California Medicare Options - Medicare Giveback Part B Plans Explained

Giveback Advantage Plan for Seniors Explained

There's a lot of buzz (and advertising) these days around so-called "Giveback plans". What exactly are they and are they legit?

We're going to walk through the entire process is a simple to understand walk through as these plans may be a good fit for some seniors.

Our credentials are here:

These plans have grown from 2% of the Advantage market to over 13% within a few short years!

Here's what we'll cover:

- What is Part B and how much does it cost

- What is the Giveback benefit?

- How much Giveback benefit is available?

- Does the Giveback benefit make sense?

- How to compare Giveback plans

- How to quote and enroll in Part B Giveback plans

Let's get started!

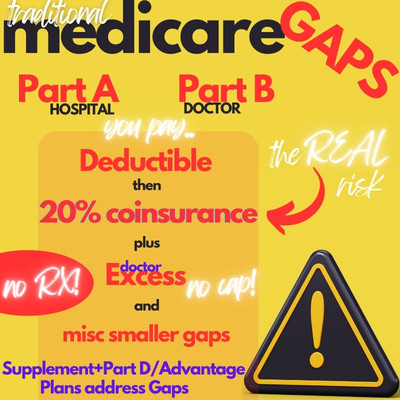

What is Part B and how much does it cost

First, giveback what exactly?

Medicare is composed of 2 parts:

- Part A for Hospital - usually free if you payed payroll taxes during your life

- Part B for Doctors - requires a separate monthly premium

The Part B premium is what we're focusing on here. It's averaging $174 currently but goes up each year (like everything else).

This amount can differ up or down depending on your prior income. Even at $174, that's over $2K annually!!

It's important to get Part B for one reason....the 20% that Medicare doesn't pick up has NO CAP!

If a surgeon's bill is $10K, you're on the hook for $2K.

That's the real downside to having only Medicare.

Alright...we set the stage now. So...what's this giveback everyone is talking about?

What is the Giveback benefit?

Certain Advantage plans have an added benefit called Part B Giveback.

Essentially, the carrier will pay part of your Part B premium. Most people have this premium taken automatically from their Social Security. You can also get a quarterly billing for it as well.

Either way, the Part B Giveback plans means you'll get MORE Social Security (if deducted) or a lower bill (if you get an invoice).

That's it! You don't get money sent directly to you. You get a reduced part B premium bill but the net effect is the same.

More money in your pocket.

But how much money?

How much Giveback benefit is available?

This varies across the different plans and carriers.

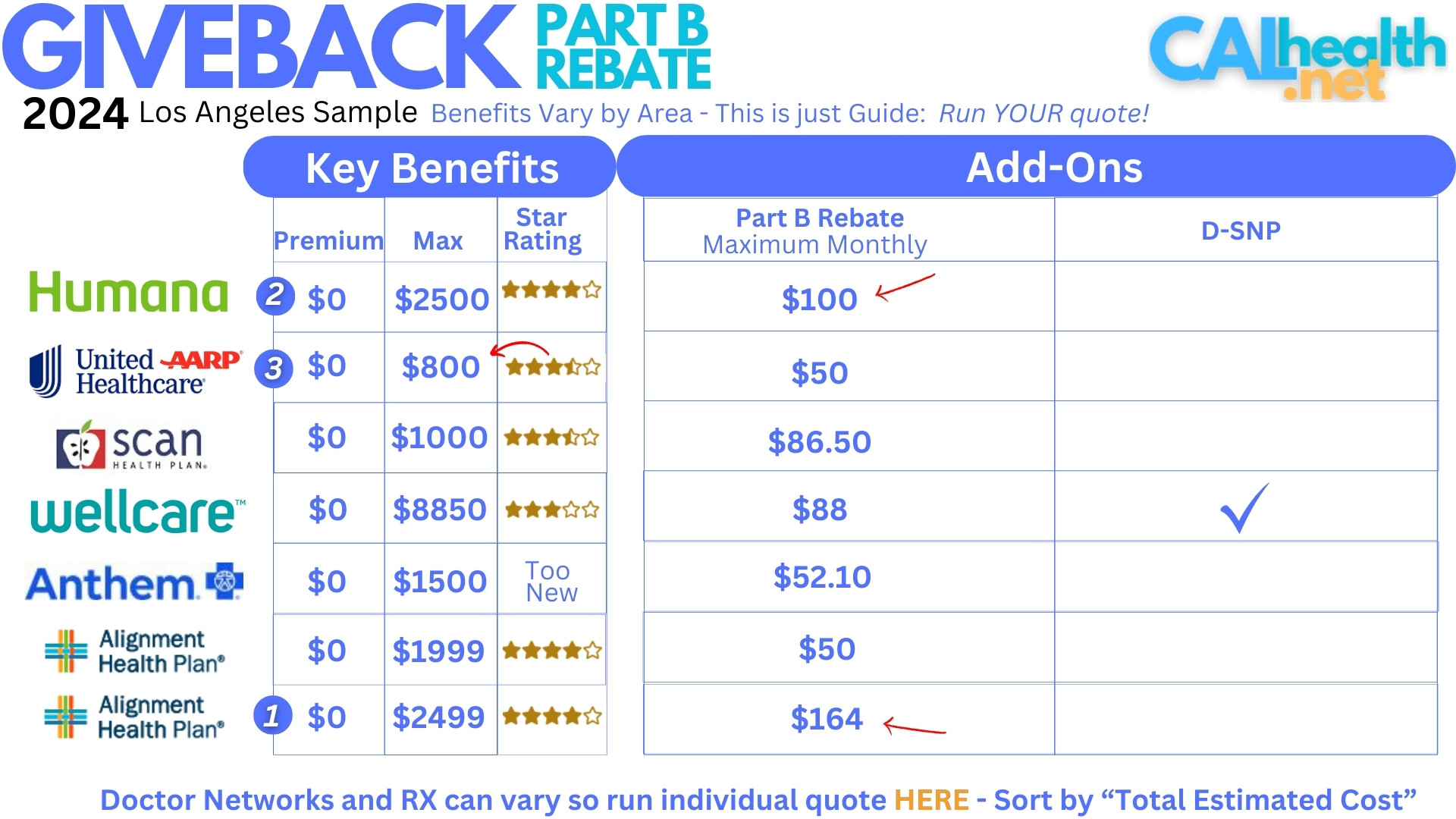

Here's a sample look at Los Angeles Giveback plans and amounts (we'll show you how to quote your area below):

Quite a range!

From $50 to $164/month

But why? Why wouldn't everyone just take the higher amount if the Giveback is what they're after?

After all...$164/month is almost $2000 annually and very close to the full Part B premium.

To answer your question...many people are picking that plan and it's very popular right now.

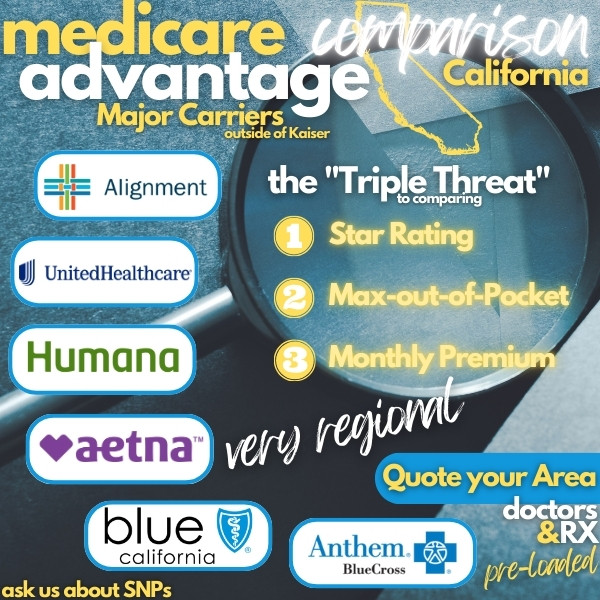

Keep in mind that the Giveback plans is an "Add-on" benefit. It's not the whole story.

Advantage plans are a type of health insurance so we have to also compare the key factors that we normally use to compare Advantage plans.

Big review on how to Compare Advantage plans to get you grounded but a few tips:

- Focus on the Star Rating first

- Check your doctors and hospitals

- Don't sleep on the Out-of-pocket Max

Let's touch on these.

The Star Rating tells you how satisfied prior members are on the given plan.

Aim for 4 stars or higher. 3 Stars is pretty mehhh. 3 and ½ is okay but not great.

This narrows the field quite a bit...not only for Giveback plans but for all Advantage plans.

If there are certain doctors or hospitals you want access to, we need to make sure they work with a given plan. We'll show you how below.

Finally...the Out of Pocket Max! No one's talking about this and it's one of the most important aspects.

In a really bad year of healthcare cost, what are you on the hook for? That's the Max!

This is where the comparison with the giveback benefit comes into play.

What's the catch though? How are we getting an extra $2K (with the Alignment plan) versus standard Advantage plans?

You're old enough to know that nothing's for free.

Does the Giveback benefit make sense?

First, we need to take into account the other aspects of Advantage plans.

We want a plan:

- With 4 stars or higher ideally

- Our doctors/hospitals

- Our medications

- A reasonable Out-of-Pocket max

Not many plans will hit those. Of the plans listed above, we focus on 3:

- Alignment - 4 star with highest Giveback benefit

- UnitedHealth - low out of pocket max

- Humana - blend between the two for giveback benefit and out of pocket max

We look at how to compare Giveback plans in more detail.

But how do we compare these to the other Advantage plans with no Giveback benefit?

How to compare Giveback plans

Here's the skinny since we have plans that hit our general highlights above.

The Giveback plans are usually for people who are in good health and value the monthly cash more than richer benefits on other plans.

You'll probably see more out of pocket when you get sick or hurt versus other Advantage plans but your betting that for this year (since we can change each year), healthcare needs will be fairly mild and the cash is more important.

That's it!

Now, if we can also combine a high Star Rating, low out of pocket max, and premium....we can reduce our risk from going this direction.

For the out of pocket, we have to take into account the giveback benefit.

For example, the Alignment plan max is $2400 but the giveback benefit is almost $2K so it's really like $400 in a really really bad year healthwise. $2400 minus $2000.

See how that works? A trade-off between a guaranteed amount (the giveback) versus a potential out-of-pocket.

One more note.

It doesn't make sense to pick a plan with a higher giveback (all other things being even) than what you pay in premium.

You can't get more back than what you pay.

If you pay $80/month in Part B premium (because of lower prior income) and you get a plan that has a $100/month giveback benefit, you only get the $80.

That's why there's such a spread.

One other note...the Wellcare plan is actually for Dual Eligible (medi-medi) members with Medi-cal which is why the max is so high. Medi-cal (if eligible) will help with that.

Lots of moving pieces but we're happy to help at help@calhealth.net or by chat: https://calendly.com/dennis-jnw

What about your situation?

How to quote and enroll in Part B Giveback plans

We make this free, secure, and fast:

A few notes to get the best quote.

You can filter for Giveback plans by selecting "Part B Giveback"

Under preferences, make sure to enter:

- Your doctors and hospital

- Your medications and dosages

- Your preferred pharmacy

Sort by "Total Estimated Cost" to take into account your medication costs.

That's it!

You can easily enroll by "Adding to Cart" as our system is integrated into the enrollment systems for the major carriers shown.

There's no cost to use this system and it will automatically replace an existing Advantage plan if enrolled.

Hopefully this sheds some light.

We have more detailed with our Giveback plan comparison.

Happy to help with any questions of course!