California Medicare Options - New to Medicare Discount Codes

Which Carriers have New to Medicare Discounts for the G Medigap Plan?

We have some good news here. In California, there are now multiple carriers that offer a discount for the first year.

For years now, Blue Shield of California offered this discount and now the other big carriers have joined suit.

We'll show you who is eligible and how to take advantage of this G plan discount.

More importantly, we'll look at pricing when the discount drops off to make sure you're not overpaying. First, our credentials:

Let's cover these topics:

- What is the New to Medicare discount

- Which carriers offer the New to Medicare G plan discount

- How to compare the G medigap plans after the discount

- Quoting and enrolling in Medigap plans with the New to Medicare discount

Let's get started!

What is the New to Medicare discount

Blue Shield was first with this and it was very successful. Any person just coming onto Medicare ran quotes and saw that Blue Shield was cheaper!

So...what is it?

If you have a new Part B with Medicare, you're eligible for this discount.

The standard discount is $25/month on the G plan for the first 12 months with a new Part B.

Usually, this is when a person turns age 65 or if they leave employer coverage after age 65.

Either way, it's the new Part B that triggers the discount eligibility since a person may already have Part A which is generally automatic.

Part B requires a person to "opt-in" or select it and pay a premium with Social Security.

The New to Medicare discount applies to the standard G medigap plan which is the most popular plan anyway.

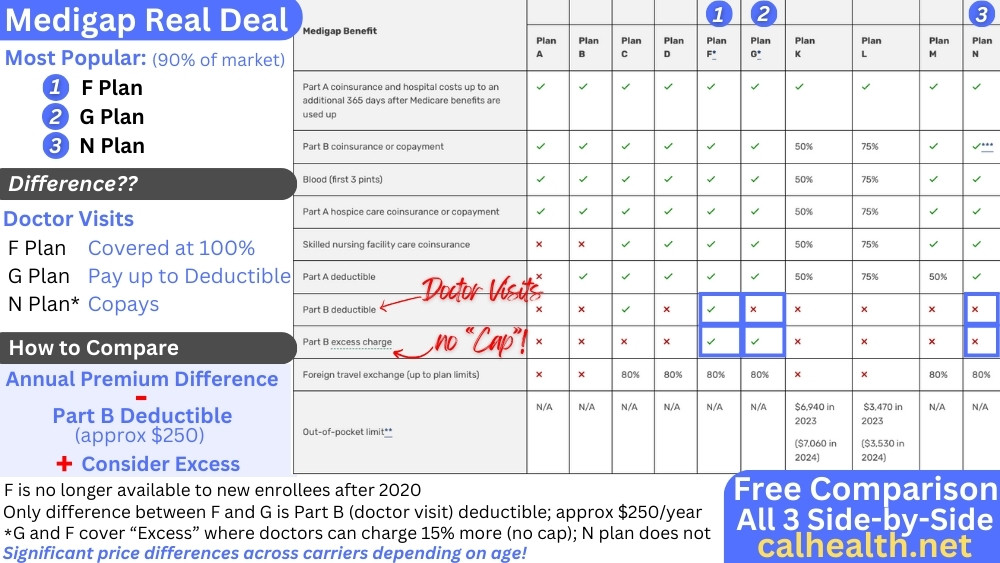

Learn more about why the G plan is so popular or how to compare the medigap plans.

Just a heads up...there are other G plans with add-on benefits (vision, hearing aids, etc) which might not have the discount.

It's the standard G plan that is eligible.

So, which carriers offer this discount?

Which carriers offer the New to Medicare G plan discount

Currently, these are the carriers in California that have a New to Medicare discount:

- Blue Shield of California

- Anthem Blue Cross

- UnitedHealthcare®

- Health Net

This matches the dominant Medicare supplement carriers anyway with Shield, Anthem, and UnitedHealthcare® being chosen by the majority of people new to Medicare anyway.

This definitely levels the playing field for the major carriers when comparing the G plan.

Otherwise, comparing the G plan is easy:

- Benefits are same across the board

- Networks (doctors/hospitals you can see) are the same

- Customer service is pretty comparable with the major carriers

So it's basically cost and cost stability. Let's look at that piece now.

How to compare the G medigap plans after the discount

Not too long ago, Blue Shield was the top choice because only they had the New to Medicare discount.

That's no longer the case and the playing field is definitely more level.

But what about after the discount goes away?

We ran an analysis of G plan rates across age bands (from 65 to 75) and it's pretty interesting.

The best value at age 65 is definitely not the best at age 70 or even 75.

We're able to apply to change plans any time of the year but once we're outside our open enrollment period (the new Part B trigger), we have to qualify based on health.

This is usually not too difficult but if we're not able to do so, we can rely on the Birthday Rule.

We have a big review on the birthday rule but essentially, we can move to a plan of same or lesser benefit around our birthday regardless of health!

This is fantastic for people in California. We can help you with the process and there's no cost for our assistance.

It's our back-up option if our current G plan is no longer the best value.

More on comparing medigap carriers.

So...what's your G plan rate?

Quoting and enrolling in Medigap plans with the New to Medicare discount

We make this fast, secure, and easy here:

The quote will show the standard rate but know that if you have a new Part B, you can deduct $25 from the rate shown.

Enrollment is equally easy via online or even paper apps. We're happy to help with the entire process at zero cost to you.

help@calhealth.net or pick a time to chat.

We also have plenty of information on how to save on Part D (medication costs).

That's the other piece of the equation alongside the G plan when you're new to Medicare.

There's a penalty for not enrolling in a Part D plan when eligible of 1% per month!

Reach out with any questions!