California Medicare Options - Humana Part B Giveback Review

Humana Part B Give Back Plan Review

The Give Back plans are all the rage now on the Medicare Advantage scene and we explain why at our Give Back Comparison page.

With actual money in your pocket from $50-164/month, it's a big deal for many seniors these days.

With Humana being one of the biggest Advantage carriers on the market, it goes without saying that they're in the frame.

Interestingly, Humana has decided on the Goldilocks strategy with their Giveback plan offering as we'll see below.

First, our credentials here:

Let's cover the following:

- Quick intro to Part B Giveback plans

- Humana's Part B Giveback plan

- How does Humana's Part B Giveback plan compare with the market

- How to quote and apply for Humana's Part B Giveback plan

Let's get started!

Quick intro to Part B Giveback plans

We have deeper dives on Part B Giveback explained but a quick intro would be nice.

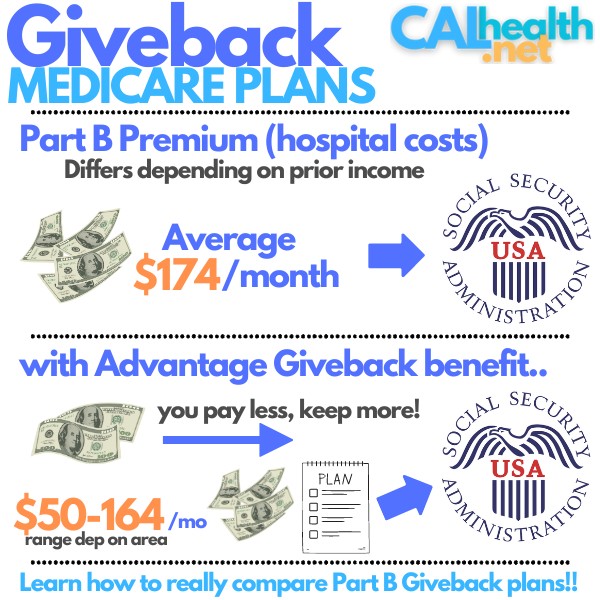

Everyone with Part B through Medicare (including those with Advantage plans) has to pay a premium to keep it in effect.

This is usually deducted from Social Security (the most common) or paid via 3-month invoices.

Either way, it's a pretty big hit especially when everything is so expensive.

The average is $174/month and it goes up each year with inflation (great!!)

The Part B giveback plans are a type of Medicare Advantage plan (learn how to compare Advantage plans) that will pay a portion of this Part B charge!

Carriers have decided to approach this plan type differently with amounts from $50-$164 on the market.

This makes sense since the $174 above is the standard amount and your actual amount is based on your prior year's income.

It can be much lower or higher!

So...what did Humana decide to do?

Right in the middle!

Humana's Part B Giveback plan

The Giveback plans aren't available everywhere (yet) but with the rocketing popularity, we expect to be added in more areas.

Let's run a test quote in Los Angeles to see what Humana is offering:

The Part B Giveback currently (run your current quote below to see changes) is $75/month.

So $900/year or just under $1000.

We need to compare this with the Out-of-Pocket max of $2500 since that's our exposure for really big bills in a calendar year.

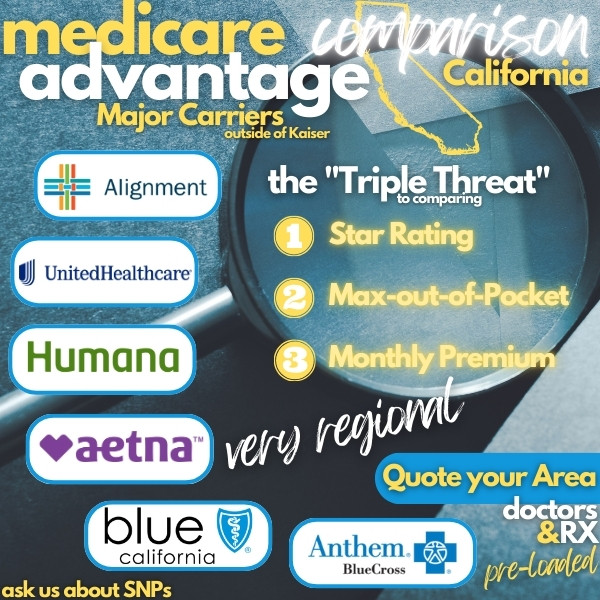

It's part of our Triple Threat selection:

Deductible is zero (in Los Angeles) and the Star Rating is 4 Star which is very good.

When you run your quote, you can see the other key benefits (copays, medication, etc) below.

The big question is this...how does Humana's Part B compare with the other options?

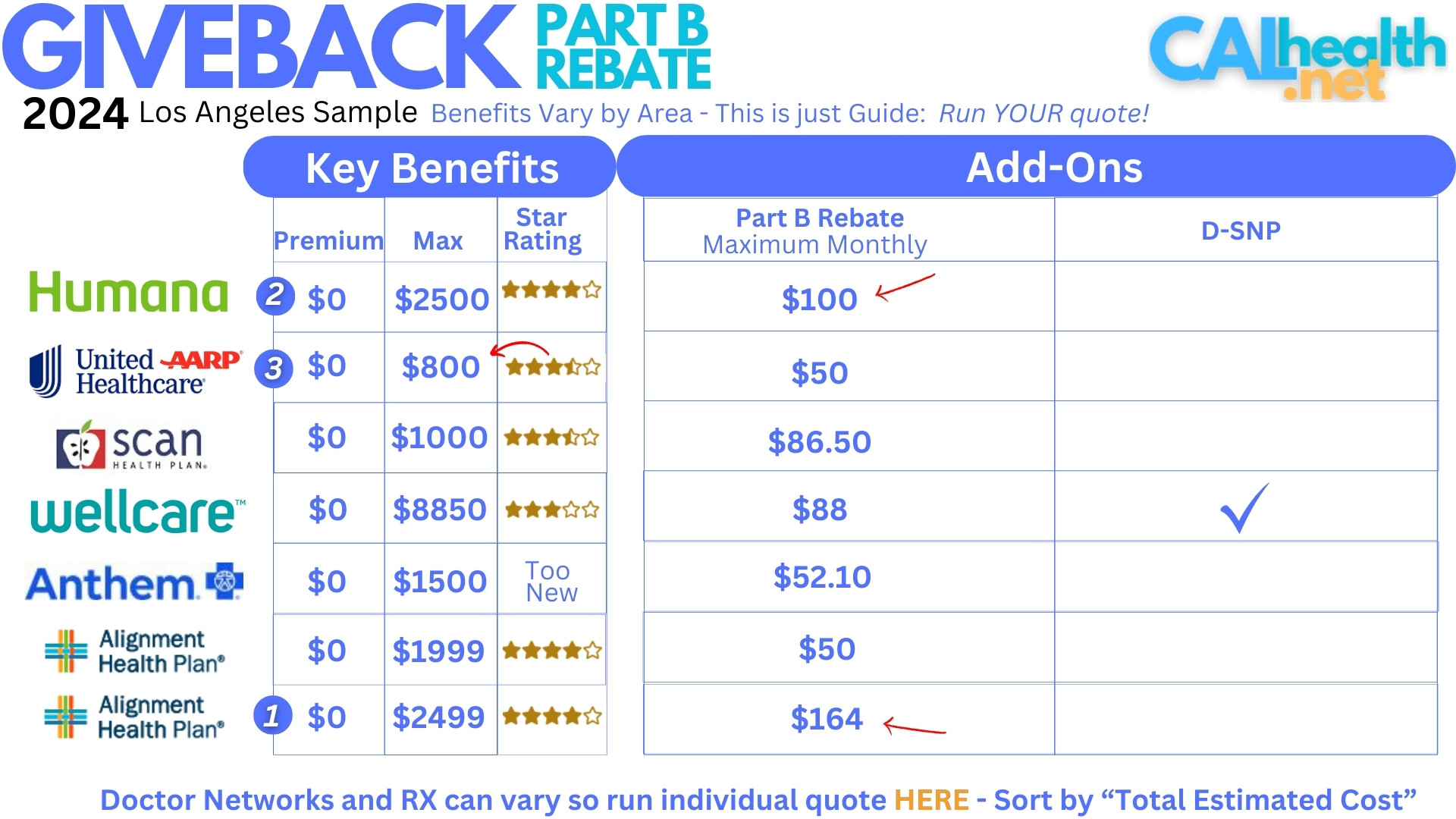

Let's look at Los Angeles (since it has the most Part B giveback plans) again for comparison.

How does Humana's Part B Giveback plan compare with the market

Let's look at the full LA Giveback market (you'll need to run your current quote below):

Okay...some background info is helpful.

The three dominant (non medi-cal) Giveback plans are:

- Alignment with $164/month giveback

- Humana with $75/month giveback

- UnitedHealthcare® with $50/month giveback

Now look at the out-pocket-max's (annual):

- Alignment: $2500

- Humana: $2500

- United: $800

Okay...so the way to compare these core factors is to subtract the annual giveback benefit from the out-of-pocket max (in case of really bad bills in a year).

Now our Humana net exposure is $2500 - $900 or $1600 in a year.

The Alignment works out better at a net of $500 ($2500 - $2000). United's is $200 ($800 - $600).

The issue with United's is the Star Rating (current) at 3 ½ star (not fantastic) compared to the 4 star with Humana and Alignment.

Really, Alignment's Giveback plan is pretty solid among the three so what gives?

The one difference may be the doctor networks!

Make sure when you run your quote to enter your medications and doctors as the networks are different and this is generally an advantage for Humana and UnitedHealthcare® with the Giveback plans.

Speaking of quotes...

How to quote and apply for Humana's Part B Giveback plan

We make this fast, free, and easy here:

A few notes to get the best quote:

- Make sure to enter under preferences the following:

- Your medications and dosages

- Your doctors

- Your preferred pharmacy

When done, click on "Part B Giveback" on the left to only show these plans.

Sort by "Total Estimated Cost" up top so it takes into account your medication out-of-pocket.

That's it!

You can now compare the different options and make sure to focus on Star Ratings.

You can add to cart and apply all through this free, secured system hosted by Connecture, the biggest Medicare advantage platform in the country.

Of course, we're happy to help with any questions at help@calhealth.net or pick a time to chat by phone here.