California Medicare Options - Should I switch from J plan to the G plan?

Do Medigap Plans Cost More as You Get Older?

Sure...the low rate at 65 sure does look good for your G plan.

What about at 70? 75?

Remember, we're partially buying a plan for a few decades (more on how to change that below).

Some carriers like Blue Shield may even give you $25/month discounts for the first year.

It used to be that we picked a plan and stayed on it for years. We were tied to our decision at 65 because outside of our original guaranteed issue period, we might not be able to change due to health.

That has changed!

We'll look at whether rates change as we get older and more importantly, strategies to deal with it.

Here are the topics we'll cover:

- Do medigap plans cost more as you get older

- Medigap options to reduce cost as you get older

- The birthday rule in California is that as you get older

- Advantage plans as you get older

- How to quote medigap plans to make sure you getting the best rate

Let's get started!

Do medigap plans cost more as you get older?

Yes!

Rates are definitely tied to age (and area) with medigap plans so they do go up as you age.

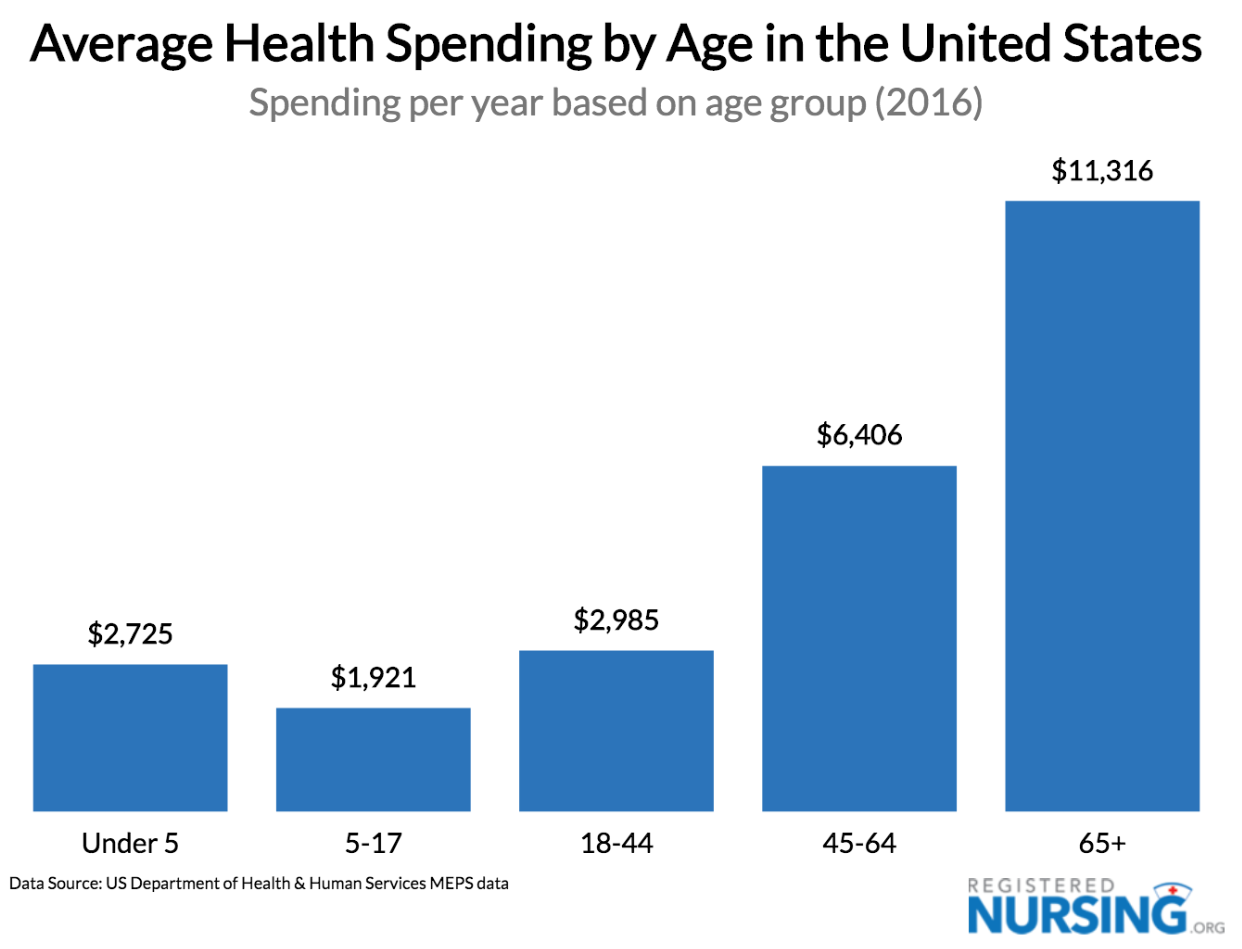

This reflects the underlying cost since health care costs roughly double with every decade of life and this speeds up age 65+.

Let's do a quick test. G plan, LA county, age 65, 70, and 75:

- Age 65: $158/month - Blue Shield (one of best priced options - see a

comparison of medigap carriers)

- Age 70: $205/month - Anthem Blue Cross (one of the other best priced options for

California medigap)

- Age 75: $249/month - Anthem again among rough 10 carriers

So...about $50/month or $600/annually every 5 years.

Now keep in mind that other areas might be different in actual numbers (LA tends to be more expensive) but the trajectory is the same.

The more interesting takeaway we can use is the spread of costs at each of those levels.

For example, at age 70, here's a sample of costs for the exact same plan:

- $249/month - Anthem Blue Cross

- $277/month - Blue Shield

- $259/month - Cigna

- $272/month - Health net

- $365/month - Humana

- $327/month - Aetna

- $230/month - UnitedHealthcare® is the 3rd top carrier with Anthem and Shield

Look at that spread!!

From $230/month to $365/month for the exact same plan!

That's $135/month difference or almost $1500/year. Basically lighting money on fire.

Even the big 2 (Shield and Anthem) which are price leaders earlier are more expensive.

By roughly $500/year and $250/year respectively!

Here's the crazy part...many people never re-check their medigap rates as they get older.

They just stay put.

"I like my plan. Don't want to rock the boat".

All three are solid carriers (Anthem, Shield, and UnitedHealthcare®).

You're not going to feel much difference between them on a day to day basis.

- Benefits are identical

- Doctor network is identical

- Medicare determines what is covered and the carriers just pay accordingly

It's to the point that we take it as our mission to reduce the maybe 10's of millions of dollars of over payment.

Keep in mind that all those carriers have 1000's of members at each age band.

Let's not give the carriers extra money, okay??

So...what can we do?

Medigap options to reduce cost as you get older

There are a few options and we can help you with any of these at no cost to you!

Check our Google reviews:

The most common are:

- Changing carriers to the same plan type as you get older

- Downgrading coverage to a lesser plan either with the same carrier or a

different carrier

- Moving to an Advantage plan with low/no premium

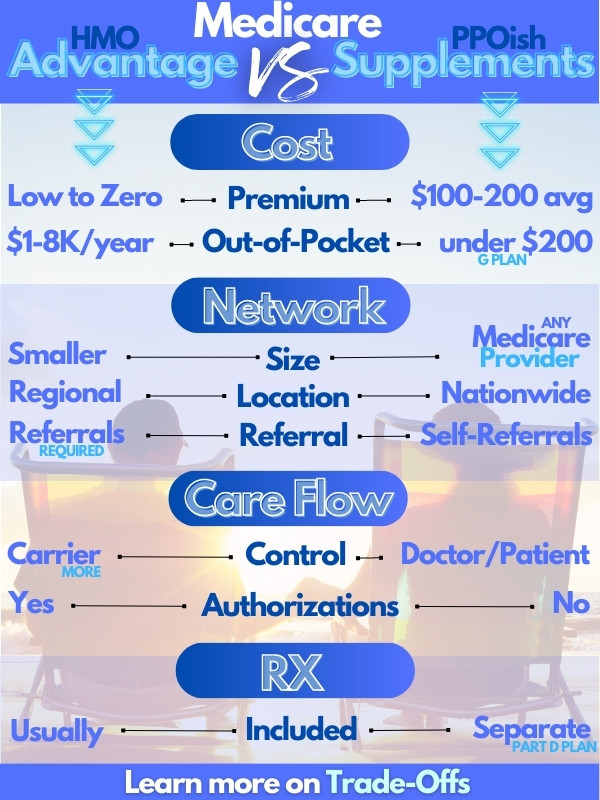

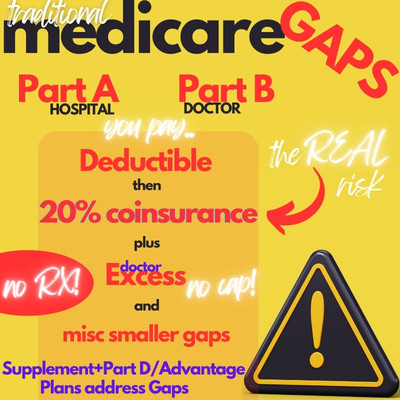

We need something in place to address the uncapped 20% coinsurance with just

having Medicare alone.

65+ is the wrong time to take that risk as we saw above!

So...let's walk through the options above.

Changing carriers to the same plan type as you get older

What if you're 75 and on the Blue Shield G plan which was priced so well when you first started?

You can move to a G plan with UnitedHealthcare® and save $600/year. Losing nothing.

We'll explain below how to make the change but the first step is to run the quote and see if there are better priced options.

Of course, we're happy to do all this for you. Just need date of birth, zip

code, and your current plan/rate at help@calhealth.net

Zero cost for our assistance.

It doesn't stop at just changing to the same plan.

Downgrading coverage to a lesser plan either with the same carrier or different carrier

We can also look at whether there are good options at lesser plans.

We're consistently surprised at how many people are still on the old F plan which is no longer available to new enrollees.

Most people (especially as you get older) can save about $700/year by switching from the F to the G plan and worst case, they have the Part B deductible (max around $240) as the offset.

That's not even taking into account if they happen to be on a more expensive F plan (i.e. the carrier spread situation above).

We can look at ALL of this for you.

Some people may even want to move the N plan or a high deductible G plan.

We look at how to compare what the medigap plans cover but lots of options.

We'll run the full quote or you can see the rates right away here:

Finally, a move that many Californians are making as they get older.

Moving to an Advantage plan with low/no premium

Advantage plans are not for everyone.

See What's the trade-off between Advantage plans and Medigap or Why do people take medigap over Advantage plans.

However, if you're okay with the HMO trade-offs, there can be plans with zero premiums depending on your area.

It's important though that you take into account the backend when you get sick or hurt.

The out of pocket max!

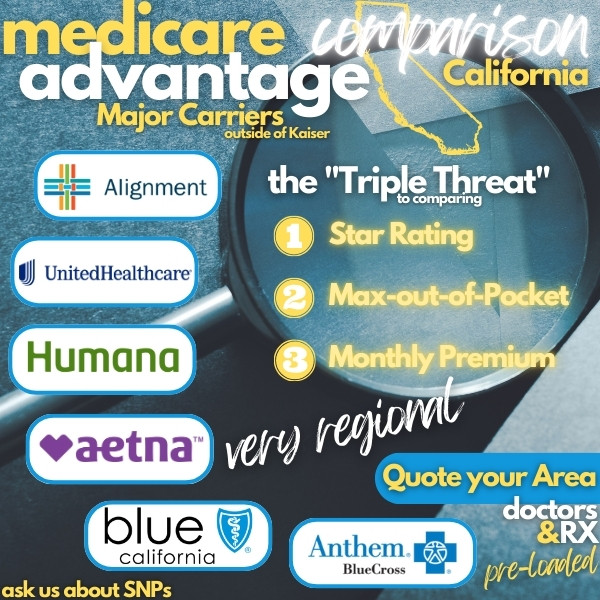

We look at how to really compare Advantage plans but the "Triple Threat" is our go-to when comparing for people:

There are specific rules around when we change to an Advantage plan (generally,

open enrollment end of the year) so check with us at

help@calhealth.net

Let's say you can get a better rate for the same plan or even a downgrade medigap plan that works for you.

Then what?

The birthday rule in California is that as you get older

This is really fantastic news.

Keep in mind that you can apply for medigap plans anytime of the year.

Once we get outside our initial enrollment period plus a few special enrollment triggers (a move, loss of coverage, etc.), we need to qualify based on health.

The requirements aren't too bad (your health has to be pretty bad not to

qualify) but still, that can be an issue.

Hello California Birthday Rule!

Around your birthday (learn more at our

Birthday Rule Guide), you can change to

the same or lesser plan REGARDLESS of health.

Even across carriers!

Meaning you could jump from an F plan to a G plan across the market or from a G plan to a better priced G plan with another carrier.

Again, we have this in our back pocket in case we can't qualify based on health.

This is separate from the Part D plan (medication) which is not affected by changes of medigap coverage.

We can help with the whole process at no cost to you. We even have online applications right through the quote system!

What if Advantage plans are where you want to go??

Advantage plans as you get older

Advantage plans can be very attractive, especially in the greater Los Angeles area (see Los Angeles Advantage comparison).

There are plans with zero cost and out-of-pocket maxes of around $800. Combine that with a high star Rating (like UnitedHealthcare® Health) and many people are going in this direction.

Advantage plans are different though:

You need to stay within a network and care decisions are more "managed".

It's a bigger decision than just switching medigap plans as you get older.

Check out our How to Compare Advantage and Medigap plans to wrap your head around it.

Of course, we're happy to quote both options and help with questions.

Enough talk...how do we check the rates and move forward. We're not getting any younger!

How to quote medigap plans to make sure you getting the best rate

This is easy, free, and online!

You can run your medigap quotes here across some of the biggest carriers:

We recommend checking rates every 1-2 years since price superiority can change

as you've seen above!

You'll even get access to Advantage plans and Part D to check those numbers based on your doctors and medications.

Enrolling is all online now right through the our quote system that we'll give you full access to.

Zero cost for this or for our help! It's Medicare after all. Lean on someone with 25+ years of experience in California.

Our track record.