California Medigap Options - Compare AARP and Blue Shield Medigap Plans

AARP versus Blue Shield Medigap Plans

California's market for medigap is basically a slugfest between

3 dominant carriers.

AARP (United Health) and Blue Shield make up two of the contenders (with Anthem Blue Cross being the third).

In many areas, AARP and Blue Shield go head to head and that will only intensify now that AARP has added the $25/month new to Medicare discount to match Blue Shield.

We'll look at pricing below but also cover if there are any other differences that sway the decision one way or the other.

As for our credentials after 25+ years in the Medigap market:

We'll cover these areas:

- Comparing AARP versus Blue Shield medigap plans

- Pricing between

AARP and Blue Shield

- How to quote AARP versus Blue Shield in your

area

- How to enroll or switch medigap plans between AARP and Blue Shield

Let's get started!

Comparing AARP versus Blue Shield medigap plans

First, we need to meet the two contenders.

AARP is generally 'known" by consumers but the actual underlying carrier is United Health, a top-3 nationwide carrier.

Essentially, AARP and United have a marketing agreement where AARP will use UnitedHealth as the carrier for their branded medigap plans.

So...AARP is the name but UnitedHealth is the carrier.

Blue Shield of California is a stand-alone, non-profit carrier (separate from Anthem Blue Cross in California at the Medicare level).

Both have offered medigap plans for decades now. AARP used to contract Aetna but United has been the partner since 1997 so it's a long term arrangement.

Medigap is a unique market so it's important to work with carriers that have extensive knowledge and history which partially explains why the Big 3 in California are the Big 3 (Anthem being the third - see Shield versus Anthem Medigap).

Before we jump into the pricing comparison, let's explain a few aspects of medigap.

Medigap plans are standardized which means a G plan with AARP will be identical to a G plan with Blue Shield (aside from the one-off plans like G Extra, etc.).

Benefits are identical and maybe more importantly, the provider network is identical.

Basically, any provider that accepts Medicare will be fine with either AARP or Blue Shield medigap.

This is not true for Advantage plans (see how to compare Advantage plans).

Medicare ultimately decides if a bill will be covered and the secondary medigap carrier (AARP or Blue Shield) will pay accordingly.

In terms of day-to-day interaction with the two carriers, they're pretty comparable.

Generally, both have a good reputation for medigap customer service.

Remember...you're not dealing with AARP for day to day interaction (billing, claims, etc).

That's the carrier, United Health.

United Health is for profit. Blue Shield and AARP are non-profit.

Ultimately, that doesn't really translate to pricing. Let's go there now!

Pricing between AARP and Blue Shield

Pricing for medigap in California is all over the place depending on:

- Area

- Age

- Plan level

It really is unique to each person.

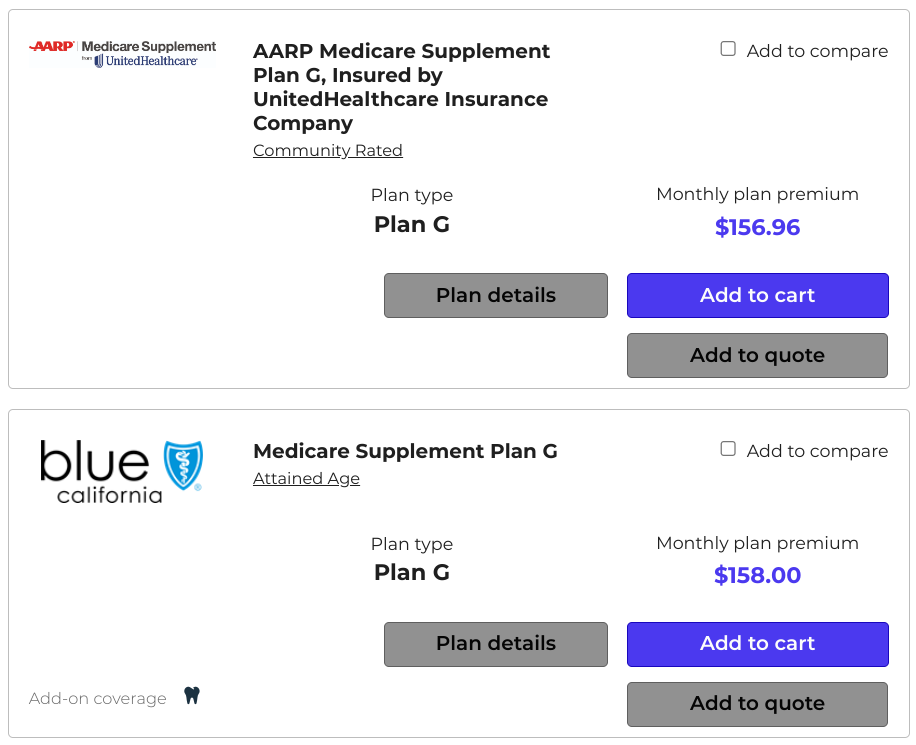

Let's take an example with the G plan (most popular); age 65 in Los Angeles:

There can be a $25/month discount for the first year

if you're new to Medicare (essentially, a new Part B).

Pretty comparable. $1 difference.

Before, Blue Shield would show that rate reduced by $25 and most people would jump to Blue Shield for that reason.

Both Anthem and AARP just matched the $25/month discount (first year).

The interesting part is that most people don't reprice their medigap coverage!

They just stay on the same plan for years and never look up.

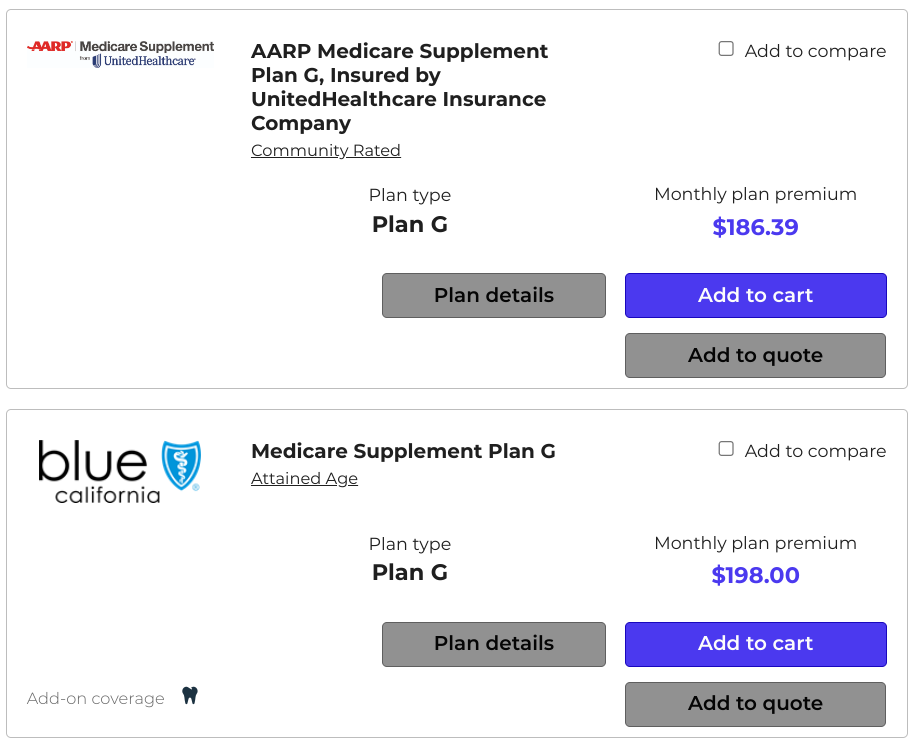

Let's look at age 70.

Hmmm....so now AARP is cheaper by about $140/year.

Actually, Anthem is even cheaper at that age.

See why you need to check your rates each year (more on that below).

Essentially, Shield would offer a $25/month discount for the first year and recoup it over the next few years.

Now, they all have the $25/month discount!

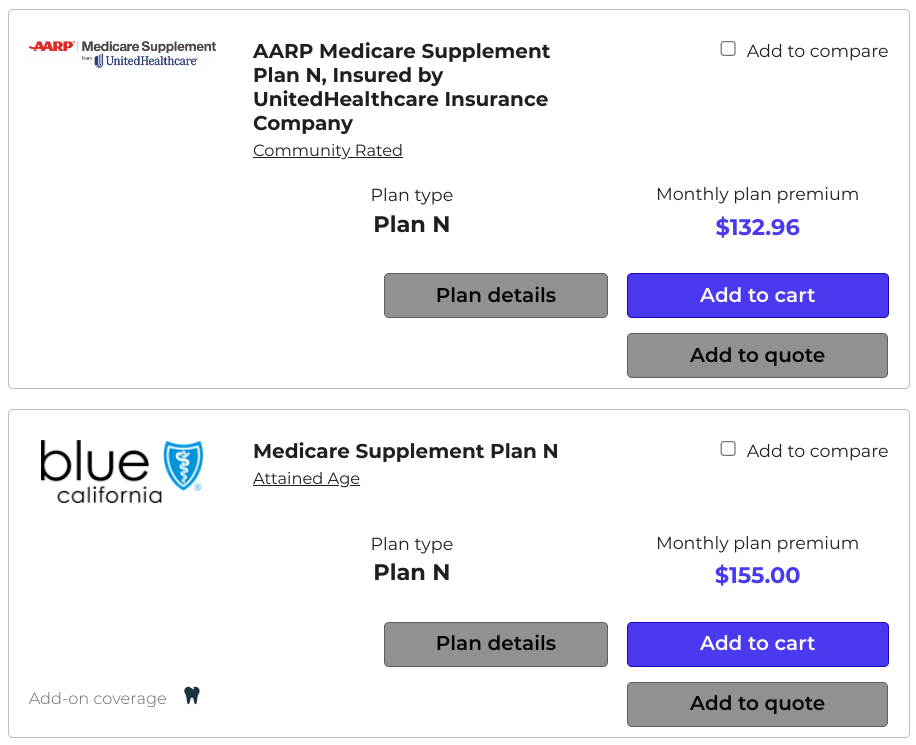

What about the N plan?

The N is currently popular plan #2 behind the G plan (see

comparison of G versus N plan).

So, there's a bigger price difference there even at age 65. Roughly $250/year for the exact same benefits.

Remember that the carriers are all dealing with the very same exposure and claim risk. With enough members, the rates should be pretty comparable.

And they both have lots of members!

This is all well and good but the only thing it tells us is that we need to quote our area and age.

Let's go there.

How to quote AARP versus Blue Shield in your area

So...let's make this easy.

First, you can run your quote here:

AARP doesn't allow its rates to be published so we can run an

AARP quote separately and send it to you or you can request Shield

versus AARP side by side at help@calhealth.net

We just need your date of birth and zip code. Note what carriers you want to quote.

Now, you'll have your medigap rates side by side and we recommend also including Anthem in the mix since price leaders can vary among the three by area and age.

We work with all the biggest carriers!

Okay...let's say there's a clear price advantage for your plan of choice. Then what?

How to enroll or switch medigap plans between AARP and

Blue Shield

There are three scenarios:

- Newly enrolling in Medicare with a guaranteed issue window

- Looking to enroll or switch to okay health

- Looking to enroll/switch but with more serious health issues

The first is easy. You can enroll if you're in a guaranteed

issue window (see

When can I enroll in Medigap).

We provide online enrollment and paper apps for both AARP and Blue Shield.

There's zero cost for our assistance and we can help you with questions that arise from enrollment!

Now...let's say we've been on a plan for a while (beyond the guaranteed issue window). Then what?

Technically, we can apply for medigap coverage any time of the year! There's no Open enrollment window like Advantage plans.

They can decline based on health but there's a way to switch plans even if we can't qualify based on health.

It's called the Birthday Rule if we're already enrolled in a medigap plan.

Say you bought the Blue Shield plan with the discount at age 65 and now at 68, AARP is cheaper but your health issues might prevent you from switching.

Around your birthday, we can change to the same or lesser plan in terms of benefits regardless of health!

We can help you with the mechanics of this change of course.

Let us know how we can help! Our Google reviews are above!