California Medicare Options - How to Save on Medicare

How to Save on Medicare in California

Everything's going up these days and Medicare related health expenses are no exception.

We're always surprised how many people are overpaying for health insurance on the senior market when we run quotes for people daily.

Millions each month likely. In California alone.

We'll explain why below for both supplements, Advantage plans, and Part D.

Let's also look at the real cost difference between supplements and Advantage plans since there's no much confusion on that front (maybe some of it intentional!!).

First, to clear the air about us:

Here are the topics we'll look at:

- Can you save on the Part B payment to Social Security

- How to compare savings between Supplements and Advantage plans

- How to save on Medicare Supplements in California

- How to save on Medicare Advantage plans in California

- How to save on Part D in California

- Quoting Medicare options

- How and when to switch to better priced options

Let's get started. Millions of extra money is being paid to carriers as we speak. That's not an exageration.

Can you save on the Part B payment to Social Security

This is our only bad news. Unfortunately, the amount you pay for Part B (doctor costs) is set by Medicare based on prior year's income.

If your income is coming down (which is common as people retire), you'll start to see this trickle into your Part B amount paid to Social Security.

It may need some time to catch up and the amount paid (all things being equal) goes up a little each year with CPI inflation increases.

Hopefully your Social Security also goes up enough to match this increase (plus the crazy food costs).

One note...some Advantage plans can even help pay for this Part B amount up to a certain level. Learn more about the Part B Cash Back or rebate Advantage plans.

Alright...bad news out of the way. Let's look at ways to save.

How to compare savings between Supplements and Advantage plans

We have huge reviews on how to compare medicare supplements and Advantage plans or what's the trade off with Advantage plans but let's zero in on the cost.

They really approach medical costs differently and many people get "sold" without understanding this.

We'll start with the monthly premium paid...the part everyone seems to focus on.

- A G medicare supplement (most popular by far) generally runs around $150/month at age 65 without first year discounts.

- An Advantage plan generally runs zero dollars per month for many plans in many areas.

Okay...so $1800 (let's call it $2K) versus zero. No brainer!

At 65 and older, you've learned the lesson the hard way probably decades ago. There's nothing for free...especially from insurance carriers.

So what gives? Aside from the difference in flexibility and control (HMO versus PPO really...see the comparison above!!), it's all about the expected out-of-pocket backend.

If you get sick or hurt, supplements and advantage plans work very differently.

With the G plan, after you meet your doctor deductible of just over $200/year, there's very little out of pocket for Medicare-allowed benefits.

With the Advantage plan, you generally have copays and maybe even percentages that you pay till you hit an Out-of-pocket max.

This is your true exposure in base of really big bills.

This amount can be okay in more populous areas (think greater LA county) of $400-800/year. Still well under our $2000 G plan expected cost.

In other areas, it can go all the way up to $8000! In the Bay Area and San Diego, the lower out of pocket maxes are around $3K.

So how do we compare this from a cost perspective?

Here's the calculus:

We're taking a guaranteed $2K savings per year versus the POTENTIAL of very large bills taking up to the max out of pocket.

That's why max is our of our Triple Threat selection for Advantage plans (how to compare Advantage plan).

- If you don't have much going on healthwise and monthly cashflow is tough, the Advantage plans can be popular IF you can be flexible on what providers you see and how much say-so the carrier has over care decisions.

- If you have a lot of expensive healthcare costs, the Advantage plans may be tricky IF the out-of-pocket maxes are high in your area (say $3K and up).

Think hospital-based care where numbers can rack up quickly.

This is a personal decision but you now have a better feel for the real trade-off. We're happy to walk through your actual situation when comparing them.

Zero cost for our assistance and our reviews hope reflect how we approach our job.

That's all 40,000 foot view stuff...let's get to the nuts and bolts of savings within each category.

Rubber hit the road stuff.

How to save on Medicare Supplements in California

There are so many Californians just shoveling money down the drain in this category. It's almost a passion of ours to get this fixed.

Three big categories:

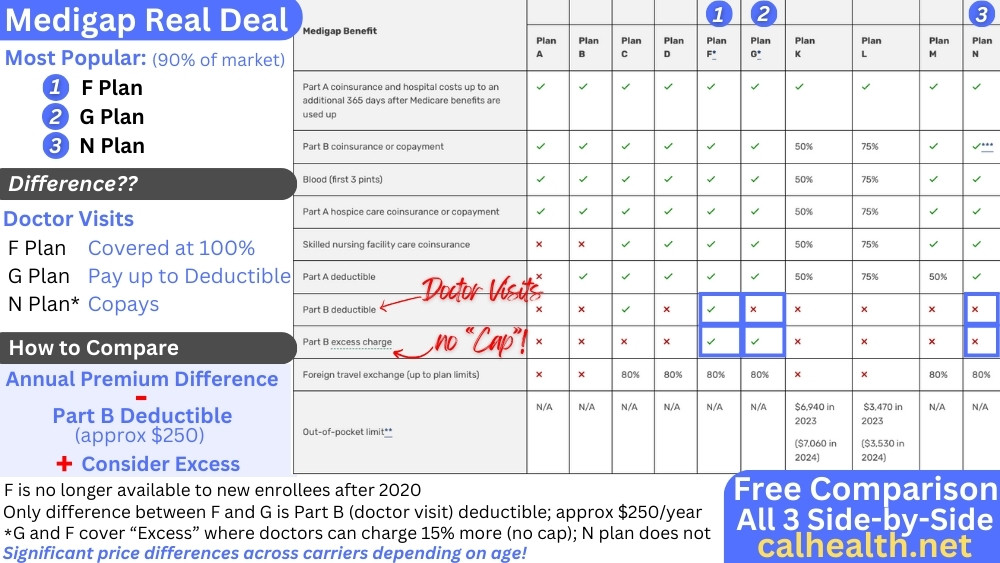

- On old plans that are way overpriced versus benefit difference (F versus G plan, etc)

- On more expensive version of the exact same plan (different carriers)

- On more expensive plan option

Let's get started.

Keep in mind that benefits and networks are standardized. A G plan is a G plan regardless of the carrier.

The supplements allow you to see ANY Medicare provider anywhere in the US. No difference there as well.

Let's get into it!

On old plans that are way overpriced versus benefit difference (F versus G plan, etc)

The F plan was "closed" to new enrollees back in 2020. It was the most popular plan by far for the prior decade or so.

A good percentage of Californians are still on the F plan because...well...because they never thought to change!

They're worried about making a change and losing something. "It's worked till now".

We have a whole review on if a person should change from the F plan to the G plan.

Typically...yes!

Here's the summary:

The only difference is the Part B deductible (just over $200/year) but many seniors are paying $750 or more per year!

Identical networks. Everything else is the same. This is "found" money and millions of seniors in California are gladly giving it to the carrier each month.

Reach out to us at help@calhealth.net and we'll run the numbers for you.

Same goes for the old J and I medigap plan. Not as many Californians still have these plans since the main reason to get them back in the day was for the RX benefit and we now have Part D.

But they're out there and paying even more than the F plan crew above...sometimes with a Part D on top of it!

Again, we love helping people find savings on this front so run your quote here and reach out with any questions.

Next up...an even bigger bucket of savings.

On more expensive version of the exact same plan (different carriers)

People tend to enroll in a Medicare supplement at age 65 or when coming off of employer coverage and then never look back.

We get it...who likes comparing medigap plans. It's terribly confusing.

The problem is that the carrier that's best priced at age 65 is rarely (if ever) the best priced at age 70 or 75. Or any year in between.

The premium difference can be ridiculous!

Exact same plan (say G plan versus G plan between Shield and Anthem or AARP United).

We have good news on this front. There are special rules in California about changing to other carriers or plans (equal or downgrade) around your birthday...REGARDLESS OF HEALTH.

The birthday rule:

We can help with this process and there's zero for our assistance.

First, run your quote to check out the landscape. AARP United quotes are handles separately so just reach out to us at help@calhealth.net.

We can also do the full analysis with date of birth and zip code and current plan/carrier.

Our goal is simple...find you the best priced plan and we work with the biggest carriers:

We'll look at carriers but also...plans at the same time!

On more expensive plan option

The big decision now is between the N and G plan for supplements with new enrollees.

Here's the big difference there:

So...how they handle doctor visits.

If you expect lots of doctor visits, the G plan might be better. If you don't expect much, you can pay the copays and maybe save on the premium.

We need to run the quotes to find out. We have a whole comparison of the G and N plan here.

The other piece is Excess which G covers and N plan does not. This may be a big deal depending on how much flexiblity and breadth you want with your networks.

More on the medicare Excess benefit here. Again, we're happy to walk through it.

Alright...what about Medicare Advantage plans?

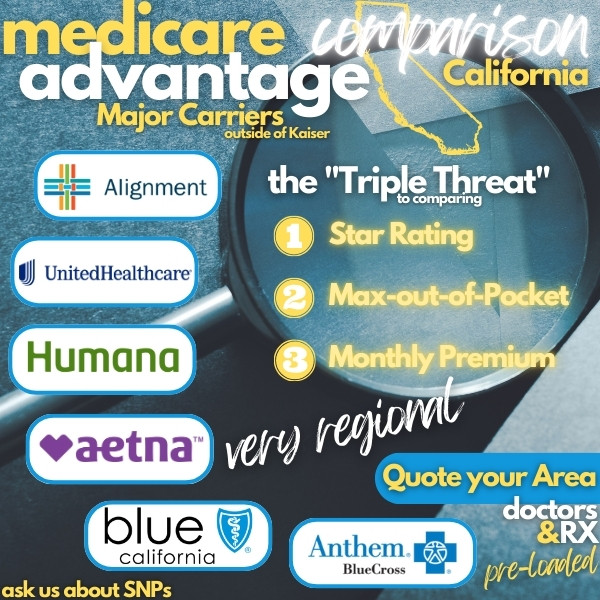

How to save on Medicare Advantage plans in California

First, there's the Triple Threat selection tips.

The biggest factor usually is network.

Meaning...

What's the best priced Advantage plans with richest benefits that allows me to use Optum (or fill in your doctors and/or hospital/network)?

If you have flexibility on doctors then look at:

- Monthly premium

- Out of Pocket max (how plan treats big bill)

- Star Rating (how well do the enrollees like the plan)

Here are some additional steps to find savings:

- Is there a Part B Cash Back option that still looks okay on the Triple Threat?

- Do I qualify for additional help (think medi-cal eligible or help based on lower income)?

- Do I qualify for additional help based on chronic illness or health issues?

- Do some plans have cash-cards for purchase, food, and travel?

Don't underestimate these additional perks.

They can amount to $100's per year and even over a $1000 depending on the situation.

You can quote the major Advantage plans in your area here:

Make sure to enter your doctors, medications/dosages, and if you have a special eligibility trigger (medi-cal, chronic illness, etc).

You can actually select for these D-SNP (medi-cal) and C-SNP (chronic illness) plans in the quote.

Also, make sure to filter by "Total Estimated Cost" since this will take into account premium AND estimated out of pocket (such as with medications).

Of course...we're happy to run the quote for you at help@calhealth.net ! No cost for our assistance.

What about Part D savings?

How to save on Part D in California

We have a whole review on Top 10 Tips to Save on Part D but let's hit the highlights.

This is actually pretty simple if someone would lay out it for everyone.

We're that someone!

Okay, so there are two main cost considerations:

- Monthly premium

- Estimate out-of-pocket costs during the year's time

All you have to do is plug in your medications and dosages (be very exact) and voila!

Next, you sort by "Total Estimated Cost" and both these factors are taken into account.

You can run the Part D quote here (make sure to select "Prescription Drug Plan" tab.

A few important notes to get the most savings.

The system will tell you how many of your drugs are "included" for each plan. You can click on this to see if there might be alternatives that provide savings (such as generic, etc).

Also, we have many clients who will get their very expensive (not included) meds from either Canadian pharmacies or goodrx.com.

The savings can be ridiculous! We just looked at an expensive statin and CVS offered us the "discount" from $400 to $350.

Goodrx.com was $85! That's not uncommon and we run all our meds through goodrx.com to check pricing.

They even price-check local pharmacies and the difference in cost can be equally ridiculous.

It's all a big game so make sure you have every advantage!

- So quote and get the best value for Part D.

- Take advantage of Canadian pharmacies and/or www.goodrx.com

Sort by total estimated cost in the quote!

One note...this year, Wellcare has been the most popular by far with a plan at 40 cents/month!

People always assume that's bogus...how could they charge that and still cover my meds??

First, remember that Medicare is paying the bulk of the cost so the part D carrier is simply working around the edges. Hence, the lower price.

Second, it may not remain that low next year but we're able to change plans end of each year during Open Enrollment so this year is what matters!

Again, we're happy to help.

So...how do you price-check YOUR options??

Quoting your Medicare options for savings

You can quote Medicare supplements here:

AARP requires a separate quote so just reach out to us at help@calhealth.net if you want that included. No worries...it's what we do all day and our goal is to find you the best-priced option among major carriers.

For Advantage plans, you can quote major carriers here:

The MAPD is the tab to select since it includes the Part D benefit. This is the right move unless you already have medications covered (Tricare, etc).

Part D quotes are also available at that link..just select the "PDP or Prescription Drug Plan" tab.

If you want us to quote all three for you (or just a subset), we only need your date of birth, zip code, current plan and we'll get to work. help@calhealth.net Let us know if you have a preference (for example...supplement and Part D).

Alright...let's find we find a much better value (very common)...then what?

How and when to switch to better priced options

This depends on the type of plan we have the type we want to move to.

Can be a little more complicated so reach out to us but here are the broad strokes.

Advantage to Advantage

- We can switch end of each year during Open Enrollment (Oct 15 - Dec 7th)

- During first 3 months of year, we can generally switch if we don't like our Advantage plan

- Medi-cal eligible can switch once per quarter (check with us)

Those are the big ones but here are other trigger so let us know your situation at help@calhealth.net

Supplement to Supplement

If we're in good health, we can change any time of the year!

Always worth submitting an application if you we're in a grey area since the worse case is that they say no and then...

- We can move to an equal or lesser plan around our birthday each year (more on Birthday Rule)

- Some carriers will have "Underwriting Holidays" where they don't look at health...usually at the end of the year.

Check with us for special eligiblity triggers at help@calhealth.net

Advantage to Supplement

This can be trickier. Ideally we want the Supplement approved first before cancelling anything.

We can generally only cancel Advantage plans (and go back to traditional Medicare which is required with supplements) at year end UNLESS we have a special trigger (first time trying Advantage plan, etc). Check with us so we do this right. We'll also need to coordinate the Part D.

Supplement to Advantage plan

Unless we're newly eligible for Part B with Medicare, think end of year in most situations. Open Enrollment is our wide open time to enroll (Oct 15th to Dec 7th) in Advantage or Part D.

Part D to Part D

Newly eligible for Part A with Medicare, Part B with Medicare, or Open Enrollment are mainstays. So worst case, think end of year!

Some of this get tricky so reach out to us and we'll go through the options. The good news is that either at birthday or end of the year, we generally have the ability to make changes...worse case.

It's worth the $100's in savings that compound each year!