California Medicare Options

- How and Why to Price Check Medigap Plans Annually

California Medicare Options

- How and Why to Price Check Medigap Plans AnnuallyWhy check your Medicare Pricing Every Year (and NOW!)

It's almost a mission for us.

So many people on Medicare do not realize they are overpaying for their Medicare option (whether Advantage, Medigap, and/or Part D)

We'll explain some of the tricks used that cause this issue but we'll also look at how to quickly spot-check the market and really understand what you're comparing.

If you've been on the same Medicare plan for a full year, this becomes relevant!

We'll show examples below of pricing differences and different strategies to maximize your value.

Otherwise...we're literally gifting money to the carriers in certain situations.

Don't expect them to let you know!

Here's what we'll cover by plan type:

- Why you need to price-check medigap (medicare supplements) annually

- Switching medigap plan strategies

- Why you need to price-check Advantage

plans annually

- How to really compare the advantage plans for total value

- Why you need to price-shop Part D plans annually

Our reviews here:

Let's get started!

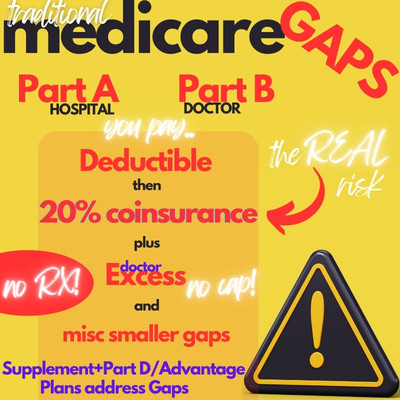

If you need to understand the differences between Medigap and Advantage plans or what's the trade-off for Advantage plans.

Why you need to price-check medigap (medicare supplements) annually

We'll hit these highlights:

- The 1st year discount that goes away

- Different pricing as we get older

- Really understanding the plan designs

The 1st year discount that goes away

Usually, people are introduced to Medicare when they turn 65 and/or when they lose employer health insurance.

Blue Shield had (has) a New to Medicare $25/month discount for the first 12 months. This meant that when we run a quote (or millions of seniors did), Shield would come out quite a bit cheaper for the most popular plan, the G plan (learn why G is most popular).

After 12 months, this discount would drop off but most people don't revisit the pricing!

It turns out that without the discount, Shield may not be the best value for the exact same benefits and networks.

Remember...medigap plans are standardized so a G plan is identical from one carrier to another. They all work any provider that accepts Medicare.

Customer service is pretty similar across the biggest carriers (UnitedHealthcare®, Anthem, and Blue Shield).

So...we're paying more..for nothing!

UnitedHealthcare® and Anthem finally figured this out (after years) and have added a $25/month discount (New to Medicare - essentially a new Part B).

This helps level the playing field for the first year but it still doesn't address after the discount drops off.

We need to re-check the rates for you! There's no cost for our assistance and we just need date of birth or zip code. You run quote here as well.

Then, there's just the difference as we get older.

Different pricing as we get older

Time flies by when your in your 60's!

You enroll in Medicare, maybe get a G or N plan (the two most popular) at age 65 and before you know it...you're 70!

There's a theory that each year feels shorter as we get older since it's a smaller % of our total life. Anyway!

That best deal at age 65 probably isn't the same at age 70!

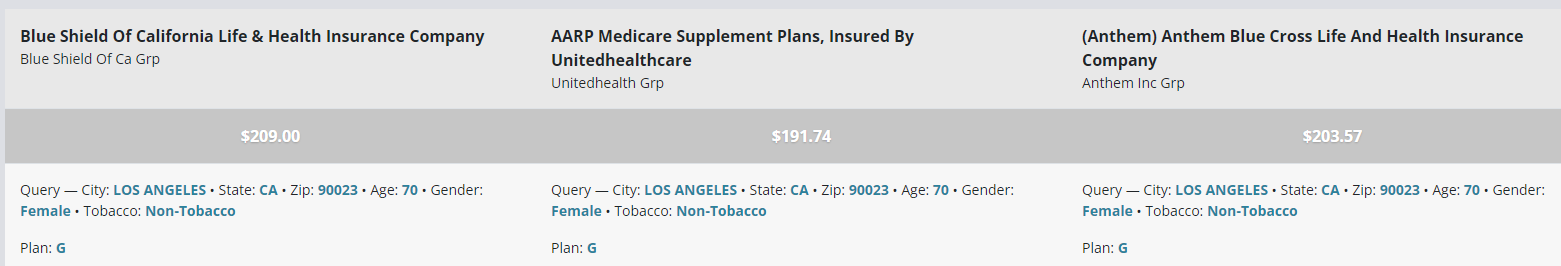

Let's look at the G plan for an example of this in Los Angeles among the three biggest medigap carriers.

First, age 65:

And now, same area and plan...age 70:

Look at the movement!

That Shield rate actually shows $25/discount (pre addition from

Anthem and UnitedHealthcare®).

So a person might be paying almost $250/year extra for...nothing by age 70!

Don't beat yourself up...there are millions of Californians doing this and worse!

Combine this age difference with the people being on more expensive plans and it can get up to almost $1000/year!

See why you need to double-check your rates? Even for the exact same plan.

We're happy to scan the market and see if you're overpaying.

Then there's the plan differences!

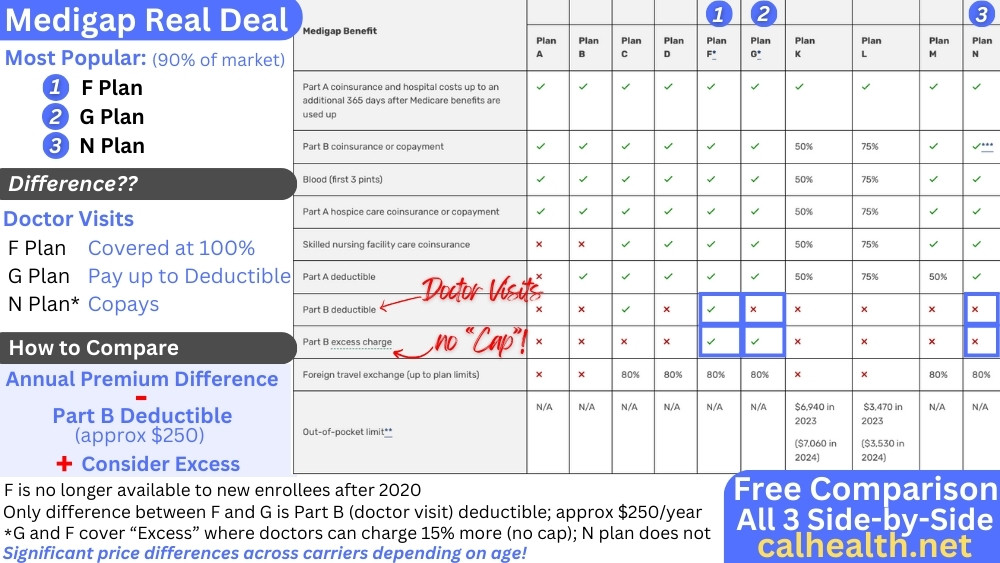

Really understanding the plan designs

So...we have lots of plan comparisons but lets hit the highlights that generally result in people overpaying year to year.

First, the basic medigap landscape:

Here's where we see big savings:

- Switching from the old F plan to the G plan

- Switching from old I or J

plan to the G plan

- Switching from G to N occasionally

- Switching from G

to high deductible G

- Switching from any plan to the A

Let's walk through these briefly.

The F, J, and I plans have been discontinued for new enrollees but you still have millions of seniors on them (especially the F plan which ended in 2020).

We did a deep dive on comparing the F and G plan. You're losing the Part B deductible (around $240+ annually) but the savings can be way more!

Let us compare this for you. More info below on when and how to

switch if it make sense.

Comparing the G and N plan is different.

- The G plan makes you responsible for office copays up to the deductible (around $240).

- The N plan has you pay copays for office and urgent care.

There can be a savings with the N plan but we need to think out how many office visits we'll have. Over around 10 a year and the G makes more sense.

The other issue is that the N plan doesn't cover Excess, where Medicare doctors can charge more than what Medicare allows. We don't like losing that since it's uncapped!

For people who want more catastrophic coverage, there's the G high deductible plan which builds a deductible of a few $1000 into a G plan. This is for the lowest priced option.

The A plan is the bare-bones. It basically covers the 20% coinsurance which is the real risk with just having Medicare alone.

Again, it's usually about moving to the G plan with the best priced carrier but we're happy to walk through all the plans!

Just stop overpaying! That's our one boogeyboo. We work with the biggest carriers anyway:

Okay...we find a better rate. Then what?

How and when to switch a better priced megigap plan

We can apply for medigap plans anytime of the year technically.

Once we're outside our open enrollment window, we need to qualify based on health but that's usually not too tough unless we have pretty serious issues.

Worse case, we can use the Birthday rule to move to the same or lesser medigap plan:

We're happy investigating which is the best approach for you and

there's no cost for our assistance!

Just email us date of birth and zip code to help@calhealth.net or call 800-320-6269.

You can always quote right away here:

That's the medigap annual checkup intro. What about Advantage plans?

Why you need to price-check Advantage plans annually

Since Advantage plans have an annual open enrollment, people are pretty attuned to double-checking what's available on the market.

Unfortunately, they may ONLY be getting their info from their current carrier or broker.

It's really important to compare all the major carriers each year at open enrollment.

You can run your quote anytime here knowing that outside of special situations, we can only change end of the year in most cases.

We can guide you through the rules if you like.

Price-check is a little different since most of the major plans have zero premium.

It's more like value-check!

And doctor/RX check.

Let's go there now.

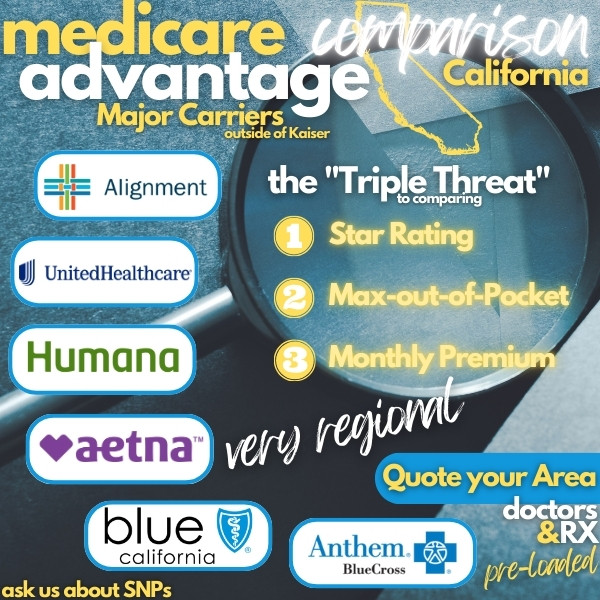

How to really compare the advantage plans for total value

Use our triple-threat selection criteria:

Focus on the out-of-pocket-max and Star Rating!

Make sure your

medications, pharmacy, and doctors are entered into the quote so that it

will reflect these preferences.

You can run your quote for Advantage plans right here:

Then, zero in on max out of pocket (you're real exposure for bigger

bills) and the Star Rating (a measure of how happy enrollees are with that

plan).

The Star Ratings can and will change each year so it's important to keep up with that.

Our quoting system automatically shows current Star Rating and you can enter RX and doctor info.

Many seniors we come across find they're not on the best plan for them. They may have a gym membership but much higher out of pocket max!

That's not the point of an Advantage plan and whomever sold it to them should have explained the back-end risk better.

Learn about how to compare Advantage plans so you're better versed.

Reach out to us at help@calhealth.net with date of birth and zip code for a full market check-up!

We do them all day long with no pressure. Check out our reviews:

Why you need to price-shop Part D plans annually

Finally, if you have a medigap plan, you probably have a Part D plan for medication.

We hope you do since there's a 1% penalty for each month you don't enroll once eligible.

Part D also has an annual enrollment that coincides with Advantage plans so many people are used to re-checking the market.

Here, the key is total out of pocket!

We have a huge review on the Top Tips to Save on Part D.

We want to make sure your updated medications and pharmacy are loaded into the quote tool here:

Then, look at "Total Expected Cost through Year End".

That takes into account the monthly premium AND expected copays and share of medication cost that come up.

This is really what's important and remember that it's very common to have a different carrier for the Part D than with the Medigap plans.

Any Advantage plan worth its salt already includes Part D so this more for medigap plans.

So...Star Rating and total expected cost is our sweet spot of value-checking a Part D plan and we should do it annually!

Things change (both with you and the carriers) and you don't want to pay more than needed.

We easily see total cost differences of 100's or even $1000's each year between plans!

Make sure your meds are entered so this is accounted for correctly.

Of course, we can run the quotes for you here:

Our main concern is that you don't overpay for Medicare options like

millions of seniors do every year.

Let's bring some of that money back to seniors when everything is so tight these days!