California Medicare Options - Is Medigap more expensive than Advantage plans

California Medicare Options - Is Medigap more expensive than Advantage plans

Is Medigap More Expensive than Advantage Plans?

Short answer. Yes.

At first glance.

That's not the whole story though by a long shot and we doubt you're going to get full picture from most people trying to sell you something.

- It can really come down to the area you live in

- What's your health like

- Can you afford big bills on the back end

We'll discuss all below and look at how to really compare the two for your situation.

This is so important when picking a Medicare option and it's mostly short-changed out there in the market.

Here are the topics we'll cover:

- Is Medigap more expensive than Advantage plans - the real deal

- How area affects the cost difference between Medigap and Advantage

- Paying now versus paying later between medigap and Advantage in today's world

- Making sure you're not on more expensive medigap or Advantage plan options

- How to quote Medigap versus Advantage

Let's get started!

Is Medigap more expensive than Advantage plans - the real deal

There are two pieced we need to really focus on:

- Monthly premium you pay to keep the plan active

- Expected out-of-pocket expense when you get sick or hurt

If you're 65+, you completely understand "There's no free ride in the Universe".

Many Advantage plans have zero cost premiums up front. In fact, that's usually all you'll hear about.

If the carrier or broker isn't telling you the whole story...run, don't walk!

We looked at why brokers push Advantage plans so hard. We're not anti-Advantage! In fact, we can work with some of the biggest and best of them.

The monthly premium is only half the story.

In our review of How much will Medicare cost me, we compare the two options:

- Advantage - generally zero premium with an out-of-pocket from $800-$3000 on

average

- G plan medigap - generally around $150/month with an out of pocket of $250 (need to add Part D for medication).

The net net of total cost estimate:

- Advantage plan - $3K annually

- Medigap - $4K annually

This is an estimate based on higher health care costs at age 65.

If you have fewer health issues, Advantage will get cheaper. If you have more health care costs, the Medigap starts to look more advantageous.

Of course there are other trade offs! See What is trade-off with Advantage plans or why do people pick medigap over Advantage to see what the right fit is for you.

This is total cost so it includes Part B with Medicare and medication.

The key with the Advantage plan is to get one with a lower Out-of-pocket max!

Ideally around $800 which is the best on the market.

The out-of-pocket max with Advantage plans speaks to how much you're on the hook for bigger health care costs in a year (all those copays and coinsurance payments, etc).

This figures into our "Triple Threat" selection criteria:

Interestingly, in California, where you live has a big impact on this. Let's go

there!

How area affects the cost difference between Medigap and Advantage

Medigap's rates will differ from area to area but the swing is not too high.

The out-of-pocket max for Advantage plans though can really fluctuate depending on area.

Generally, greater Los Angeles (including Orange and Riverside counties) are much more competitive with Out of pocket maxes around $800/year.

If you go up to the Bay Area, down to San Diego, or to more rural areas (assuming Advantage even available), the max's creep up to $3000+!

This makes a huge difference.

If you have bigger bills (more on that below), the Advantage plan now now be much more expensive in TOTAL cost (premium + out of pocket).

The way to think about a $3000 out-of-pocket max is that it's functionally like $250/month premium!

Assuming you have bigger bills.

It's your worst case in a year. This brings us to the key point on whether medigap is more expensive than Advantage plans. It's about risk.

Paying now versus paying later between medigap and Advantage in today's world

Essentially, with a medigap plans, we're paying a higher fixed monthly premium now and reducing our exposure if something big happens (roughly $240+/year for the part B deductible).

With Advantage plans, we're paying less now but risking paying much more if we have bigger healthcare costs.

Now...if the max is $800/year (greater Los Angeles), then that's not bad.

Think of it as $70/month premium...worst case.

So...it's like we're paying $70/month (just through copays, coinsurance, etc) versus $150/month for the G plan premium.

The problem is when our max is $3000+/year.

Now, it's like we're paying $250/month versus $150/month (plus Part D).

So...with medigap plans, they're more expensive monthly but we have more control of expenses if we get sick or hurt.

With Advantage plans, we pay less now but the backend is more open-ended.

Pay now or pay later!

This doesn't factor into doctor selection and flexibility plus control of health care cost decisions.

We're only looking at whether medigap is more expensive than Advantage plans.

Now you have a more complete picture:

- Monthly premium

- Expected out-of-pocket if sick or hurt

We need to know both!

What's frustrating to us is that so many people are on more expensive medigap and Advantage plans!

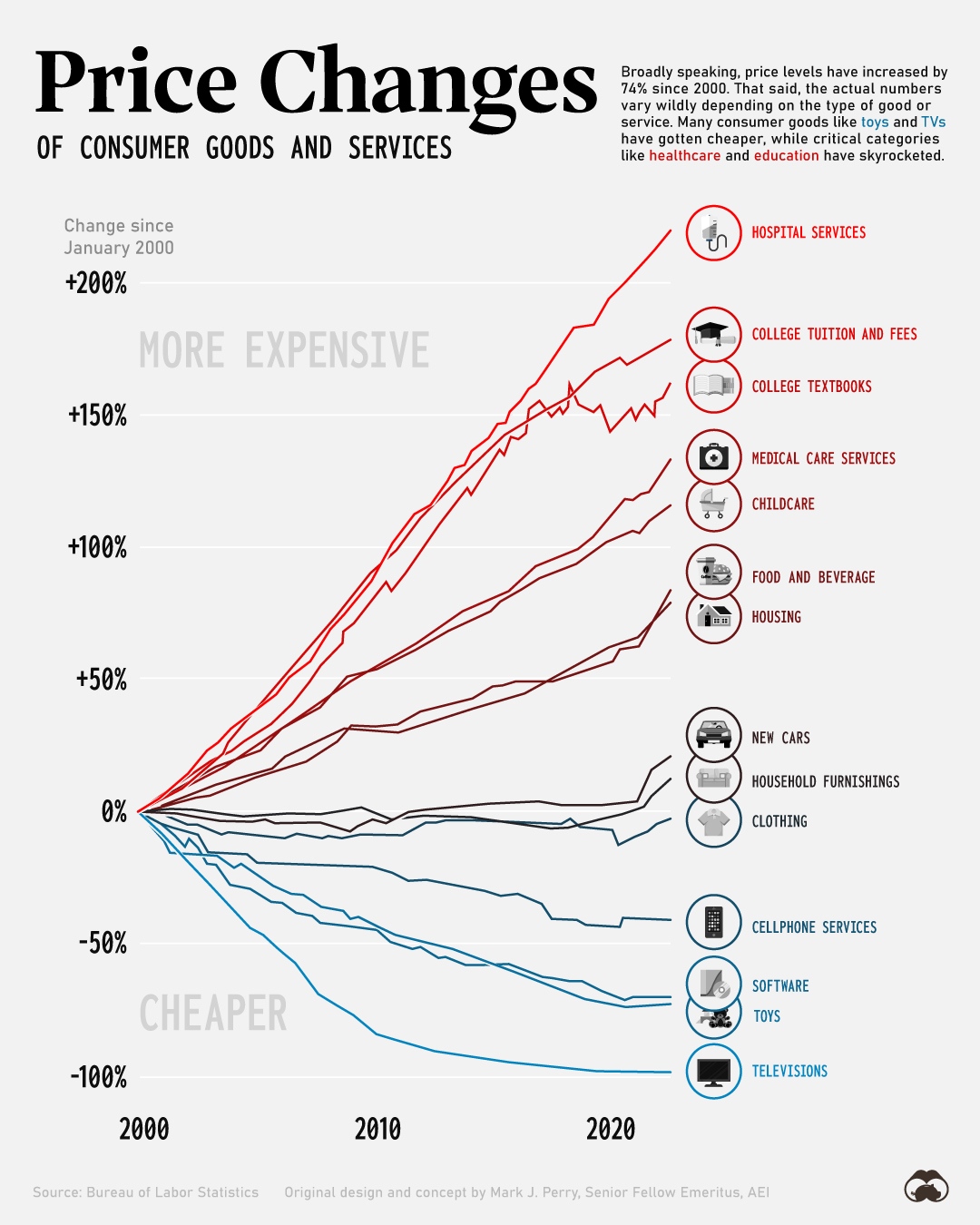

Why did we say "in today's world" in the title of this section?

This is so important to understand.

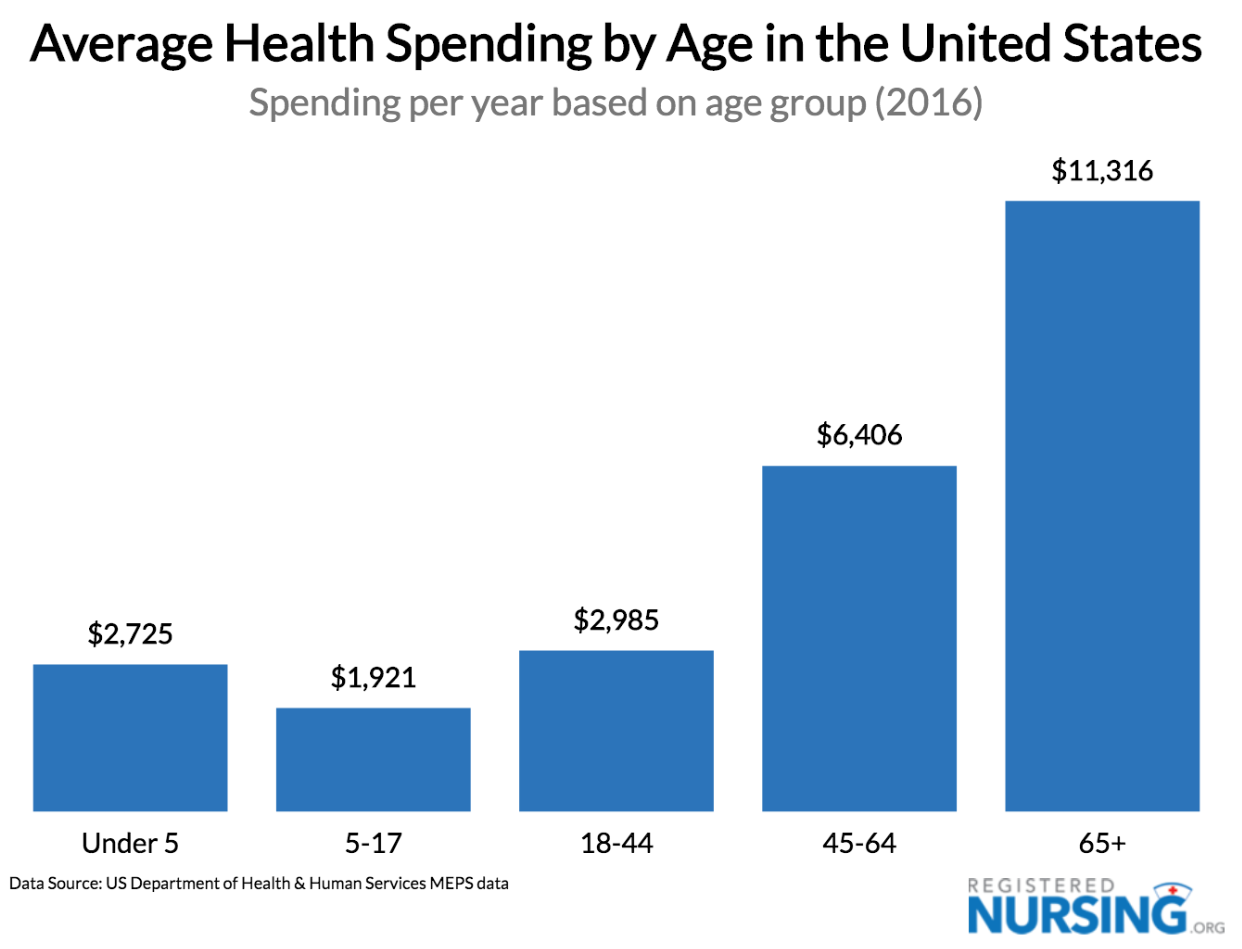

Most people are like "I'm healthy. I never see the doctor so I'll just a zero premium Advantage plan and save the monthly premium".

It's like betting agaisnt the house in Vegas.

65+ is the worst time to take this bet!

And it's only getting worse and at a ridiculously fast clip:

So...if Advantage plans have more back-end exposure (out of pocket max), it's

likely to feel the brunt of this crazy medical inflation.

In the time of post-Covid, "I'm healthy" doesn't mean much anymore unfortunately.

Just to give you taste of what we're seeing, a customer got his bills for open

heart surgery.

$5 millions!

$250K for each hour his heart was off-line while operating.

Either way (medigap or advantage), let's make sure we have the least expensive (total cost) options.

Let's go there now.

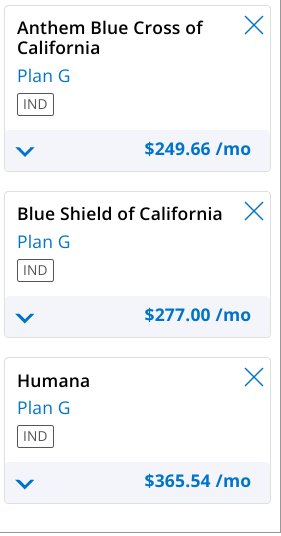

Making sure you're not on more expensive medigap or Advantage plan options

The medigap cost spread for the exact same plan is ridiculous!:

Identical benefits and networks but one plan is much more expensive.

And 1000's of people are on those plans!

We looked at the Birthday rule to make changes regardless of health but if we're in good health, we can change medi-gap plans any time of the year.

We also look at what the most popular medigap plans cover.

As for Advantage, same same.

So many people are on bad Advantage plans with either higher max-out-of pockets, worst networks, or poor Star Ratings.

Check out our how to compare Medicare advantage plans.

This reflects our comparison above.

Medigap is about the front-end expense (monthly premium) and Advantage is about the back-end expense (plus Star Ratings and doctor networks).

We even looked at whether people should switch from the old F plan to the G plan.

Crazy amount of money wasted on more expensive medigap plans..

How to avoid this situation??

How to quote Medigap versus Advantage

Quote! Early and often!

Really, this should be done once per year as some carriers are more competitive earlier (age 65) while others get less expensive (for the same plan) as we get older.

You can run your quote here:

If you would rather not wade in the weeds, send us you current plan/cost, date

of birth, and zip code to help@calhealth.net

We'll send you a full proposal across medigap, Advantage, and Part D to find the

less expensive options for you!

Our reviews are here and we do this for people every day!

Hopefully, you understand that it's not simply a question of whether medigap

is more expensive.