typical situation.

You have $185 deducted from your Social Security monthly for the Part B side of Medicare.

You then select the Alignment (if in your area) that has the $164 giveback benefit

In this situation, you would only have $10 deducted from your Social Security.

It's like you're getting an extra $164 in your Social Security if you have Part B in this situation.

You don't get the cash direct from the carrier. You get a reduced Part B cost.

One part of qualifying was having these plans available in your area. Let's go there now.

How to quote and enroll in Medicare giveback benefits

You can quote Medicare giveback plans if available with our free, secure, and fast system here:

To see if you qualify for the giveback, select "Part B Giveback" for type of plan.

Then under "Preferences", add:

- Doctors and hospital

- Medications and dosages

- Preferred pharmacy

Sort by "Total Estimated Cost" to take into account medication costs.

That's it! The plans will show up if you qualify based on your zip code!

Applying is even easier. Just "Add to Cart" in the quote and it's tied directly into the enrollment system for the major carriers.

Of course, we're happy to help with any questions! help@calhealth.net or let's chat. There's ZERO cost for our assistance.