California Medicare Options - Is it necessary to get a Medicare

Supplement?

California Medicare Options - Is it necessary to get a Medicare

Supplement?

Is it Necessary To Have a Medicare Supplement?

We get this question often and it's legitimate.

For most people coming off of the Exchange or Employer health coverage, Medicare is a brave new world!

Different terminology. Different plans.

It's really important to understand what it covers by itself and most importantly, what it doesn't!

We get calls on the other side where someone only has Medicare and finds out the hard way.

Let's go through the whole question from top to down and more importantly, look to see the best values for covering the "holes" in Medicare.

Here are the topics:

- Is it necessary to have a Medicare Supplement?

- What is the risk of

just having Medicare

- What's the least expensive way to cover the holes in

Medicare

- How should I compare and quote the Medicare options

- What if I don't like the Advantage or Medigap plan - Can I go back to Medicare by itself

Let's get started!

Is it necessary to have a Medicare Supplement?

Absolutely not. You can just have Medicare by itself.

Let's spell out what means exactly.

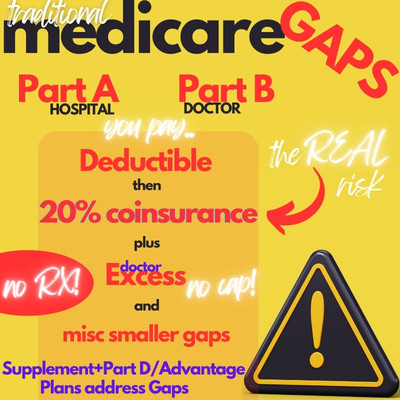

Traditional Medicare is broken up into 2 parts:

- Part A - Hospital of facility care that most people have paid for their

whole life via payroll taxes

- Part B - Doctor charges which has an optional monthly premium

Usually, Part A is automatic. This means you have coverage with limits (more below) for hospital or facility based care.

You can "opt in" for Part B to cover doctor changes (think...out of the hospital).

This requires a monthly premium which can change depending on your income

There's also a separate Part D for medication which you pay a monthly premium for if you wan to.

One note...if you don't get a Part D plan when eligible, you'll start to add a 1%/month penalty if you every choose to add it!

Alright...we have our basic parts. What exactly do they cover?

The core benefits for both Part A and B revolve around:

- An initial annual deductible you have to pay first before benefits kick

in

- After deductible, you pay 20% coinsurance for remainder of the year

There are other bells and whistles (blood, preventative, etc) but the deductible and 20% coinsurance is really the heart of traditional Medicare.

A and B just tells what type of care they're applied to (hospital versus doctor).

A is usually free and automatic. B requires a monthly premium and is optional.

So...a Medicare supplement is not necessary in the truest sense of the word but that's a bit misleading.

Here's why.

What is the risk of just having Medicare

The deductibles are fixed amounts.

Roughly (since they change a bit each year):

- Part A - $1600+

- Part B- $240+

We can kinda wrap our heads around these amounts if we have healthcare costs. We can budget for that (not that we should...more on that below).

It's the 20% coinsurance that's an issue. A big issue!

There's no cap to it!

For a $100K bill, you're on the hook for $20,000.

Which generally leads to..."I never go to the doctor. I'm healthy!"

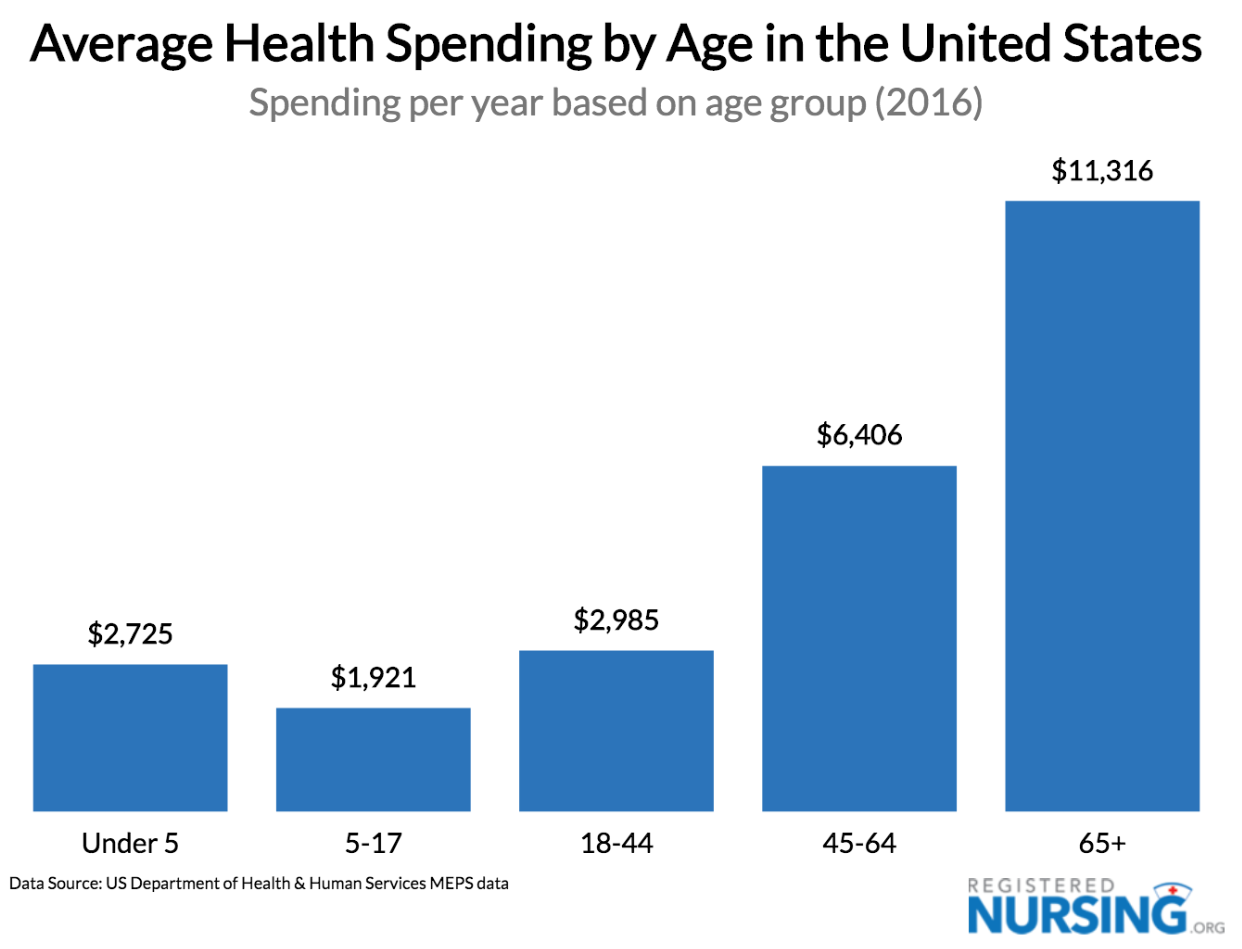

Totally understand that but there are two things working against this approach.

First, our healthcare costs double with every decade of our life on average and 65+ is the worst time to take this gamble.

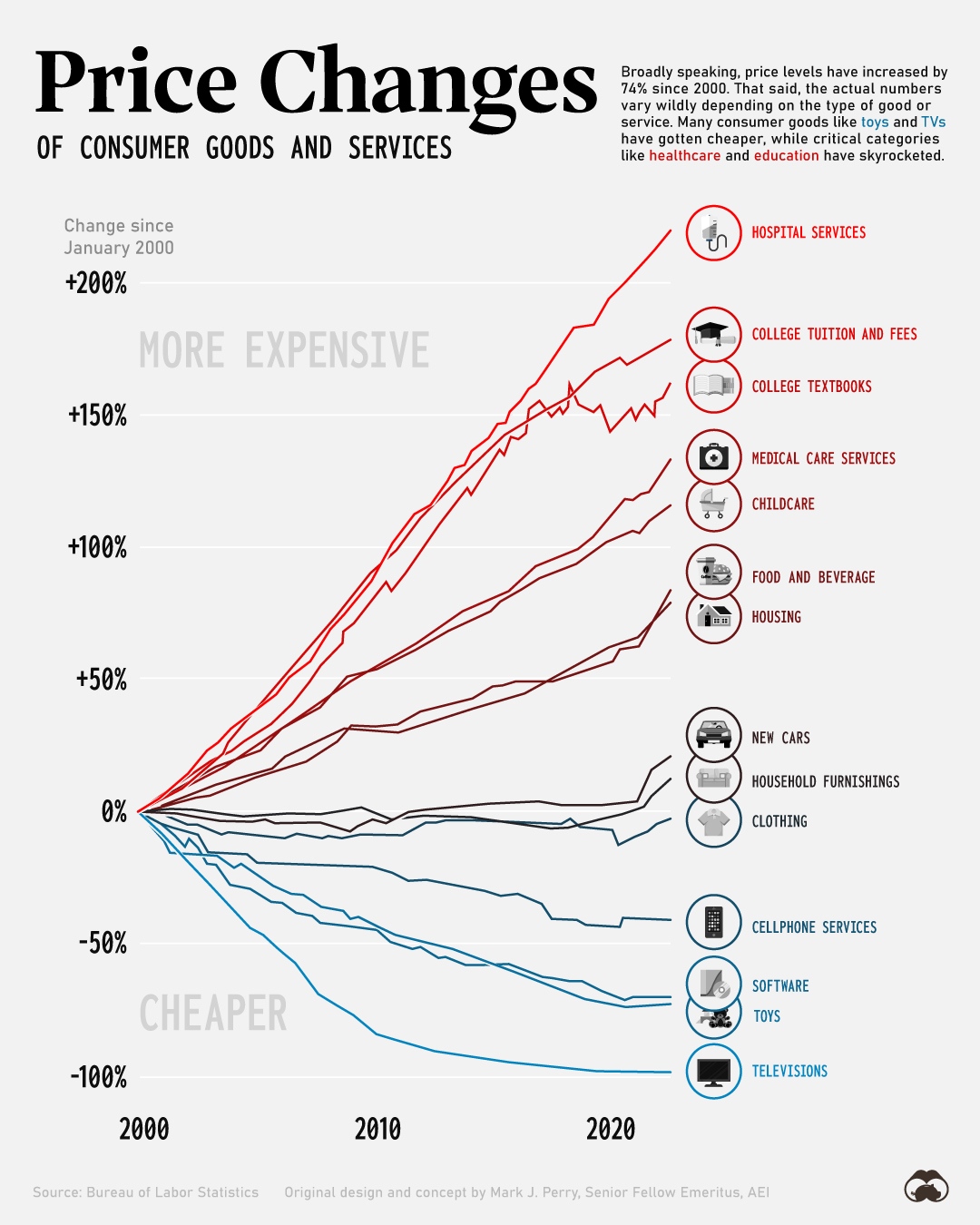

Second, the trajectory for healthcare costs is through the roof.

In the aftermath of Covid, we're seeing clients with claims of $250K, $1M, and even $5M (open heart surgery).

It just doesn't make sense to risk that open-ended 20% when there are ways to cover the coinsurance for very little cost.

Let's go there now.

What's the least expensive way to cover the holes in Medicare

There are two approaches to addressing the 20% and/or other holes of Medicare:

- Advantage plan - HMOs generally with low or no cost but more restrictive

- Medicare supplements - wraps around traditional Medicare to cover the holes

We have a big comparison of

Advantage versus Medicare supplements.

The net net:

- If you like the flexibility of traditional Medicare (see all Medicare

doctors and

- Have more control over health care decisions), then supplements will be the better fit.

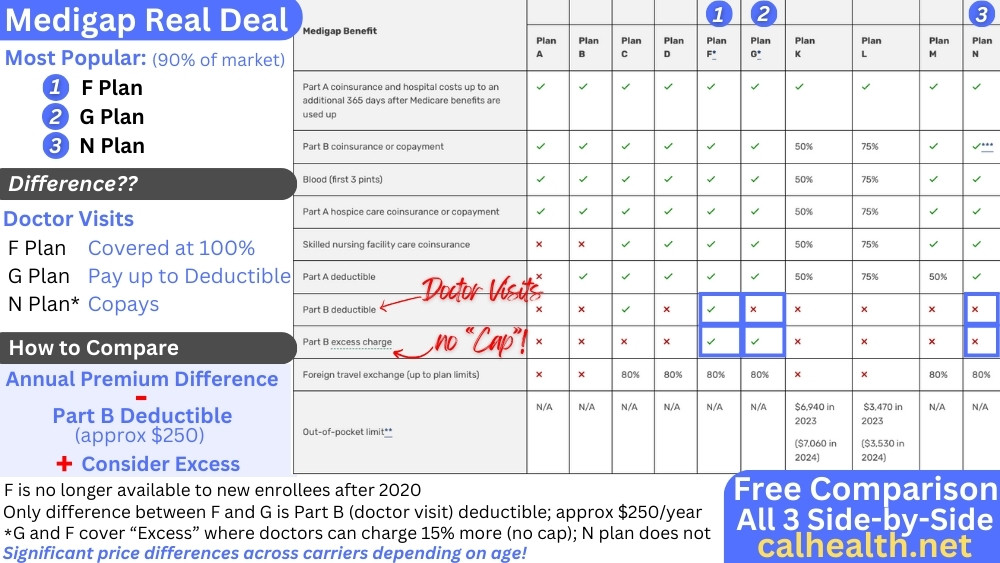

There's a comparison of what Medicare supplement plans cover but the quick lay of the land.

First, the range of options:

Focus on four price points:

- G plan - most comprehensive and most popular; just missing the Part B

deductible

- A plan - just covers the 20% coinsurance

- N plan - adds in

copays for office and urgent care

- High deductible G plan - builds a roughly $2-3K deductible into the G plan

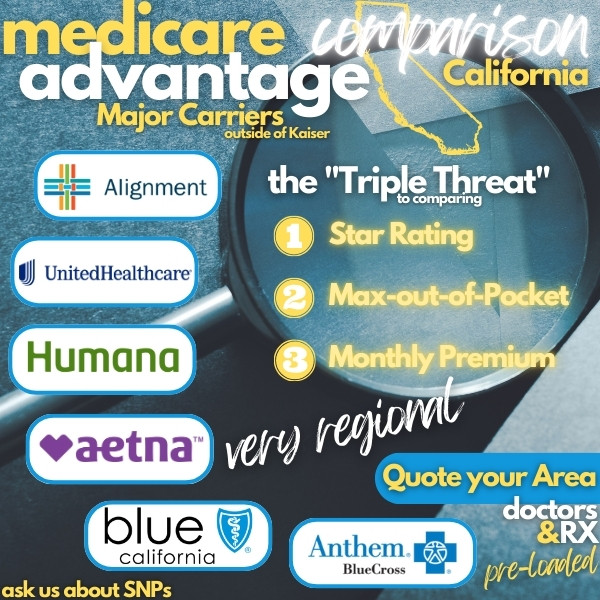

On the Advantage side, focus on the Triple Threat:

- Zero premium

- Max out of pocket around $800

- Star Rating of 4 stars or higher

We go through this at our Insider's Guide to Advantage plans

If you need help comparing the two options or even plans within one

of them, there's no cost for our assistance and we really do help people

navigate all this new stuff:

In the meantime, you can look at what these options might cost you.

How should I compare and quote the Medicare options

It's easy. You can quote and compare the different options here:

Don't forget Part D if you're getting a Medigap plan. Most Advantage

plans over Part D already.

We looked at total expected cost between Advantage and Medicare supplements.

We're happy to run quotes across both suites for you. Just need date of birth and zip code at help@calhealth.net

We'll do all the running around!

What if you don't like the plan?

What if I don't like the Advantage or Medigap plan - Can I go back to Medicare by itself

Yes.

With medigap, you can cancel at any time during the year.

For Advantage or Part D, there are certain times you can cancel them and go back to traditional Medicare.

We looked at this in our Cancelling Advantage to go back to Medicare.

Worst case, you're looking at end of the year during Annual Open Enrollment (Oct 15th - Dec 7th).

Again, for medicare supplements, you can cancel those month to month any time and you can change plans around your Birthday (worst case). See the Birthday Rule for more info.

We can help with any questions! Reach out to us at 800-320-6269 or help@calhealth.net